News Traders Can Use

Trump administration sues to block AT&T-Time Warner merger

AT&T’s (NYSE: T) gotten out ahead of an expected Justice Dept. announcement that it’s suing to block an AT&T-Time Warner (NYSE: TWX) merger, saying the suit is a “radical and inexplicable departure from decades of antitrust precedent.”

“Vertical mergers like this one are routinely approved because they benefit consumers without removing any competitor from the market,” says AT&T General Counsel David McAtee II. “We see no legitimate reason for our merger to be treated differently.”

The deal will make TV more affordable, innovative, interactive and mobile, he goes on. “Fortunately, the Department of Justice doesn’t have the final say in this matter. Rather, it bears the burden of proving to the U.S. District Court that the transaction violates the law. We are confident that the Court will reject the Government’s claims and permit this merger under longstanding legal precedent.”

Source: Politico

Why this matters to traders: According to AT&T, the vertical merger would benefit consumers by making TV more affordable, innovative, interactive and mobile. The government argues that given control of Turner Broadcasting, AT&T would benefit from higher prices and lower competition. Experts are split on how the court battle will be resolved.

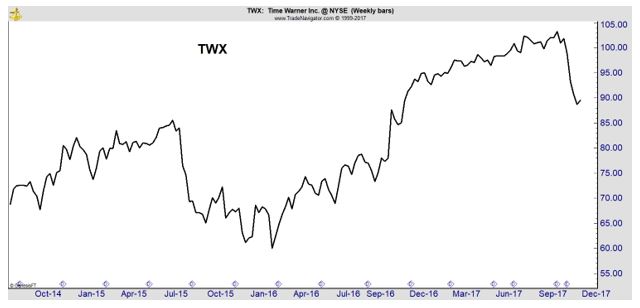

Shares of TWX sold off sharply on the news.

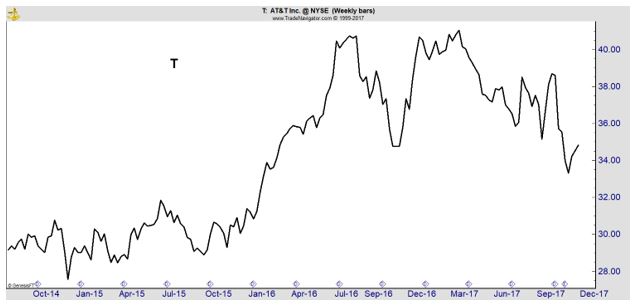

Shares of T were under selling pressure even before the announcement.

Bargain hunters may find more value in TWX, for now.

Mexico to raise minimum wage…to $4.70 a day

Nearly 25 million Mexicans are getting a pay raise next week. From $4.25 to $4.70 — a day.

Mexican government and business leaders agreed on Tuesday to raise the country’s minimum wage starting on December 1 to 88.36 pesos from 80.04 pesos. The 10% raise is good news for 24.7 million Mexicans who work either one or two minimum wage jobs.

For Mexican workers, the wage hike is much needed as rising prices have weakened Mexicans’ purchasing power for nearly two years, the Mexican peso has hovered around its all-time low, roughly worth five cents. Seen the other way, one dollar has been worth between 18 and 22 pesos since early 2016.

Source: CNN Money

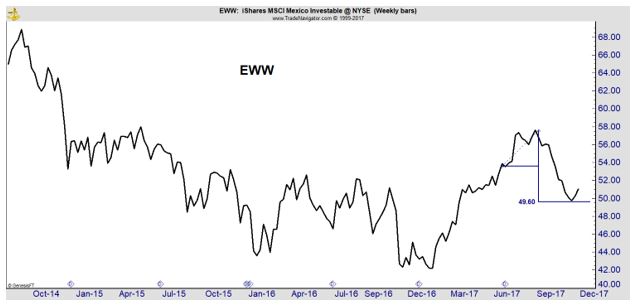

Why this matters to traders: Mexico has a clear advantage to attract jobs. This could make an ETF tracking the country’s stock market attractive.

iShares MSCI Mexico (NYSE: EWW) is also moving higher after meeting the target of a small head and shoulders pattern. This is bullish from a technical perspective.

Buffett loves Coke. But will he back a Pepsi buyout?

Warren Buffett often jokes that he gets a quarter of his daily caloric intake from Coca-Cola. But an investment firm is suggesting that Kraft Heinz, which Buffett’s Berkshire Hathaway owns a nearly 27 percent stake in, may want to buy Coke rival Pepsi. Fixed income research shop CreditSights said in a report this week that Kraft Heinz (Nasdaq: KHC) appears to still be itching to do a deal.

European consumer products conglomerate Unilever (NYSE: UL), the owner of Lipton and Ben & Jerry’s as well as the Dove brand of personal care goods, rejected a more than $140 billion bid from Kraft Heinz earlier this year. The CreditSights analysts noted that Buffett has already ruled out the possibility that Kraft Heinz could buy Mondelez (NYSE: MDLZ), the Oreo and Cadbury owner that split from Kraft Foods in 2012. (Kraft Foods subsequently merged with Heinz in 2015.)

So, Pepsi could be Kraft Heinz’s next target. But the thought of Buffett switching teams, so to speak, and backing a Kraft Heinz deal for Pepsi (NYSE: PEP) might come as a surprise to those who follow the Oracle of Omaha closely.

