Overcoming the Problems of Covered Calls to Create Passive Income

Source: EatonVance.com

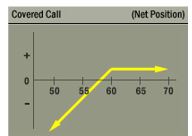

Covered calls are a well known income strategy. With this strategy, an investor sells call options on stocks that they own. They generate immediate income by selling the call which can increase the yield on their stock portfolio.

It’s an appealing strategy for income investors. But, there are a number of problems for individual investors seeking to use the strategy.

The primary problem is that this strategy requires a large amount of capital. Options trade in contracts that cover 100 shares, so an investor must own at least 100 shares of a stock to use this strategy. That can require a large amount of capital, more than many individual investors have available.

A small investor might have 100 shares or more of a low priced stock but the options premiums available on low priced stocks can be rather small. This makes it difficult to generate sufficient income from this strategy after costs are considered.

Income would also be variable, depending upon market conditions that affect the stock market’s volatility along with news and other factors unique to the stock.

In addition to these problems, investors need to consider the advantages and disadvantages of the strategy.

The advantage of a covered call strategy is that it allows investors to generate additional income from stocks they already own, assuming they own a sufficient number of shares and options are available on the stock to generate a sufficient amount of income to cover transaction costs and taxes.

But, this strategy does not do much to mitigate the risks of owning the stock. The maximum loss is limited but substantial. The worst that can happen is for the stock to become worthless.

In that case, the investor will have lost the entire value of the stock. However, that loss will be reduced somewhat by the premium income from selling the call option.

It is also worth noting that the risk of losing the stock’s entire value is inherent in any form of stock ownership. In fact, the premium received leaves the covered call writer slightly better off than other stock owners.

On the other hand, the maximum gains on the strategy are limited. The maximum gains at expiration are limited by the strike price. If the stock is at the strike price, the covered call strategy itself reaches its peak profitability, and would not do better no matter how much higher the stock price might be.

The strategy’s net profit would be the premium received, plus any stock gains (or minus stock losses) as measured against the strike price of the option. This is summarized in the chart below.

Source: OptionsEducation.org

Overall, when all of the risks and potential rewards are considered, selling covered calls is an excellent strategy for passive income but, unfortunately, the traditional approach to the strategy is largely out of reach for many individual investors.

Overcoming Those Problems With an Elegant Solution

There is a closed end fund that sells covered calls and makes the strategy accessible and affordable to any investor. A closed end fund, CEF, raises capital from investors and then invests that money on their behalf. The CEF then trades like a stock and is not subject to risks of sudden redemption.

Because it trades like a stock, the price is set by the market and the trading price can be above or below the value of the assets the CEF actually holds. CEFs often trade at a discount allowing investors to buy assets at a discount.

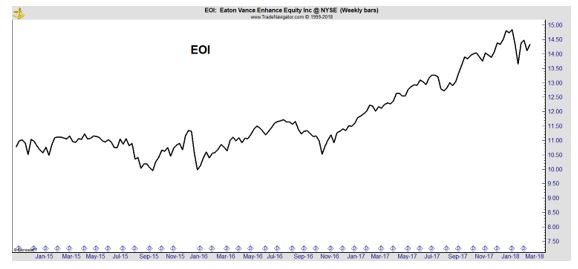

There is a CEF, Eaton Vance Enhanced Equity Income Fund (NYSE: EOI), that uses a covered call strategy. The fund holds a diversified portfolio of more than 50 individual stocks, collects the dividends form the stocks, enjoys capital gains from price increases in the stocks and sells calls to generate additional income.

The fund itself is relatively stable, showing lower than average volatility.

EOI pays a steady distribution of $0.0864 per month and has paid that amount every month since March 2012. That’s a yield of about 7.2%, well above the yield of the S&P 500 index and almost all individual stocks. The high yield comes from the covered call strategy and the fund’s structure.

As a CEF, EOI is able to return capital to investors at times to hold the level of income steady. This means some of the distribution will be tax free at times.

Its holdings are stable, as the chart of its largest holdings shows.

Source: CEFConnect.com

The fund is able to hold Amazon and generate income from the position by selling calls. This demonstrates the power of the Covered Call Strategies to benefit from capital appreciation while generating income even if the stock doesn’t pay a dividend.

Buying Passive Income At a Discount

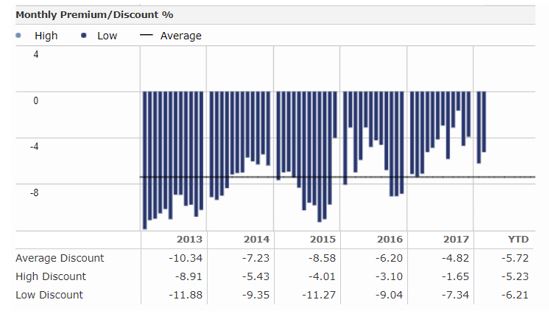

Remember that CEFs trade at a market price which can be more or less than the value of their assets. Many investors limit their investments to CEFs that trade at a discount to their asset value. It’s even possible to develop a strategy that trades based solely on the discount.

A trader could buy when the discount is significantly below average and exit a position when the CEF trades at a premium or when the discount is at least narrower than it was at the time the fund was purchased. The popularity of these strategies means data on discounts is readily available.

For EOI, the average discount over the past three years has been 6.57%. Now, the discount is a little lower than average at about 6.2%. But, the discount typically varies over the course of the year as the chart below shows.

Source: Morningstar

At its current discount, investors are able to buy $1.00 worth of assets for less than $0.94. That is attractive to bargain hunters and value investors.

This is a simple way to generate passive income and based on the history of the fund, the income is steady and predictable with the same amount being paid every month for almost six consecutive years. It also offers a tax advantaged income since any amount that is considered a return of capital will be tax free to individual investors.