These Stocks Could Shine in a Bear Market

The S&P 500 fell slightly more than 20% from its all-time, intraday high to its recent low. The Dow Jones Industrial Average shows a 19.4% decline from its highest level. Yet, to purists, this isn’t a bear market. Some analysts require a 20% decline based solely on closing prices to declare a bear market.

While it might not be an official bear market, there is little doubt that there has been a steep decline and many investors are nervous. That means, according to a recent Barron’s article, now could be an ideal time to look at preferred stock.

Preferred stocks are an often overlooked asset class. Preferred stocks are assets that combine some of the features of stocks with some of the features of bonds.

Shares of preferred stock are a claim on the company’s assets, just like common shares which are the class of stock that is more commonly traded. However, preferred shares have a higher claim on the company’s assets and earnings than common stock.

Preferred shares generally have a dividend that must be paid out before dividends to common share holders can be paid. Unlike common stock, preferred shares usually do not have voting rights that provide share holders with a say in the company’s operations.

One benefit of preferred stock is that although it pays a fixed level of dividends, like common shares the market price of the security can go up.

Some Preferred Shares Are Attractive

In the recent article, the financial paper noted that sometimes, preferred stocks are attractive and at other times they are not. In that way, they are simply like the more familiar common stocks. Specifically, the article noted:

“From time to time, Barron’s writes about preferred stocks, which are of particular interest to income-seeking investors. They aren’t as sexy as common stocks because their price moves—up or down—are more restrained.

But that relative stability attracts some folks, as does the offer of juicier dividend yields, compared with those of plain equities. Moreover, when preferred prices fall significantly—as some have now—there’s the potential for capital gains, too.

[Several months ago] in these pages, Nat Beebe, a portfolio manager at…preferred specialist Ulland Investment Advisors, suggested that readers sell some preferreds because they were expensive. Back then, net issuance of preferreds was down and redemptions were up.

Scarcity value had boosted prices, but the yields weren’t high enough to compensate for the risk of rising interest rates. The securities he eschewed have slid some 5% to 8% since we wrote about them.

Now, he says, some preferreds could give almost equity-like double-digit percentage total returns next year. In part, his reversal reflects a technical change in that market and the softer outlook for interest-rate hikes by the Federal Reserve in 2019.

The market selloff has hit other asset classes. And large outflows from exchange-traded funds that specialize in preferreds, plus selling by mutual funds, have depressed prices.”

Rising interest rates tend to dampen demand for preferreds. Now, “we view the Fed as close to done,” Beebe observes.” The chart below shows the yield on the ten year Treasury has been falling.

The article adds, “…it’s a better time to lock in some 6%-plus yielding preferreds and possibly get capital gains, too, he says. As preferred prices have fallen, yields have begun to look more attractive. (They move inversely to prices.)”

Specific Recommendations

The amount of the dividend is fixed when a company issues preferred shares. That amount will often be expressed as a percentage because the par value of the shares.

The par value is the face value of the shares. This is a concept that is usually applied to bonds. The par value of a bond is the amount that will be paid when the bond matures. It is typically $1,000. The market price of a bond may be above or below par, depending on factors such as the level of interest rates and the bond’s credit status.

Par value for preferred shares is usually $25 or $100 and the market price will be determined by the current level of interest rates and the financial health of the issuer.

Specifically, “Ulland likes preferred securities with yields of 6.25% and above, and finds three that merit a look. He expects all three, which are $25 par priced, to gain $1 to $1.50 in price, which would bring the total return to about 10%.

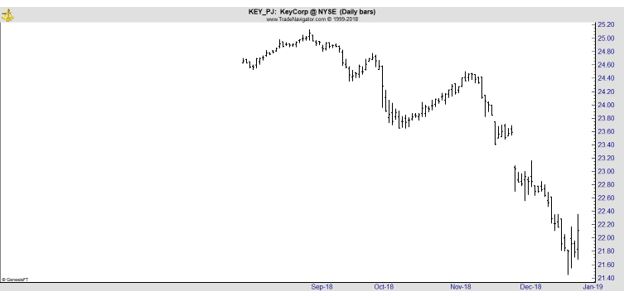

Among his picks are Keycorp 5.65% perpetual preferred, series F (NYSE: KEY-J), trading at $22.11 recently. It offers a healthy dividend of about 6.37% and the stock could get to $23.50 when it rebounds,” Beebe says.

This stock has pulled back in recent weeks.

Another is Capital One Financial ’s 5.2% preferred, Series G (NYSE: COF-G), trading at $20.93. It’s yielding 6.21% and is off 15% this year. “There could be a nice snapback if the market stabilizes,” he says.

This stock has also been in a down trend.

The third favorite is TCF Financial , a local Minnesota bank. Its 5.7% perpetual preferred (NYSE: TCF-D) series C is priced at $21.81 and yields 6.44%. It’s a smaller bank and off the radar screen for many investors; hence, the higher yield.

The pattern on this stock is the same with a recent decline.

The credit ratings on these three issues are at or slightly below investment-grade. Nevertheless, Beebe says these banks are healthy and have strong capital levels. Ulland owns all three, with the Keycorp preferred most recently added to client portfolios.

There are many individual issues available, or an investor could choose to invest in an index of preferred securities. Several exchange traded funds, or ETFs, make it possible to conveniently invest in a diversified basket of preferred shares at a low cost.

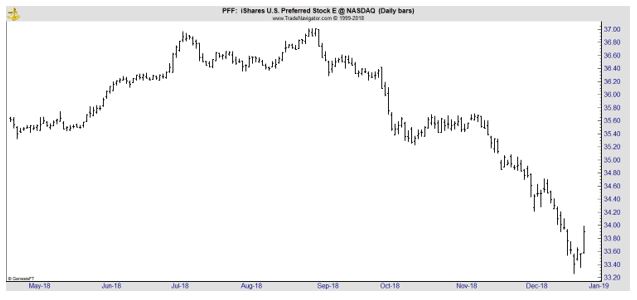

One ETF is iShares US Preferred Stock ETF (NYSE: PFF). The next chart shows the price action in this ETF is similar to the movements seen in the stocks shown above.

The drawdown in the 2008 bear market was more than 68% but investors who held through that decline did recover their losses, just as investors in the broad stock market indexes did.

Given the risks related to a price decline in the ETF, investors need to be comfortable with the level of income provided. The yield on PFF was recently 5.8%.

After the recent declines, this asset class could be attractive to nervous investors.