Source: CNN Money

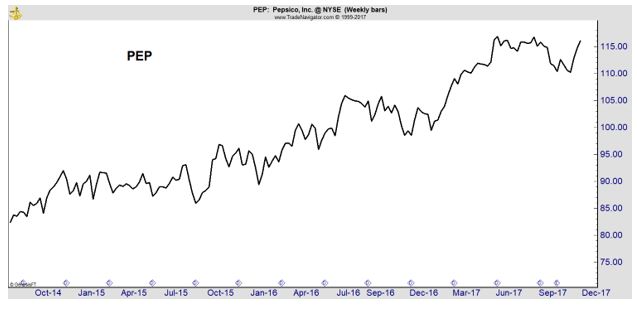

Why this matters to traders: This rumor seems unlikely to be possible given the increased regulatory scrutiny seen in the AT&T deal. But, even without a deal, the chart of PEP looks appealing from a technical perspective.

The stock seems to be breaking out of a recent consolidation and could make a short term move to the up side.

GameStop (GME) Q3 Earnings Top, Raises Comps View, Stock Up

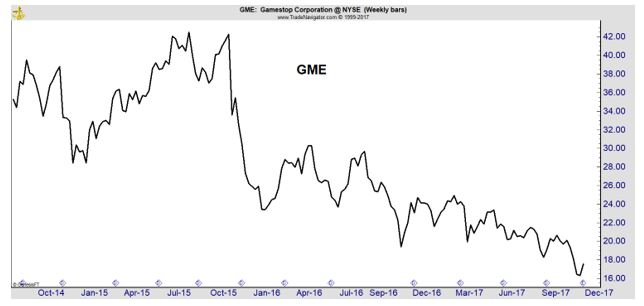

GameStop Corp. (NYSE: GME) reported robust third-quarter fiscal 2017 results, wherein both the top and bottom lines surpassed the Zacks Consensus Estimate. However, the big take away from this quarter was that earnings improved year over year after witnessing a decline in the trailing two quarters.

The company’s shares, which have witnessed a sharp decline of 26.2% in the past six months, underperforming the industry ‘s gain of 8.1% took a sharp U-turn following the result. The stock gained 7.6% during the after-hour trading session on Nov 21.

The company recorded adjusted earnings of 54 cents per share that comfortably beat Zacks Consensus Estimate of 43 cents and also increased 10.2% from the year-ago period. Net sales were up 1.5% year over year to $1,988.6 million and surpassed the consensus estimate of $1,958 million.

The company’s sales were driven by robust demand for Nintendo Switch along with collectibles and software. International sales were also strong during the quarter. The company stated that new console hardware as well as collectibles will drive holiday season results. Further, the company expects robust demand for Nintendo Switch during the holiday season.

Source: Nasdaq

Why this matters to traders: The stock has been beaten down to he point where the 5% rally on the news is barely visible on the weekly chart.

GME is well positioned for the holiday shopping season and could be among the biggest winners if consumers spend as much as anticipated.

How Does Holiday Shopping Impact Stocks?

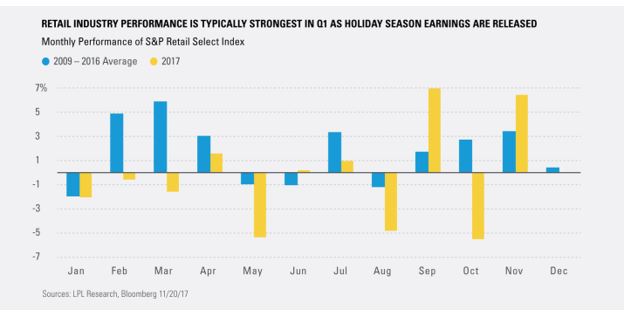

The National Retail Federation has estimated sales for the 2017 holiday season could increase between 3.6% and 4% versus 2016 sales—a solid number which is slightly above the post-crisis average of 3.4%. But what do holiday shopping forecasts mean for the stock market (and the retail sector in particular)?

Stock market performance from mid-September to mid-December has historically had a high correlation with year-over-year increases in holiday retail sales. The S&P 500 Index has already gained approximately 4% since September 15, and retails sales estimates for the holiday season may give investors another reason to be optimistic.

As the chart below shows, retail seasonality doesn’t necessarily follow the shopping schedule of consumers. Since the financial crisis, the S&P Retail Select Industry Index (which includes both online and brick-and-mortar retailers) has performed well heading into the holiday season as analysts start to develop holiday shopping estimates and investor optimism rises. However, the index’s performance during December and January has historically been lackluster as stocks in the index tread water ahead of retailer earnings.

February and March have been two of the strongest months on average for the index since 2009, as retailers generally release holiday season earnings over this period.

Source: LPL Research

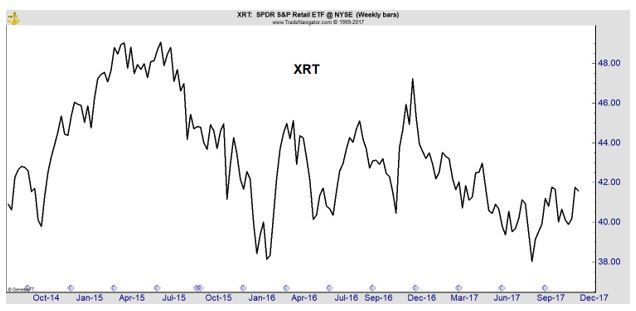

Why this matters to traders: Bargain hunters may want to look at some of the stocks in the retail sector or at SPDR S&P Retail ETF (NYSE: XRT).

If seasonal trends occur as expected, this ETF could deliver a significant gain over the next three months.