It’s Time to Ask What Bitcoin Really Is

When an investor buys a stock, they know what they are getting. Technically, it’s a chance to participate in the future gains of the company’s business.

When an investor buys a bond, they also know exactly what they are getting. They are receiving an agreed upon interest payment that acts as rent for the money they lend the company until the company returns that money when the bond matures.

Investors buying options on stocks, exchange traded funds, foreign exchange, real estate or almost anything else know exactly what they’re getting. But, when buying cryptocurrencies, many investors have no idea what they are buying.

Different Meanings to Different People

Cryptos are explained by white papers which define exactly what the process for the issuing and exchanging the currency will be. So, from a technical perspective, the investor has the opportunity to understand exactly what they are buying.

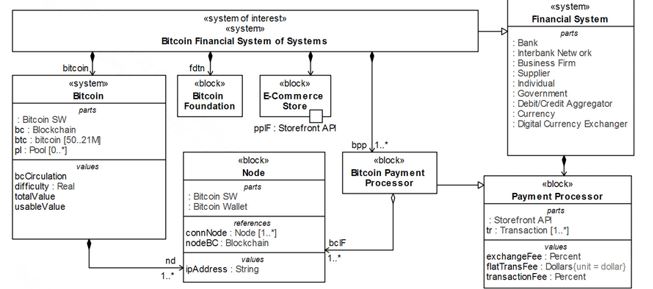

An example of the technical architecture is shown below.

Source: ResearchGate.net

This is, of course, important. But, the technical architecture is usually not going to be the most important piece of the investment decision for investors. That’s also true for stocks, bonds and other investments. Here, an investor is buying a business or a growth opportunity.

But, from a practical perspective, what the cryptocurrency offers is less well defined.

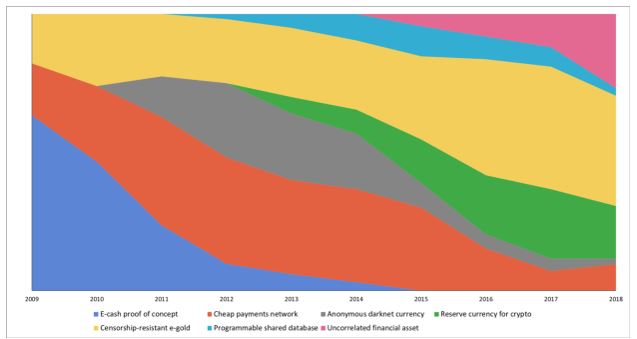

One study identified seven different explanations for the investment case in cryptos. The rationale has evolved over time. In an approximate chronological order, the investments cases have been:

- E-cash proof of concept. Since all prior e-cash schemes had failed, it took a while for people to be convinced of its technical and economic viability and move on to more expansive conceptions of the protocol.

- Cheap p2p payments network. In essence, this would be a decentralized and open source version of Paypal or Venmo.

- Censorship-resistant digital gold. For this argument, crypto’s characteristics including the fact that it offers an untamperable, uninflatable, largely unseizable, intergenerational wealth store which cannot be interfered with by banks or the state. This is an argument similar to the one raised by individuals who prefer gold bars as a disaster hedge.

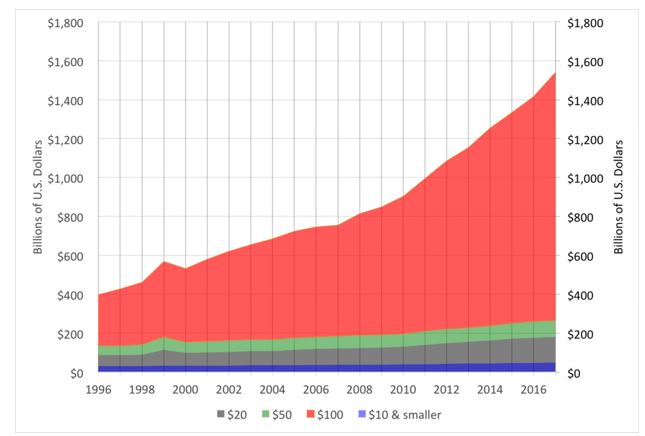

- Private and anonymous darknet currency. This use allows cryptos to be employed in illegal transactions. While this may not seem like a goal of a currency, the fact is that many illegal transactions are conducted using large denominations of U. S. currencies.

Experts estimate that somewhere between one quarter and three quarters of $100 bills, for example, are used in criminal transactions and many are held outside the country. This explains why there are so many $100 bills in circulation despite their near absence from everyday transactions for many individuals.

Source: MoneyandBanking.com

- Reserve currency for the cryptocurrency industry. Others argue that bitcoin serves as reserve currency for a global financial system based on cryptos. This would make bitcoin equivalent to the dollar which serves as the reserve currency for global commerce.

- Programmable shared database. This is described as “a slightly more niche view, and generally involves the understanding that Bitcoin can embed arbitrary data, not just currency transactions.

Individuals holding this view tend to see Bitcoin as a programmable, expressive protocol, which can facilitate broader use-cases. In 2015–16, it was popular to express the notion that Bitcoin would eventually absorb a diverse set of functionalities through sidechains.

Projects like Namecoin, Blockstack, DeOS, Rootstock, and some of the timestamping services rely on this view of the protocol.”

- Uncorrelated financial asset. This view holds that investing in bitcoin or other crypto provides exposure to an asset class, similar to the classes of stocks, bonds, real estate and other traditional investment selections.

The chart below shows the evolution of these arguments.

Source: Medium.com

That chart also shows there is no single argument for exposure to cryptos that is accepted at any one time. Investors could hold bitcoin for a number of those reasons or for other reasons.

The Investment Case for Cryptos

Here, it might be helpful to consider the reasons many investors give for considering an investment in gold:

- A History of Holding Its Value

- Weakness of the U.S. Dollar

- Inflation

- Deflation

- Geopolitical Uncertainty

- Supply Constraints

- Increasing Demand

- Portfolio Diversification

The truth is that all of these arguments except the first one (a history of holding its value) can be applied to cryptos. And, depending on the time frame being considered, crypto can be a store of value. They have experienced a number of bull and bear markets in their brief history, like any other asset.

But, in some cases, cryptos have withstood the test of time. There have been a number of economic catastrophes around the world in the past decade and cryptos did allow some to store wealth even as their country’s currency collapsed.

Crypto assets are also mobile and could be transferred quickly. In this way, they are like gold bars but perhaps more practical given the weight of gold. It isn’t hard to envision the arguments in favor of an allocation to crypto in a portfolio as a disaster hedge.

It is not difficult to envision a scenario where cryptos become more useful as advances in computing power make them easier to use and lower transaction costs.

While they are unlikely to replace credit cards or debit cards in the foreseeable future, an investment in cryptos could be like an investment in credit card processors when the industry was beginning.

Demand for cryptos could increase simply as cryptos survive. They have survived a bubble and by some measures the bubble has been completely retraced. To many analysts, when prices return to the beginning level of the bubble, that’s considered a buy signal.

But, bubbles take time to resolve and the markets rarely recover quickly. Now could be the time to start investing in crypto with a long term plan to accumulate the assets in a diversified portfolio. A small investment every month, similar to dollar cost averaging in mutual funds, could reward investors in the long run.

For other educational articles, Click Here.