How to Invest Special Report

How to Invest in the Next Billion-Dollar Startup

It’s every investor’s dream—the one trade that makes a fortune.

Of course, more fortunes have been lost in pursuing that dream than have been made. The idea of finding one tiny investment where a mere $1,000 investment can turn into millions seems like a pipe dream.

That makes sense. After all, if you bought $1,000 of a stock and it went up tenfold, you might think about taking the money and running with it. The true test is to buy, hold, and stick to it.

That’s the simple secret of success behind many of history’s greatest investors. Of course, many of the investment greats have done so with one hand tied behind their back. That’s because they were limited to buying shares of publicly-traded companies after those companies had gone public, and after they’d already grown enough to become sizeable firms in their own right.

There’s a way to drill into a pool of companies that haven’t gone public yet. Some might, some might not. But even fi they don’t, as an investor in these companies, you could reap substantial profits.

This isn’t some fly-by-night offer, either. There’s over $1 trillion in these privately-held companies.

And best of all, anyone can invest in them, even if they only have $100 to put to work.

Flight of the Unicorns

In the world of companies that haven’t gone public yet, the unicorns reign supreme.

Unicorn is the term for a company that has a valuation of over $1 billion dollars. How are these valuations tracked? By private buyers and what they paid. Say a company sold a 10 percent stake to a private equity firm for $150 million. That implies a valuation for the whole business of $1.5 billion.

Think about it. This isn’t a company that’s publicly traded. Someone making a large commitment—and putting up a huge percentage—isn’t looking to buy on Monday and sell on Friday. They’re looking to see their investment grow… substantially.

Crunchbase estimates that there are 276 companies right now that are unicorns. And the value of these companies is $967 billion dollars. Add in the smaller companies that haven’t hit that billion-dollar mark, and you’ve easily gotten to over $1 trillion in private wealth that you can’t access by calling your stockbroker or logging onto your online account.

These unicorns might be where the Silicon Valley fat cats play around with their venture capital. But individual investors can play that game too, thanks to the power of crowdfunding. By getting in before a company even hits the unicorn stage, it’s very possible that an investment of just $1,000 could grow tenfold or more in just the space of a few years.

What a Difference a Decade Makes

Think back to 2008. We all remember the housing market bubble and collapse. And while it’s been a decade since the peak fear hit, it seems as though the economy is still struggling to find its way forward.

In some sense that’s true. But in others it isn’t. We’ve made some profound changes in how we live in the past decade. But the chances are it’s been so gradual that you haven’t even thought about it.

But a decade ago the world was a very different place for many other reasons:

Touchscreen smartphones were still in their infancy. The most popular brand of phone among the business community was the Blackberry.

While we had the Internet on our phones, we didn’t have the quality streaming video capabilities of the 4G Network.

If you needed a ride, there wasn’t an app for that.

Those are just a few changes in the world of technology.

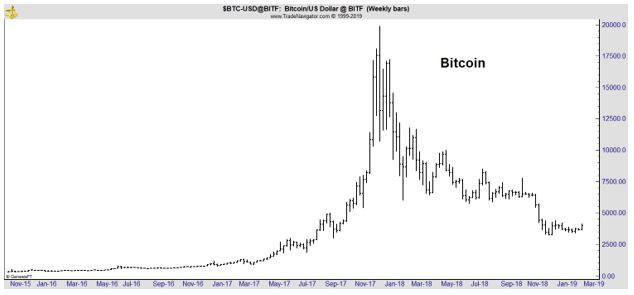

And, of course, the hot financial topic of 2017 was cryptocurrencies. They didn’t even exist a decade ago, much less surge over $500 billion in value like they did in 2017.

But there’s another financial innovation of the past 10 years that can also create wealth like that. I’m talking about crowdsourcing.

In many ways, crowdsourcing is a lot like traditional investing. A group of people pool their capital and take a stake in a company—sometimes in the form of ownership (called equity) or sometimes by lending the company money and becoming a bondholder.

But the truth is, crowdsourcing is far different than buying a stock online. But it gives you a chance to invest in the companies that we’ll look back on in 2028 and wonder how we ever got by as a society without it.

Winning Strategies for Crowdsource Investors

With all the dozens of crowdsourcing opportunities out there, you’ll need to be armed with some simple, easy-to-understand concepts to succeed. Knowing how to invest is critical, and will make the difference between a great investment and a poor one.

Here are a few key things you need to know:

1) Diversify, Diversify, Diversify!

I know, I know. It’s not the exciting advice you want to hear. But let’s face it: you need to diversify. Investment professionals stress that anyone with less than 20 stock positions isn’t sufficiently diversified. Any fewer positions, and you run the risk of any single position causing devastation to your portfolio if it goes belly-up. That’s a bigger risk with crowdsourcing, as many companies could potentially lose money. But if you’re diversified, you’re increasing the chances of having more winning investments on your side.

With early-stage companies, that’s no exception either. In fact, it’s even more important. Here’s why:

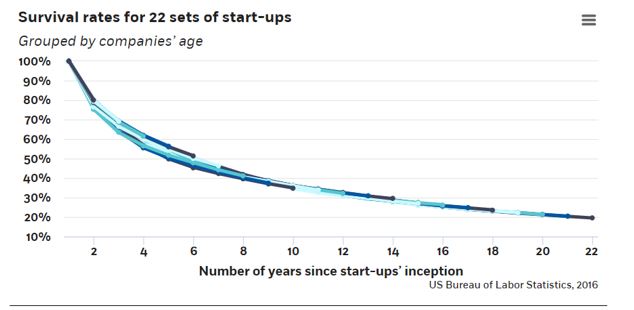

As with any investment, you can’t just put all your eggs in one basket. When investing in smaller, startup-level companies as you are in the crowdsourcing stage, some businesses simply won’t pan out. It doesn’t matter if they run out of money, can’t compete with a better business model, or otherwise fail. The fact of the matter is that most businesses fail, and typically well before they ever get on the public’s radar.

