Pitfalls of Value Investing: Value Traps

Investors are a diverse group. Some focus on the long term and others have a shorter term time target. Some pursue quick gains, others want to hold positions for years and still others try for short term gains but if they experience a loss, they decide to hold a position for the long term.

Despite the diversity, many investors share common experiences. One experience many investors share is the pain of a value trap. This occurs when investors buy a stock because it is undervalued, and the stock becomes more undervalued or refuses to move higher.

This amounts to dead money and is something no investor can afford. Trading capital is limited and dead money is capital that fails to deliver a significant gain for an extended period of time.

An Example of a Value Trap

The value trap is often in a well known company. General Electric Company (NYSE: GE) is an example of a well known company which until recently enjoyed a reputation for outstanding operations and management.

Over the past year, the stock price has plummeted as investors question the ability of management to continue delivering gains. Like almost all events in the stock market, this isn’t the first time we’ve seen a plunge in the price of GE. Looking at the past could help us develop a plan for the future.

In the bear market that bottomed in 2009, GE was also plummeting. This was, of course, true of almost all stocks. However, many investors initially viewed GE’s decline as a potential buying opportunity. At this point, the company’s reputation was still intact. However, even then, problems lurked under the surface.

The problems then were related to GE Capital, the company’s financing arm which had, in fact, become highly leveraged. Eventually, GE Capital would require a bailout, catching many investors and even policy makers by surprise.

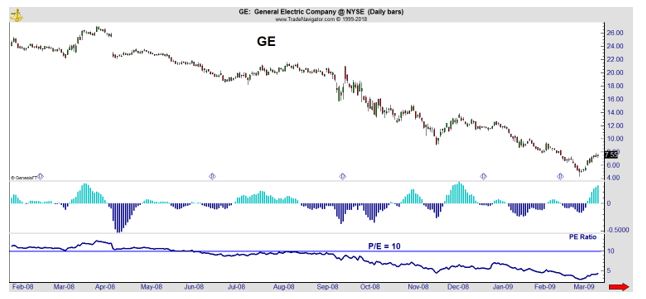

Despite the looming problems, the stock was attractive to many individual investors. The chart below shows why. The stock’s price to earnings (P/E) ratio was below 10. In the chart, the P/E ratio is shown at the bottom and the horizontal line marks the value of 10, a level often considered attractive.

Investors who bought when the P/E ratio broke below 10 in the summer of 2008 would see the value of their investment fall by more than 60%. They had bought based on value and become trapped in an investment that was falling.

GE, in 2008, was an example of a value trap. Looking solely at value is a mistake, but it is a mistake many investors make. This is true for both individual investment and professional investment managers.

Why Value Traps Exist

Value, on its own, can be deceptive. For our purpose here, value refers to a stock trading with low P/E ratio or offering low valuation on other metrics. It is important to remember that P/E ratios are just one metric. Any valuation metric offers the same benefits and potential pitfalls to investors.

A low P/E ratio carries one of two meanings. The stock is either undervalued and due to rebound or overvalued and due for even more problems. The truth will only be known for sure in hindsight.

We generally think of value highlighting bargains rather than problems. But, consider the stock of a company that is headed towards bankruptcy. The company might have some earnings from the past twelve months but the company is troubled.

Assume the earnings of a drug company are $1 per share. The stock is at $20 and the P/E ratio is 20. Analysts see that the company’s product is losing patent protection next year and there is no replacement in the research pipeline. The company will be bankrupt in two years.

As traders begin acting on this insight, the stock falls to $10 in a matter of weeks. The P/E ratio is now 10. Some individual investors may now believe the stock was worth $20 just a few weeks ago and it is now on sale. They buy, expecting a rebound to $20.

The stock falls to $5 after the next earnings report where the company manages to report earnings that are unchanged from a year ago because of share buybacks and accounting benefits. Now the P/E ratio is $5 and some investors buy more, averaging down because they believe the stock is worth $20.

Notice the P/E ratio in this case is plunging because the stock is facing problems and likely headed to zero. But, some investors believe it reflects a bargain. That leads to the value trap.

Look for Momentum and Value

James O’Shaughnessy published “What Works on Wall Street: A Guide to the Best Performing Investment Strategies of All Time” in the late 1990s and demonstrated that value is an excellent investment strategy. But, it works better when combined with momentum.

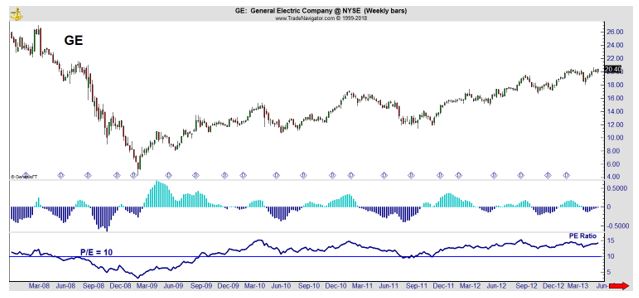

The next chart adds MACD, a momentum indicator to GE.

Avoiding GE when the MACD is bearish is one way to avoid the value trap. This is a daily chart and would require active trading. The next chart is a weekly view and would require less trading.

Other indicators such as relative strength could also be used, and they would be less active than a MACD strategy, but those indicators are less widely available.

What About Now?

GE is once again trading at low valuations, and many investors are tempted to buy, noting that the company has survived for more than 100 years and seems unlikely to be headed towards bankruptcy and a stock price of zero.

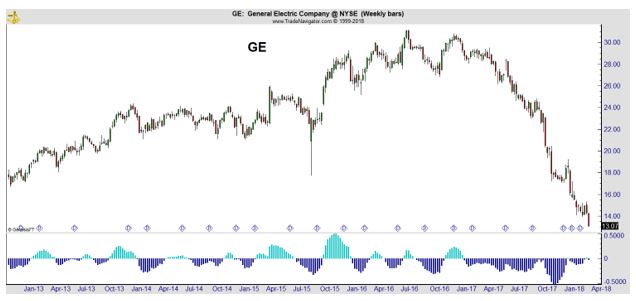

The stock chart below shows the recent price action, using weekly data.

Notice that momentum, again shown with the MACD, has been negative throughout the stock’s decline. This indicates there could be more downside.

Of course, using a momentum filter to buy stocks offering value will result in buying after the bottom has formed. This guarantees an investor will never catch an absolute bottom. It also reduces the risk of a value trap. There will always be tradeoffs and individual investors need to decide which is more important to them.

If they are truly focused on the long term, they could ignore momentum. However, if they lack unlimited resources and want to avoid dead money, waiting for confirmation that a decline has most likely ended could be the best approach to a value based investment method.