These Four Large Cap Stocks Are Bargains Now

Market sell offs do have a silver lining. As prices fall, valuations tend to decline in the market. As prices fall, in other words, some stocks become bargains. And, with the S&P 500 and other major market averages showing double digit declines, bargains are appearing.

The question investors must answer is what is a bargain. It could be best to define that in advance and then hunt for stocks that meet that definition. Could prices be lower, later? Absolutely. But, even Warren Buffett buys early.

In November 2008, months before the market bottom in March 2009, Warren Buffett was a big buyer, in one deal, he invested $5 billion in Goldman Sachs Group.

In exchange, Goldman gave Buffett:

- $5 billion worth of “perpetual” preferred shares. Goldman agreed to pay a 10% dividend on those preferred shares to Buffett, which cost Goldman about $500 million a year.

- Warrants for 43.5 million additional shares. Warrants are similar to options. In this case they were the legal right to buy a stock at a particular price, which for Buffett was $115 per share. The deadline for exercising these warrants was Oct. 1, 2013.

In the end, Buffett was rewarded for buying too soon:

- On the preferred shares, Goldman had the right to buy them back, and did so in March 2011, paying Buffett $5.64 billion. That included the original $5 billion in principal, as well as a $500 million bonus for early repayment, and $140 million in dividends Buffett was due.

In total, Buffett made $640 million on his $5 billion investment, or about 13% in a little more than two years plus he received dividends of about $1.1 billion in that time, a total return on this half of the investments of about 35%.

- The warrants allowed Buffett to add to his gains. This part of the investment allowed him to buy shares at $115 which he did, and he is a large shareholder of the company.

Now, of course, we aren’t Warren Buffett. But we can find value in the market.

Finding Value Like a Quant

A quantitative approach to investing relies on computers to identify characteristics of successful stocks. Based on historical performance of that factor, the investor buys all stocks that meet the defined criteria.

Quants often use a computer output to drive all decisions. They may not supplement that output with any other analysis. This has provided success and outsized returns to some investment managers.

But, for many years it required expensive data sets and customized programming skills to find stocks with a quant strategy. Now, those tools are available to individual investors and some tools for implementing quant strategies are even available for free.

A Free Quant Screening Tool

One way to find stocks meeting a variety of predefined requirement is with the free stock screening tool available at FinViz.com. At this site, you could screen for a variety of fundamental factors like free cash flow, high levels of institutional ownership and bullish institutional transactions.

There were 7,544 stocks in the database on a recent day. We want to search for just a few that could be good investments. We will focus solely on fundamentals criteria and we will search for safe income stocks. There is no guarantee these stocks will be safe but we use quant criteria in an attempt to limit risk.

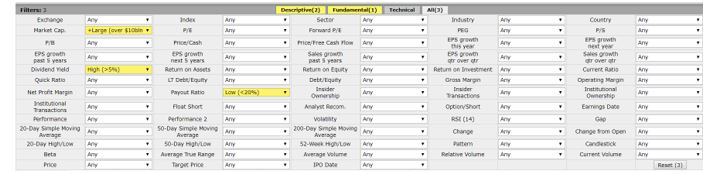

To ensure the stock is tradable at a reasonable cost, even in a market crash, we will limit the search using market cap selecting just the largest stocks which is defined in FinViz as stocks with a market cap of at least $10 billion. All selections are made with pull down menus as shown below.

We then added a filter for high income (a dividend yield of at least 5%) and for safety we required a low payout ratio of less than 20%. This screen is shown below.

Source: FinViz.com

The payout ratio is defined by Investopedia as “the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage. The payout ratio can also be expressed as dividends paid out as a proportion of cash flow.” It is the dividend per share divided by the earnings per share.

Lower payout ratios are generally considered to be safer. An example can illustrate that point.

If the payout ratio is greater than 100%, that means the company is paying out more in dividends than it is earning. In the long run, that is likely to be unsustainable and would indicate the dividend is not safe.

Four Safe, High income Stocks

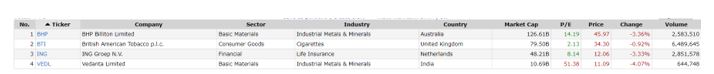

The criteria we used left us with just four stocks to consider as buys.

Source: FinViz.com

These are simply stocks that passed a quantitative screen. Additional research could be useful.

For example, British American Tobacco p.l.c. (NYSE: BTI) made the list. Its dividend is 7.8%. But, the company was the recent subject of significant news stories.

Earlier this month, the Food and Drug Administration announced plans to ban on the sale of menthol cigarettes. The rules could take up to two years to be finalized but traders reacted quickly to the news by selling BTI.

The company makes and sells Newport, one of the most popular menthol brands in the United States.

Menthol sales account for about one-quarter of BAT’s annual profit, according to analysts at Jefferies. Owen Bennett, an analyst at Jefferies, said, “In terms of how much profit is at risk, though, we think it is way below this.”

“We think many will just switch into a non-menthol variant of their brand versus quitting, or, given the availability of reduced-risk products, will now switch into one of these. The question is then, can the majors take their fair share of those switching?”

The company also has plans to maintain profits after the rule becomes effective. CEO Alison Cooper told investors the company was targeting ambitious growth in “next-generation products”.

But, those products are also in the sights of regulators and there is no guarantee of success. Investors should consider the risks when making investment decisions and add some research even when quant screens are used, especially during a market sell off.