Most venture capitalists expect their investments to go belly up a lot of the time. But one success will more than offset a dozen failures. The important thing is to build a diversified portfolio of startup level companies across a variety of industries.

Remember, diversification isn’t just about the total number of positions you have. It’s where those companies are located in their industry. Owning 10 different startups working on a new ride-sharing app doesn’t make you diversified. Especially if it means potentially missing out on a promising app company outside that space.

2) Start Small and Scale Up

Investing is supposed to be about rationally allocating your capital. But let’s face facts: people can get emotional about their investments. One important factor to consider with investing is to be able to sleep well at night. Yes, that may sound silly. But think about it this way: If something’s keeping you up at night, it might be because you’re too exposed to it. You’d be better off elsewhere.

As with any other investment, then it pays to start small, get comfortable with what you’re doing, and then scale up. If you only have $5,000 to invest, putting more than 10 percent into any one opportunity may mean creating a big risk of loss. Even at that level, a huge profit from an early-stage company can more than grow your portfolio as a whole without putting too much risk into a single position.

Sure, some investments sound better than others. But sometimes a great story behind a company doesn’t have a fairy tale ending. That’s why by starting small, you can scale up later. It’s impossible to start with all your money and scale up any further—and that may lead to difficult losses later down the road. Putting a lot of money into a single investment may seem like a great idea at the time—but at some point, it’ll cost you sleep. Better to start small and scale up.

3) Investing is a Marathon, Not a Sprint

When investing, consider your timeframe. You don’t need to make millions overnight. And trying to do so will just encourage a lot of frustration along the way. Early-stage companies might hit it big in a few months after you invest—or it may take years. Many successful companies didn’t get there on their Plan A. Rather, they were on Plan B… or Plan C. you get the idea.

Taking the time ensures that you’re making the best choice possible with your money. It means you’re not rushing into an investment. You have the time to do your research, and get comfortable with an investment. Likewise, by monitoring and reviewing your positions over time, if there’s a potential problem, you’ll have the time to see how it develops. Rather than sell out at a panic, you might see a company transform its business model and move on to more successful endeavors.

This goes hand-in-hand with diversification. If you’re diversifying, you’ll have money set aside for a future opportunity that may come along. When you don’t need to rush, you have the ability to build a great portfolio of crowdsourced companies over time.

4) Buy the Company, Not the Story

It’s easy to get caught up in a great story. And when it comes to early investing, when a company doesn’t have a track record or years of financial records to analyze, it’s tempting to give into the story.

While it’s fantastic to live in an era where there are so many innovators looking to change the world for the better, not every opportunity will pan out that way.

Consider what you’re getting for your equity stake when you invest in a crowdsource opportunity. Make sure a company isn’t overvaluing its potential relative to the produce or service it expects to provide. Stay emotionally disciplined. A story that sounds too good to be true might be.

Remember the Internet tech bubble of the 1990’s? Any company could go public with little more than an expectation of being profitable within five years. Towards the end, a few companies even added “dotcom” to their names just so their shares could go along for the ride. Many of those companies went bankrupt, and investors in those companies lost out because they focused on the story, not the company.

To some extent, you can also avoid the story by buying in areas where you are using a company’s product. By buying into something you understand, you improve your chances of making a great and profitable investment. It’s already some area that you have tangible knowledge of. That’s a good sign that you’re buying the company on the merit of its products, not just some concept.

5) Follow the White Rabbits

As with the old children’s fable, slow and steady wins the race. Focus on building a portfolio that’s balanced across a variety of sectors. That may prevent you from investing as much as you’d like in a compelling opportunity. But you only need one huge winner in an early-stage company to build surprising amounts of wealth from small amounts of capital.

Some companies will act like the hare—making big changes in valuation in a short amount of time. Others will act like the tortoise. But remember, these are early-stage companies.

Many may simply limp along from the starting line only to drop out of the race entirely. That’s okay. We’re here to profit from the best opportunities possible—but sometimes being the best at something in the business world isn’t enough.

But in investing, you can do well following the proverbial white rabbits. Those are the big players in the market who are investing.

By buying alongside major venture capitalists and hedge funds, particularly those with a track record of success, you’ll likely increase the chances of a winning opportunity. If you’ve ever seen Shark Tank, you know that Mark Cuban, the early venture capitalist in Facebook, selects his deals wisely. His years of making deals in early startups has given him a keen eye that not everyone else has (not to mention the ability to make quick decisions on the show!).

The point is, there’s no rule and nobody to stop you from following the news. If a company gets major funding from a hedge fund with a great track record and there’s a crowdsource opportunity, that might play a deciding factor. Remember, these aren’t just the big players—they’re also following these same rules that we’ve looked at in this report.

Conclusion: How to Make the Best Crowdsourcing Investments

It’s clearly a new era. We’re constantly innovating as a society, finding new and better ways to do things. Ways that are often disruptive—and have the potential to create huge sums of wealth along the way.

The things we take for granted 10 years from now may just be an idea in some innovator’s mind today. But thanks to tools like crowdsourcing, they can get the capital they need to make their idea a reality. Some of those realities won’t be very profitable. Others may become the next Facebook or Google. Time, patience, and luck will tell.

By combining the tools of diversification, patience, scaling, emotional discipline, and following key industry players, anyone can make a profit from the leading companies of tomorrow.

It’s a growing space, so there’s still plenty of opportunities out there. One trade can make a fortune. But many good prospects won’t pan out. That’s okay. You have the tools to succeed. Take the time, be patient, and get started.