The Truth About Value Investing

Value investing works. Plus, it is intellectually appealing. Yet, it is difficult for many individual investors to strictly follow a value investing philosophy in the long run. There are some very good reasons why value investing is so challenging to implement.

First, let’s consider its intellectual appeal. Value investing is widely described as buying assets at a discount. As Warren Buffett says, it’s best to buy both socks and stocks at a discount. Bargain hunters are drawn to value investing because of this idea.

Discounts Can Be Misleading

In retail stores, shoppers know that markdowns can be misleading. For example, a “70% Off” sign will often include fine print that the discount is based on a suggested selling price and the item may never have actually been sold at that higher price.

In stocks, the discount that investors believe they are getting may also be based on a price that is well above what the stock would sell for in the market.

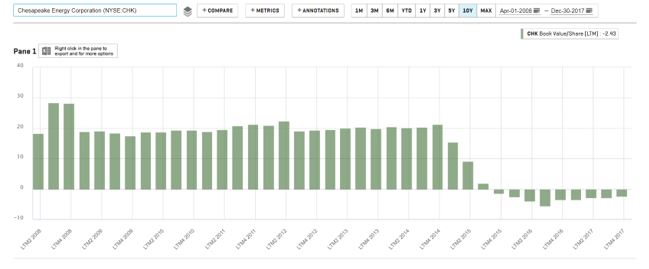

For example, an investor might find a stock priced at $3 a share. But, the book value is $22 a share. They believe the market price is a deep discount to its book value and they buy, expecting to reap a significant profit when other investors notice the value.

Unfortunately, the investor is buying just weeks before the company announces that it is writing off billions of dollars in book value because of changes in the market conditions. After the write offs, the book value drops to just $2 a share and traders are concerned the value is still overstated.

This simple example demonstrates that the appeal of value investing could be an illusion in some cases. There will be times when the apparent value is not real. The market is simply discounting a problem at the company that has not been fully revealed yet.

Importantly, this is not just a hypothetical problem. The chart below shows that book value does change, suddenly at times, and can make a bargain into in an overvalued situation with a single announcement from the company.

Source: Standard & Poor’s

The same is, of course, true for retail bargains. That $2 knock off of a $200 watch is not going to last and many shoppers avoid buying this type of merchandise. But, in stocks, the true value of a company can be difficult to determine.

But, Value Works in Studies

Although many individual investors have suffered large losses buying stocks that appeared to offer value. They take solace in the fact that many studies have demonstrated that value investment strategies work.

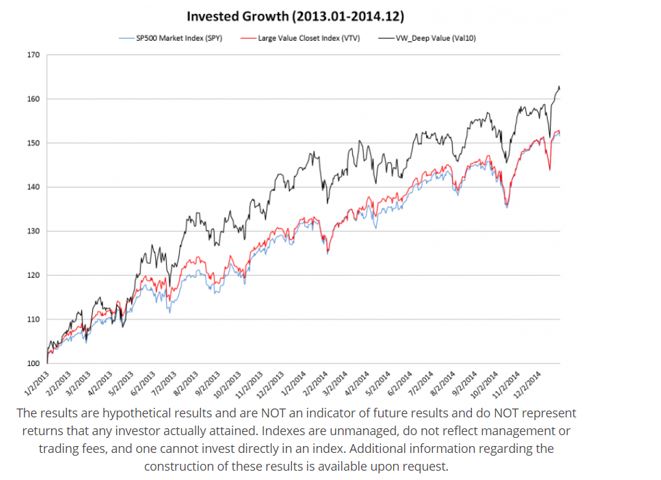

Many of the studies show a chart similar to the one below.

Source: Alpha Architect

The value portfolio outperformed the market portfolio, in the long run. Studies consistently confirm this and the studies show any measurement of value is likely to deliver results that beat that market.

That means investors could select stocks based on a low price to earnings (P/E) ratio, low price to book (P/B) value, a high dividend yield or nearly any other valuation metric. In the long run, studies show the strategy should provide market beating results as long as the strategy implemented in the same way the strategy is presented.

The key is that to obtain the type of results shown in the studies, the investor must invest like the study says. And, the truth is, that’s impossible for individual investors to do.

Studies generally sort stocks into deciles, or ten groups that each include several hundred stocks. Many studies then assume a long and short investment where the investor buys the stocks in the most undervalued decile and sells short all of the stocks in the most overvalued decile.

Doing this would require holding several hundred positions and the minimum account size required to duplicate these strategies is, quite simply, beyond the reach of almost all individual investors.

The reason the portfolio outperforms is because some of the positions will deliver very large gains. Many of the positions are likely to deliver either small gains or losses and some will result in relatively large losses.

Overcoming the Obstacles

Now, the problem is clear. The success of value investing depends on identifying the few stocks that will be among the biggest winners. Simply buying undervalued stocks will not guarantee success since there is no way to determine in advance if any single stock will be a large winner or not.

To overcome this problem, even small investors should consider the need to diversify their investments. They should always hold at least a few stocks but there is no right answer as to how many is the correct number of holdings.

One solution is to cut losses quickly and let winners run. This means an investor will sell a position when it falls in value and could even add available funds to the winning positions. This strategy is not one that is easy to follow.

Many individual investors add to losing positions. They seem to be thinking that if the stock offered value when they made the first purchase, it is now on sale at an even better price. This, however, will mean that they add to the stocks that are destined to deliver losses.

Rather than adding to losers, an investor should give a stock sufficient room to decline and then sell. The meaning of what represents sufficient room will depend on the investor’s risk tolerance. Many investors sell when prices fall by 20% while others may use a 30% loss as their sell signal.

One way to limit losses is to know what percentage loss will trigger a sell when the buy is made. Then, stock with that decision, no matter what happens. If the stock truly offers value it could always be bought back later.

Another important consideration is to use multiple indicators. Rather than using solely the P/E ratio, consider requiring growth in sales as an additional factor, for example.

These simple steps – diversification, cutting losses and using confirming indicator – will not guarantee success but they will help an investor avoid the large losses that are possible even with a value investment approach.