Insiders and Institutions Love These Cheap Stocks

We can think of stock market investors in terms of groups. Some groups in that structure know more than others. Two groups that seem to know the most are insiders and institutional investors managing large accounts. Fortunately, individual investors can learn from those groups.

It’s important to recognize that information asymmetry exists in the financial markets. Potential investors have only limited information about a company. The only information generally available to investors is the information management chooses to disclose.

Management does disclose a great deal of information, but some information is kept secret. This could include business plans that provide a competitive edge to the company. Management will always know more than investors.

Because of this, Congress passed a law requiring corporate insiders, defined as the company’s officers and directors along with beneficial owners of more than 10% of the company’s stock, to report any changes in ownership.

This rule has been in place since 1934 when Congress passed the Securities Exchange Act of 1934. The Securities and Exchange Commission (SEC) have updated the rules over the past 70 years and forms are now available immediately to investors over the internet.

Insiders are required to report their transactions in a timely manner, generally within two days of the transaction.

Now, remember, no one knows a company better than an insider. When an insider makes a purchase, they are committing their personal funds to invest in the company. They may be acting on information they have access to that is not yet publicly available.

Institutional investors are also required to report holdings. They have an edge because their portfolios are so large that they can often afford more extensive research than individual investors. There are now reports, for example, of analysts using drones to determine foot traffic at retail stores.

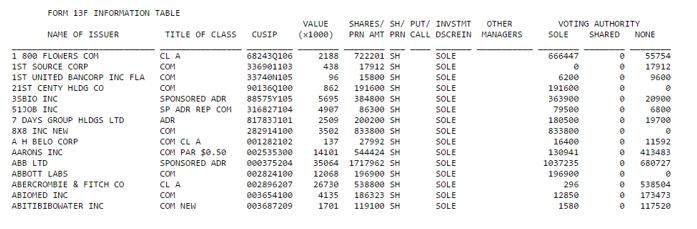

Congress also required these investors to report their filings and among the filings large investors must make is SEC Form 13F, more formally called the Information Required of Institutional Investment Managers Form.

The 13Fs must be filed once a quarter by any investment manager with at least $100 million in assets under management. By law, 13Fs must be filed with the SEC within 45 days of the end of a quarter. For example, forms must be filed by February 15 for the quarter which ends December 31 each year.

By itself, the 13F filing can be confusing. An extract of one recent filing is shown below:

In order to be useful, the information from the 13F needs to be collected and analyzed in some way. When the information is moved into a sortable database, we can determine what the filer is buying and selling.

We can even combine the filings to see which stocks are favored by hedge fund managers as a group. This information can be used to develop a trading strategy that follows the funds, but without the steep fees.

The same is true of insider activity where data aggregation can be beneficial.

