This Company Demonstrates Why You Should Diversify Your Portfolio

Many investors follow Warren Buffett because he may be the most successful value investor of all time. That means they read what Buffett says and try to incorporate his ideas into their own portfolio management.

This can be helpful but could also present some problems. Buffett, for example, has said, “stated that “diversification is protection against ignorance. It makes little sense if you know what you are doing.”

This contradicts much of what can be conventional wisdom about diversification.

Diversification, according to Investopedia “is a risk management strategy that mixes a wide variety of investments within a portfolio.

The rationale behind this technique is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk of any individual holding or security.

Diversification strives to smooth out unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others.

The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated—that is, they respond differently, often in opposing ways, to market influences.

Studies and mathematical models have shown that maintaining a well-diversified portfolio of 25 to 30 stocks yields the most cost-effective level of risk reduction. The investing in more securities generates further diversification benefits, albeit at a drastically smaller rate.”

This contradicts with Buffet’s view, which is in effect saying that studying one or two industries in great depth, learning their ins and outs, and using that knowledge to profit on those industries is more lucrative than spreading a portfolio across a broad array of sectors so that gains from certain sectors offset losses from others.

Risks Might Not Be Easy, or Even Possible, to Fully Understand

Let’s say you become an expert on an industry and believe you understand the risks of the industry. Let’s assume that it’s the utility industry. Zack’s summarizes key risks of the sector:

“Regulatory Risks: Most U.S.-based large-cap utilities are regulated at the state and local levels. With many of these companies operating in multiple states, that means an increased burden on management to ensure the company does not fun afoul of regulatory guidelines.

That is more of concern for the company than for investors. However, if a major utility gets into hot regulatory water in one state,

Wall Street is not likely to care about the fact that the same company operates in 10 other states. When companies draw the ire of regulatory bodies, it is rarely good for the stock, regardless of sector.

Commodities Prices: For decades, more than half of the electric power in the United States was generated with coal. Electric utilities started to drift away from coal in the 21st century as a shale boom made the nation one of the world’s largest natural gas producers.

Then when gas prices collapsed during the 2008 financial crisis, utilities embraced heavier natural gas use because it was cheaper and cleaner. The bad news is that as natural gas prices and demand spike, utilities could be forced to use more coal.

The worse news is that emerging markets could stoke coal demand, driving prices higher. Utility companies could be faced with higher prices at the same time for the two commodities they most depend on.

Growth Stocks in Favor: Utilities they tend to prove durable during market downturns. However, that cuts both ways.

In a legitimate bull market in which investors favor high-beta growth stocks in sectors such as technology, investors holding utilities stocks are likely to see their returns underperform the broader market.

Interest Rate Risk: A high interest rate environment is often viewed as extremely bad news for utilities stocks, for two reasons. Electric utilities are capital-intensive businesses that often carry large debt loads.

When interest rates rise, so does their cost of financing debt. And because those higher debt costs strain some balance sheets, some utilities pare or suspend dividends when interest rates are high.”

These are all risks that can be understood and quantified to some extent in financial models. Analysts could, for example, understand the risk to earnings of interest rates go up or commodity costs spike higher.

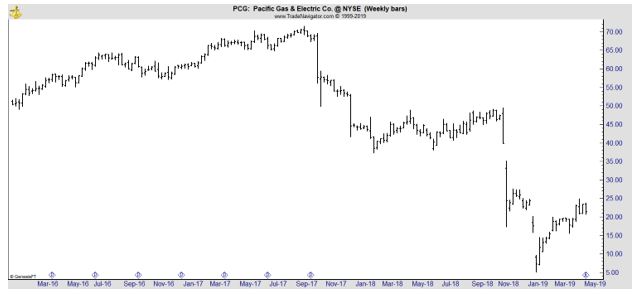

Yet, the risk that undermined Pacific Gas & Electric (NYSE: PCG) are not on the list.

Wildfires Claim the Company

PG&E filed for bankruptcy after “Fire investigators determined PG&E to be the cause of at least 17 of 21 major Northern California fires in 2017.

It is also suspected in some of the 2018 wildfires that have been described as the worst in state history, including one that killed at least 86 people and destroyed the town of Paradise.

PG&E said it faced an estimated $30 billion liability for damages from the two years of wildfires, a sum that would exceed its insurance and assets. The bankruptcy announcement, in a filing with federal regulators, led the company’s shares to plunge more than 50 percent.”

This was a risk that investors would have found difficult to quantify. On the other hand, Boeing’s (NYSE: BA) decline after aircraft crashes were understandable.

The fact the risk of crashes is part of the aircraft manufacturing business helps to explain the stock’s resilience.

What all of this means is the reminder, once again, that we as individual investors are not Warren Buffett. His mind allows him to understand risks that other investors cannot see, or perhaps he simply focuses on safety and only invests in companies where he believes he fully understands the risks.

Buffett does in fact invest in utilities and may have been able to quantify the risks of the potential disasters that companies face. But we do not have the resources Buffett has and will not be able to develop as complete an understanding of a company that he can.

That could mean that diversification might not be in Warren Buffett’s best interest as an investor but it could very well be in the best interests of smaller investors who cannot simply call any CEO and request an explanation of risks the company could face in the future.