The Biggest Trend Investors Should Be Aware Of

The biggest trend investors should be aware of might be fintech.

Fintech is the term that is “used to describe new tech that seeks to improve and automate the delivery and use of financial services.

At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations, processes and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones.”

Investopedia explains, “Fintech, the word, is a combination of “financial technology.” When fintech emerged in the 21st Century, the term was initially applied to technology employed at the back-end systems of established financial institutions.

Since then, however, there has been a shift to more consumer-oriented services and therefore a more consumer-oriented definition.

Fintech has expanded to include any technological innovation in — and automation of — the financial sector, including advances in financial literacy, advice and education, as well as streamlining of wealth management, lending and borrowing, retail banking, fundraising, money transfers/payments, investment management and more.

Fintech also includes the development and use of crypto-currencies such as bitcoin. That segment of fintech may see the most headlines, the big money still lies in the traditional global banking industry and its multi-trillion-dollar market capitalization.”

Why Fintech Matters to Investors

As Institutional investor recently reported, “Almost a decade after the passage of the Dodd-Frank Act, what keeps bankers awake at night is not regulation by Washington, but competition from Silicon Valley.

At first, competitors took the form of financial technology startups (fintech for short), whose avowed aim was to relegate the banks to the ash heap of history.

Fintech startups ranging from LendingClub (credit) to Robinhood (securities trading) got the bankers’ attention but did not concern them inordinately.

After all, banks have significant advantages over fintech startups, such as preferred access to data and capital, not to mention the advantages conferred by the competitive moat of government regulation.

The real threat, the bankers are coming to recognize, is big tech, not fintech. Unlike fintech startups, firms such as Amazon, Google, Alibaba and Tencent have deeper pockets and better access to data than any bank.

Most important, big tech firms have uniquely intimate relationships with their customers. These factors turn big tech’s lack of regulatory oversight into a competitive advantage, allowing them to operate on the margins of financial regulation at a much larger scale than a fintech startup.”

These trends indicate that investors should reconsider stocks in the financial sector and the tech sector.

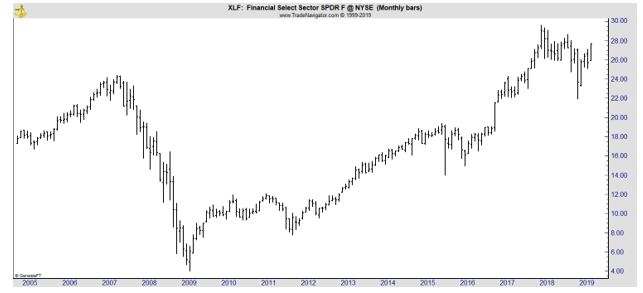

By one measure, financial stocks are at new all time highs. The chart below shows the Financial Select Sector SPDR ETF (NYSE: XLF), a proxy for the sector as a whole.

This chart could lead traders to believe that the threat of tech companies is far off. But, CNBC notes, the large firms in the sector are taking the treat seriously.

“The banking industry isn’t sitting still. In 2015, J.P. Morgan Chase CEO Jamie Dimon warned in his annual shareholder letter that “Silicon Valley is coming” to try to eat the industry’s lunch.

So for the past few years, big banks have been preparing for upstarts by building their own applications, reorganizing their tech staffs to innovate faster and partnering with fintech firms.

By offering their own tech solutions, banks hope that outsiders — whether they’re big tech companies like Amazon or fintech upstarts like Square — won’t be able to pry away their customers.

Last year, J.P. Morgan unveiled YouInvest, its answer to free-trading app Robinhood. Citigroup and others have released digital-only banking apps, and Bank of America is planning to unveil a financial coach called Life Plan in the fall, CNBC reported this month.

By making these moves, traditional banks are acknowledging that in this era of blurring boundaries between industries, everyone is a competitor.”

And the banks have good reason to worry about the threats from outside their industry – customers are comfortable with the tech giants. “Amazon and other tech firms have at least one significant advantage versus banks: Customers enjoy using their products more.

Based on what’s known as “net promoter scores,” customers much prefer Amazon to banks. The e-commerce giant earned a 47 in the score that measures the likelihood a user would recommend a company’s services, according to a September report from Bain. National banks scored an 18, while regional banks came in at 31.

Amazon customers may be open to a potential invasion of their wallets. Bain asked 6,000 U.S. consumers in 2018 if the company launched a free online bank account that came with 2 percent cash back on all Amazon purchases whether they would sign up to try it. About two-thirds of Prime members said yes.

“When big tech companies choose to go into banking, they already have brand reputation and they have the distribution,” said Karen Mills, senior fellow at the Harvard Business School and a former administrator of the Small Business Administration.

“Customers have proven that they will flock to whoever gives them a better experience.”

Trading the Trends

For investors, this means they should not become complacent. Financial stocks have a history of volatility and some of them saw deep losses in the bear market that began in 2008. Those losses were due to risks in the bank’s balance sheet caused by risky loans like subprime mortgages.

One scenario that investors can not ignore is the possibility that banks will seek to offset the risk from competition by easing lending standards. In theory, rules imposed since the financial crisis limit this risk but prudent investors should be aware of the risk and scrutinize quarterly reports for signs of credit problems.

While paying attention to potential risks, investors should also consider potential opportunities. Additional profits from financial services could lead to significant gains in large companies like Amazon or Google.

New entrants into finance should not be ignored but these companies may take time to deliver gains to individual investors. If Robinhood and other new firms complete initial public offerings, investors should consider waiting for the results to catch up to the hype. Like other IPOs, there are risks even in new fields.