Six Stocks Under $5 Designed for the Worst Six Months

We are now officially in the seasonally bearish worst six months, the time of year characterized by the popular saying to “sell in May and go away.” This is the time of year with high risks and potentially lower than average returns.

Losses for the worst six months resulted from negative returns in just a few years. Stocks were actually up 60% of the time in the worst six months, close to the winning percentage of 69.3% for the best six months. Just a few years actually explain all of the performance in both time periods.

For the worst six months, the worst year, 2008, explains why this six-month period shows a loss. Excluding that year, we have an average annual gain of 3.6% in the worst six months.

This leaves us with a problem – even in the worst six months, stocks go up most of the time. Missing the gains means we fail to meet our primary investment goal which is to maximize wealth. If we sit on the sidelines earning nothing on cash for half the year, we are almost certainly not maximizing wealth.

Sam Stovall, a highly respected researcher at Standard & Poor’s, addressed this problem and found that defensive sectors, stocks investors turn to when they are concerned about risk, outperform broad stock market averages during the worst six months.

For specific investments, he advised looking at the consumer staple and healthcare sectors. His research indicated stocks in these sectors could provide market-beating gains even during the worst six months.

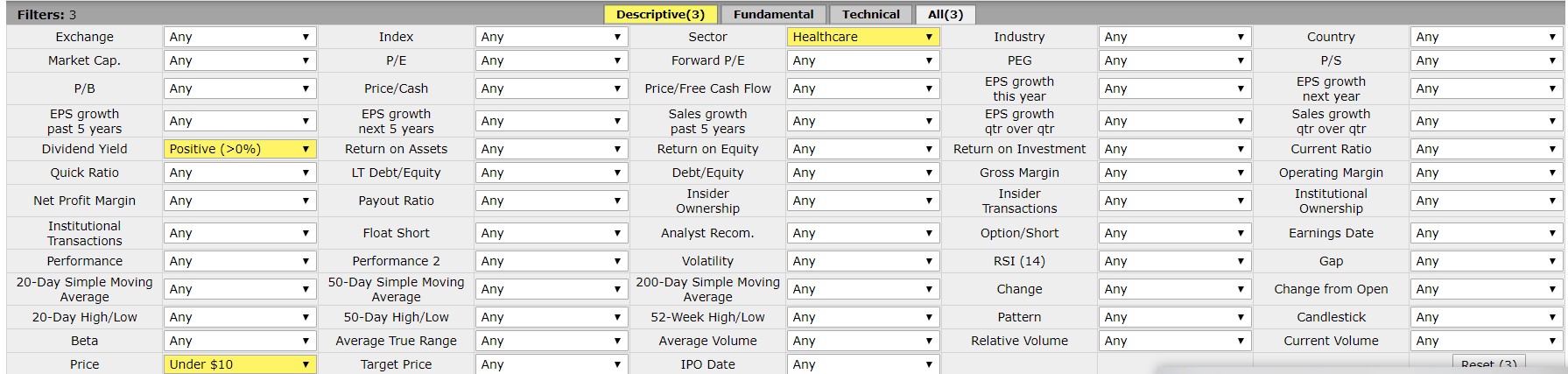

This week, we look at health care stocks that provide income and are priced below $10 a share.

Finding Potential Income For the Worst Six Months

We will start our search by focusing only on stocks that offer a dividend and, in effect, pay investors to wait for returns.

Then, we limited our search to low priced stocks.

Individual investors understand that low priced stocks could be appealing for two reasons. One reason is that the low price means they have little down side risk in dollar terms. The second reason is that low priced stocks are generally the ones that deliver the largest short term gains.

One study looked at how low priced, or cheap, stocks performed relative to more expensive stocks. The study found that cheap stocks delivered more than six times the average return of the more expensive stocks in a typical quarter.

That’s why we limited our search for potential bargains by focusing on stocks priced at less than $10 per share. While we would like to see stocks at even lower prices, there just weren’t many that passed our stringent screening criteria, so we had to use a cut off value of $10 to ensure some degree of diversification in this screen.

One way to find stocks meeting these requirements is with the free stock screening tool available at FinViz.com. At this site, you could screen for a variety of fundamental factors, high levels of institutional ownership and bullish institutional transactions. An example is shown below.

