This Could Be A Big Year for Initial Public Offerings

This could be a big year for initial public offerings or IPOs. According to Investopedia,

The process of offering shares in a private corporation to the public for the first time is called an initial public offering (IPO).

Growing companies that need capital will frequently use IPOs to raise money, while more established firms may use an IPO to allow the owners to exit some or all of their ownership by selling shares to the public.

In an initial public offering, the issuer, or company raising capital, brings in underwriting firms or investment banks to help determine the best type of security to issue, offering price, amount of shares and time frame for the market offering.

But there are some reasons individual investors should be wary of IPOs.

Potential Big Name Offerings

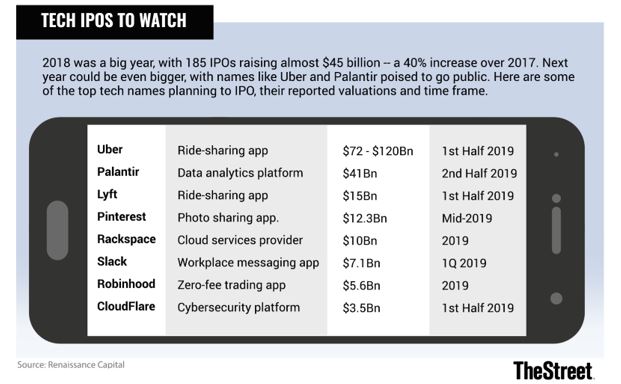

MarketWatch.com noted, “The 188 IPOs took place in 2018 as of mid-December raised more than $45 billion, over 20% more than companies raised at the same point in 2017, according to data from Renaissance Capital.

And 2018’s deals included billion-dollar tech names such as Dropbox (DBX), Eventbrite (EB) and DocuSign (DOCU) .

But even-larger IPOs are on the horizon for 2019, with giant companies like Uber, Lyft and Palantir preparing to go public provided that the markets hold up.

Last month, Lyft announced it had filed confidentially to go public and Uber reportedly did the same the very next day, with both firms reportedly racing to debut in 2019’s first quarter.”

The site listed the eight most highly anticipated tech IPOs for 2019, listed in order of their latest valuations:

Source: MarketWatch.com

- Uber

At a recent private valuation of $120 billion, according to a recent report, an Uber IPO at that level would be the biggest public offering ever.

CEO Dara Khosrowshahi has said many times that he intends to take the company public in 2019, provided that market conditions hold up, and the company hired CFO Nelson Chai in August to help get them there. In preparation for the public offering, Uber has been publishing financial statements for several quarters that show increasing revenue but substantial losses for the ride-share giant.

- Palantir

One of the most highly-valued U.S. tech “unicorns,” the secretive data mining and analytics firm Palantir isn’t discussed as frequently as ride-hailing giant Uber — but it, too, is valued in the tens of billions of dollars.

According to an October Wall Street Journal report, the firm was in discussions with Credit Suisse and Morgan Stanley for a potential 2019 IPO, which could value the firm as high as $41 billion and happen in the back half of next year.

- Lyft

Uber’s smaller nemesis is also racing towards a 2019 IPO, and may be trying to beat its competitor to the punch. Lyft was valued at $15.1 billion in June, when it raised $600 million.

The company signed on JPMorgan to lead the offering. Unlike its larger ride-hailing counterpart, Lyft operates only in the United States, but both firms are striving to re-frame themselves as transportation and mobility companies with assets beyond just ride-hailing, including e-scooter and bike-sharing businesses.

Despite its ubiquity as an image-sharing app, Pinterest mostly flew under the radar as an IPO candidate until this year when it reportedly doubled its ad revenue.

Its ad revenue for this year was projected to hit $1 billion in July, according to CNBC, nearly twice the previous year’s number. Pinterest was privately valued at $12.3 billion during its last round of financing in 2017.

- Rackspace

If the name sounds familiar, it’s because 20-year-old Rackspace, which specializes in cloud computing services, was a public company until 2016, when the private equity firm Apollo Global Management took the firm private in a deal worth $4.3 billion.

Now, Apollo may be considering a fresh IPO of Rackspace according to a May Bloomberg report, which quoted a valuation of $10 billion and a potential target date of sometime in 2019.

- Slack

The workplace messaging darling may finally be ready for its close-up. Slack’s run as a popular workplace communication tool has meant that it’s fended off acquisition talks over the years from suitors such as Microsoft and Salesforce.

CEO Stewart Butterfield says that he intends to take the company public and appointing Slack’s first-ever CFO in February. The company is said to be planning an early 2019 IPO at a $7 billion valuation.

- Robinhood

Robinhood has evolved into a brokerage for the mobile-first generation. Unlike traditional brokerages that earn money on commissions, Robinhood earns revenue from interest and cash on its accounts, as well as from premium subscriptions, and offers crypto trading as well as equities.

Its latest round of financing in May valued the company at $5.6 billion, and CEO Baiju Bhatt confirmed the company’s IPO plans in September.

- Cloudflare

CloudFlare, which sells performance and security services for websites, is a well-established name in web hosting and cybersecurity that could go public in 2019. The company is aiming to turn its ubiquity — it serves about 10 million web domains, according to its website — into a successful public offering.

According to Reuters, Cloudflare is seeking an IPO in the first half of next year that could value it at $3.5 billion, a transaction that will be led by Goldman Sachs.

Should You Buy the IPO?

Will these companies be a good deal for individual investors when their offering is completed? Maybe not. It could depend, in part, on the lockup.

An IPO lockup also referred to as a “lock-up period,” is defined as a contractual caveat referring to a period after a company has gone public when major shareholders are prohibited from selling their shares. Lock-up periods usually last between 90 to 180 days.

Once the lockup period ends, most trading restrictions are removed. And at times the stock drops sharply. This happened in the case of Snap (NYSE: SNAP).

Selling accelerated into the end of the lockup and was then heavy after the lockup. The blue arrow on the chart below shows the end of the lockup.

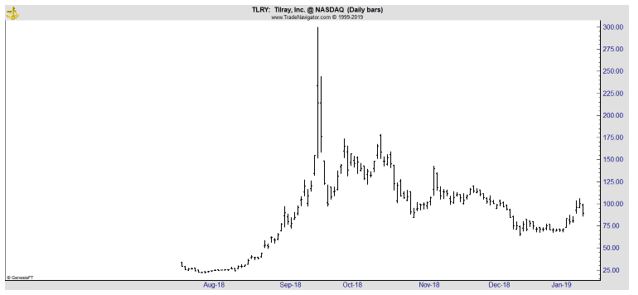

More recently, Tilray (Nasdaq: TLRY) faced pressure ahead of the end of the lockup.

TLRY took active steps to reduce the impact of the news of the lockup ending by announcing, that same day, a deal with Authentic Brands Group to develop and market consumer cannabis brands around the world.

“Through the deal, Tilray is hoping to get its cannabis products into more mainstream retail outlets — both brick-and-mortar and online — than the cannabis dispensaries’ direct-to-patient sales that are Tilray’s primary modes of sales right now. Authentic lists Walmart Inc. and Macy’s Inc., among others, as partners on its website,” according to MarketWatch.

This could indicate TLRY is a buy at this level as management is actively trying to boost the stock price.