Using the Data in the Filings

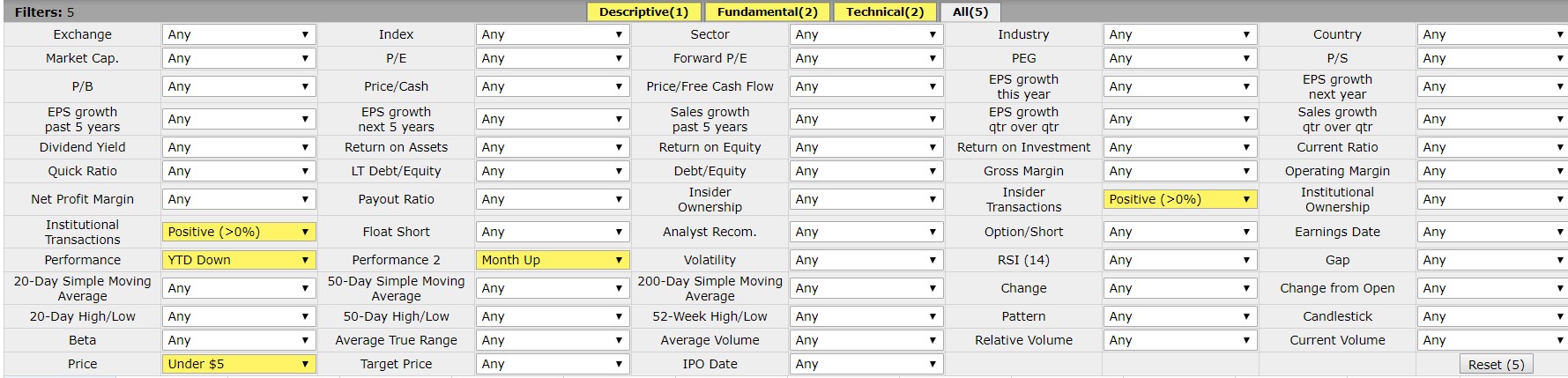

To sort through the data, there are expensive services available. But there are also free tools. We recently used the free screening capability at Finviz.com to search for companies with positive insider and institutional activity.

To narrow the list of investment opportunities that could be the subject of further research, we added additional filters.

It is near the end of the year and some investors will be realizing losses for tax purposes. This can create additional selling pressure and further reduce the price of the stock. To limit the impact of this risk, we looked for stocks that are down since the beginning of the year. This indicates loss selling could already be completed.

To increase the possibility that tax loss selling is completed, we also required the stock to be up in the past month. This indicates there has been interest from buyers in what has been a bruising market decline over that time.

Finally, we focused on cheap stocks. We limited the screen to stocks trading under $5.

Source: Finviz.com

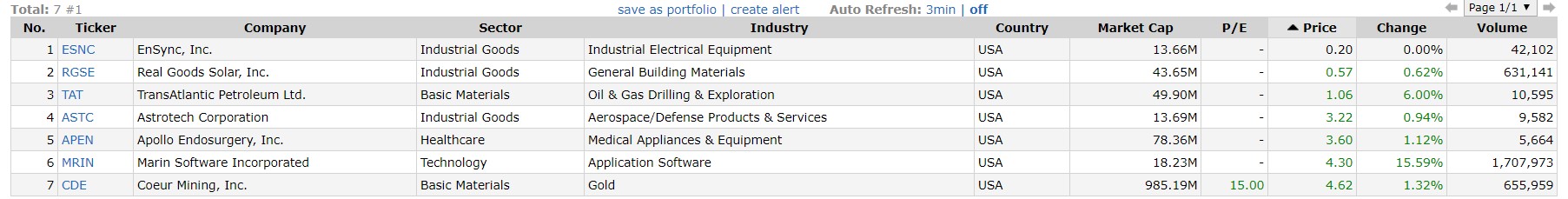

Just seven stocks passed this screen. The list is shown below.

Source: Finviz.com

This list could serve as a starting point for additional research. Or it could serve as a complete portfolio strategy.

To apply screens like this as a complete strategy, it is important to remember that there is no assurance any stocks will deliver returns. Therefore, it could be best to buy all stocks that pass this screen.

The second important consideration if this is to be used as a complete strategy is the idea of selling.

An investor could use profit targets and stop loss rules. For example, the stock could be sold if it gains 50% as a potential profit taking rule and sold if the stock drops by 20% or below the buy price as a possible stop loss rule.

Another sell strategy is to rerun the screen periodically. The period could be as short as one month although three months, six months or one year periods could prove to be more profitable since the gains would have more time to accrue. A stop loss could be combined with this strategy.

Under this strategy, the new screen would show which stocks met the screen criteria at that time. If a current holding fails to meet the criteria, it could be sold while new stocks would be added.

That highlights a quantitative, unemotional way that individual investors could make investment decisions. They could run screens to determine what to buy and sell stocks they no longer meet the buy criteria.

This simple approach could remove the emotional aspects of investing decisions and prevent investors from buying based on tips or selling based on panic. There would be strict rules about what and when to buy and also strict rules defining the sell decision.

Tools like this could provide the solution for many investors to improve their returns providing they develop strong screens based on sound criteria and follow their rules with a disciplined approach for the long run.

This particular screen also places individual investors on the same side as the large investors and insiders in the market, potentially providing them with an edge to boost returns.