This Sector Could Be the Biggest Etail Winner

Etailers, the companies that sell online products, are adding to the problems of traditional retailers. Some might say that etailers are the reason stores are shutting down at local shopping malls. The truth is etail does have some business advantages.

Traditional stores require sales staff, space to display goods, storage rooms in retail locations, distributions centers and other infrastructure. To sell online, all that’s required is a web site and the ability to ship goods.

These advantages point to a high likelihood of continued problems for traditional retailers and etailers could gain even more market share. But, the winners in the retail sector might not be the companies that sell things.

Shipping Gets the Product to the Customer

Although the struggles of retailers tends to generate emotional responses. Traders need to remain unemotional and think through the issue to find potential trading ideas. In thinking about a company like Amazon.com, one issue is shipping.

Amazon has recently been in the news for its shipping policies. President Trump has argued that Amazon isn’t paying enough to the Post Office to deliver its packages. The company is paying the market rate negotiated with the Post Office and some analysts believe the deal has helped the Post Office,

Rather than dig into how much Amazon pays or should pay, the news is important because it shows that shipping is important to the success of online retailers. This provides an investment opportunity.

According to analysts, transportation logistics companies are the increasingly tech-focused intermediaries that connect businesses with shipping companies, placing goods needing to be moved into the vehicles best able to haul and deliver them.

While we often think of UPS and FedEx when we think of shippers, there are other companies to consider.

Some Shippers to Consider

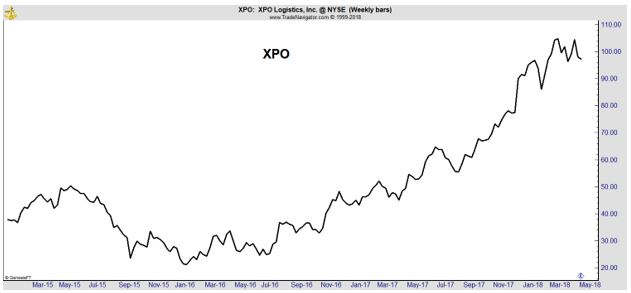

XPO Logistics, Inc. (NYSE: XPO) is a global provider of supply chain solutions. The company’s transportation segment provides freight brokerage, last mile, less-than-truckload (LTL), full truckload and global forwarding services.

The logistics segment provides a range of contract logistics services, including highly engineered and customized solutions, value-added warehousing and distribution, cold chain solutions and other inventory solutions.

XPO has more than 10,000 independent owner operators under contract to provide drayage, expedite, last mile and LTL services to its customers.

The stock price recently stalled but the company could be attractive at this level. Analysts expect earnings per share (EPS) of $4.15 next year and average growth in EPS of more than 30% a year.

Using the PEG ratio to value a stock, analysts assume the stock is trading at fair value when the price to earnings (P/E) ratio is equal to the EPS growth rate. For XPO, the P/E ratio of 30 would indicate the stock is potentially undervalued by 20% or more.

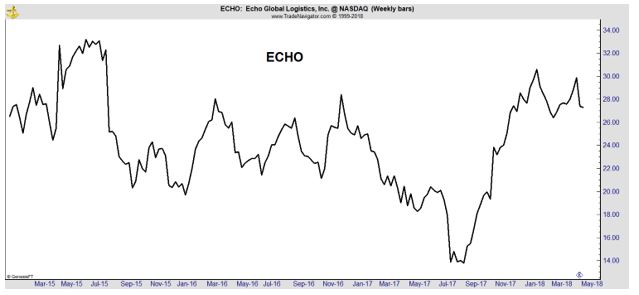

Another shipping company to consider is Echo Global Logistics, Inc. (Nasdaq: ECHO), a provider of technology-enabled transportation and supply chain management solutions.

ECHO uses a technology platform to compile and analyze data from its multi-modal network of transportation providers to facilitate its transportation and logistics services. The company focuses primarily on arranging transportation by truckload (TL) and less than truckload (LTL) carriers.

It also offers intermodal (which involves moving a shipment by rail and truck), small parcel, domestic air, expedited and international transportation services. The company’s core logistics services include rate negotiation, shipment execution and tracking, carrier selection and management, routing compliance freight bill payment and audit, payment and performance management and reporting functions.

ECHO is expected to report EPS of $1.67 and grow earnings at an average pace of 31.8% a year. The PEG ratio provides a price target of about $53, almost double the recent price.

While these shipping companies look promising, analysts note that there are questions hanging over the industry. One question is about the role electric trucks, from Tesla and others, and autonomous vehicles will mean for the industry.

Another question is whether or not the companies will have to spend an inordinate amount of money to improve tracking technologies. And, if the technologies become pervasive, there is the concern that tech companies like Amazon could simply displace the shippers.

These questions do hang over the industry in the long run. But, for now, analysts note, “The supply of trailers is tight and demand remains solid. The market could stay that way for 2019, as Washington tries to shape an infrastructure bill that could send more trucks to and from construction sites.”

An analyst with Cowen Securities cited the long term questions and the short term potential of the industry, “I think, ultimately — and I’m talking over the next 25-plus years — you have to start wondering what’s going to happen to your traditional definition of a trucking company.”

Meanwhile, full enforcement of a rule known as the electronic logging device mandate, which requires that truck cabs have an electronic device to record drive times, will take hold in April. Truckers face fines and other penalties if they don’t comply with the measure, potentially keeping them from joining or remaining in the ranks.

As warehouses and trucking fleets strain to handle the extra volume, trucking and logistics companies have been able to charge more for shipping and related services. As for demand, the produce season was strong over the summer, as was the home-and-garden season. Brisk holiday-season e-commerce helped buoy the end of 2017.

“When a new wave of buyers moves to online shopping, it bodes well for our future growth in contract logistics and last mile,” Scott Malat, XPO’s chief strategy officer, said on the company’s fourth-quarter earnings call in February. Schneider, on its earnings call in February, cited a “growing customer pipeline of notable etailers” that it said would help improve margins and be an area of “intense focus” for this year.

The challenge of the long term could be a reason for investors with a time horizon measured in decades to avoid the sector but for investors looking at shorter term gains over the next 6 to 12 months, these could be stocks to consider.