Source: FinViz.com

This screen is a reasonable starting point for additional research. There is no guarantee any of these stocks will deliver gains and risk should always be considered. It’s also important to remember that screens like this will not identify unique risk factors.

Stocks passing the screen are shown below.

Source: FinViz.com

You can see these are not household names. But they are interesting companies with potential.

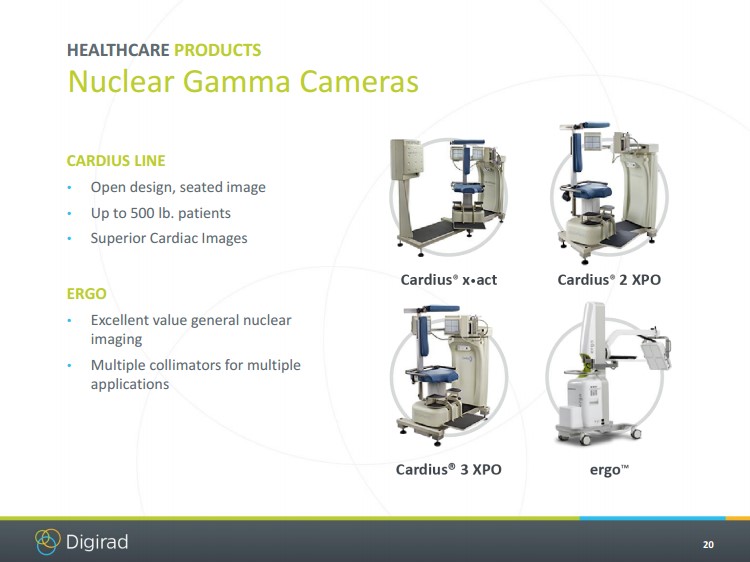

Digirad Corporation (Nasdaq: DRAD), for example, is a provider of diagnostic solutions. The company makes and services diagnostic imaging solutions for medical facilities and physicians’ offices.

Digirad provides equipment for nuclear cardiology, ultrasound, echocardiography, vascular imaging, and neuropathy diagnostics, along with equipment rental and personnel staffing.

Many of the company’s products are relatively portable, making them attractive to providers who avoid the expense of building a room to accommodate large equipment. The designs are also open, making them attractive to patients who often prefer open systems to closed-in designs that can create a feeling of claustrophobia.

Recently, Digirad acquired a mobile healthcare services division and the exclusive right to sell and service Philips Medical Equipment in the upper Midwest. The company is now integrating those operations and could grow its business with current operations or through the acquisition of small competitors as it has in the past.

DRAD began paying a dividend in 2013 and management has indicated they intend to continue doing so. However, some data sources indicate the company no longer pays a dividend.

This highlights the importance of research. We reproduced the results of our screen from FinViz in the chart above. You can see that data source indicates this is an income stock. Different data providers will sometimes present conflicting information.

If income is important to you, it could be best to verify the dividend with the company. That can usually be done by reviewing the company’s investor relations web site or by calling the company’s investor relations representatives.

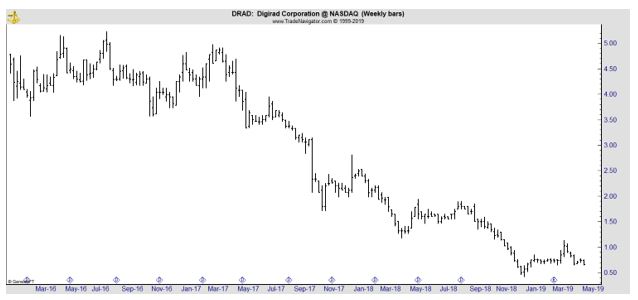

The chart of DRAD is shown below and indicates the stock is in a long term down trend.

It does appear to be trading near support and the down side risk in the stock is limited to the price paid which is relatively low. If you do find this stock attractive it could be worth considering the stock as a trade, taking profits as they become available. After all, a stock can always be repurchased after it is sold.

The stocks we identified with the FinViz screen could all deliver significant gains, or they could all prove to be worthless. That is the risk of any investment but the potential gains in small cap stocks can be large while the potential risks are limited to the price paid at the time of purchase.

While screening tools can be useful, as we saw, they should always be used as a starting point for research since the data they use could be incorrect. It could be best to verify the data points that are most important in your decision process with at least one other data source.