Value in a Bear Market

We may very well be in the early days of a bear market. No one knows for sure until the Dow Jones Industrial Average declines at least 20% from its high. That’s the official definition of a bear market.

But by the time the Dow falls that much, a number of individual stocks will have fallen significantly more than that. This means that individual investors could be facing large losses well before the experts on CNBC announce that we are officially in a bear market.

That leads to the question of what can be done about a bear market and the answer from the perspective of an individual investor could sound remarkably similar to what an investor could do about a bull market. They could consider applying a value methodology.

Value Cuts Both Ways

Many individual investors spend a great deal of time looking for value. They buy stocks that are undervalued. That is a strategy that has been proven to work in the long run for many investors. But at any given time there will only be some stocks that are undervalued. The rest will be either fairly valued or overvalued.

It is the overvalued stocks that could be of interest in a bear market. After all, in the long run value works according to a number of studies. Undervalued stocks tend to beat the market, on average, as a group.

Those studies, especially the ones that are published in academic journals, usually include an evaluation of overvalued stocks as well. The studies often show that undervalued stocks underperform the broad stock market, on average, as a group.

For example, the studies may look at a valuation tool like the price to earnings (P/E) ratio. Low P/E ratios indicate a stock is potentially attractive. High P/E ratios highlight, for many individual investors, the stocks that could be avoided.

In the studies, the authors often assume the low P/E stocks are bought and the high P/E stocks are shorted. When an investor buys a stock, they profit when the price of the stock goes up. When they sell a stock short, they profit from a decline in the value of the stock.

We will not go into the mechanics of shorting a stock. It is a high risk strategy that may not be suitable for many individual investors. But investors can also benefit from a price decline with a put option.

A put option gives the buyer the right but not the obligation to sell 100 shares of a stock at a predetermined price for a specified amount of time. The mechanics of owning put options can be confusing but interested investors should consider researching options.

One advantage of a put option compared to selling a stock short is that the risk is limited and well defined when buying a put. An option buyer can never lose more than the purchase price of an option which is often just a few hundred dollars or less, and can even be less than $100.

Finding Value Like a Quant

A quantitative approach to investing relies on computers to identify characteristics of successful stocks. Based on historical performance of that factor, the investor buys all stocks that meet the defined criteria.

Quants often use a computer output to drive all decisions. They may not supplement that output with any other analysis. This has provided success and outsized returns to some investment managers.

But, for many years it required expensive data sets and customized programming skills to find stocks with a quant strategy. Now, those tools are available to individual investors and some tools to implement quant strategies are even available for free.

A Free Quant Screening Tool

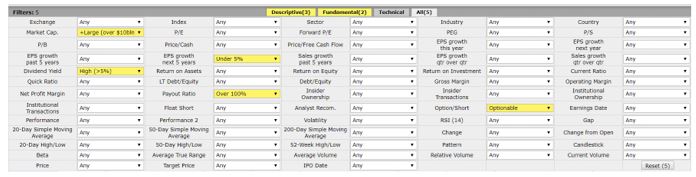

One way to find stocks meeting a variety of predefined requirement is with the free stock screening tool available at FinViz.com. At this site, you could screen for a variety of fundamental factors like free cash flow, high levels of institutional ownership and bullish institutional transactions.

There were 7,547 stocks in the database on a recent day. We want to search for just a few that could be good investments. We will focus solely on fundamentals criteria. There is no guarantee these stocks will be safe but we use quant criteria in an attempt to limit risk.

To ensure the stock is tradable at a reasonable cost, even in a market crash, we will limit the search using market cap selecting just the largest stocks which is defined in FinViz as stocks with a market cap of at least $10 billion. All selections are made with pull down menus as shown below.

We will also require the stock to be optionable. Then we will search for potentially overvalued stocks by looking for high income (a dividend yield of at least 5%) and for risk we required a high payout ratio of over 100%. That indicates the dividend might be cut.

This left us with 15 stocks. That could be a wonderful starting point for research for many investors. But we will add one more filter to reduce the number of stocks. The number of stocks to research can be a significant limiting factor for individual investors since research takes time.

We added a requirement for low analyst expectations. In this case, we looked for stocks where analysts expect earnings per share (EPS) growth to be less than 5% a year, on average.

This screen is shown below.

Source: FinViz.com

Three Potentially Overvalued Stocks

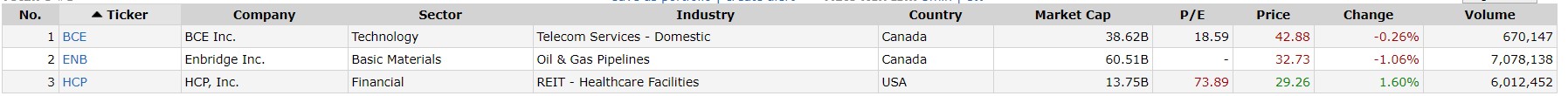

The criteria we used left us with just three stocks to consider.

Source: FinViz.com

These are simply stocks that passed a quantitative screen. Additional research could be useful. But these could be stocks that offer potential gains in a bear market because they are overvalued by some measures.

It is possible for value investors to consider flipping their preferred criteria to benefit in a market decline. The same principles that are used to find stocks to buy, in many studies, have been effective at finding stocks that are vulnerable to declines.

This fact could be especially interesting now as the market appears vulnerable to a decline.