Income From Oil, Without Investing in the High Cost Oil Producers

Energy investments are appealing for a number of reasons. They are a hedge against inflation, at least in part. This is because inflation has almost always been associated with higher energy prices. This relationship still holds, for now, but may change as alternative energy sources increase production.

These investments are also a bet on economic growth. As economies grow, they use more energy. This is a relationship that seems unlikely to change although more efficient technologies may mean that growth in energy consumption is smaller than it would have been in the past.

Many energy investments have also provided income. This is because many of the producers are mature companies with extensive infrastructure that has been paid for. These companies then return capital to share holders, often through dividends.

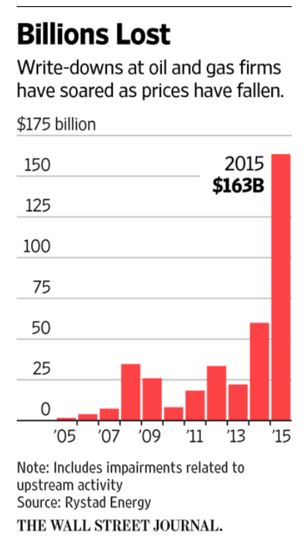

Infrastructure assets are expensive and were once viewed as an important component of returns to the oil and gas companies. But, in recent years, companies have been lowering the value of those assets, in accounting terms, writing down the value of the assets.

Source: The Wall Street Journal

This trend leaves investors wondering if investments in energy infrastructure is attractive. Fortunately, there are investments in the sector that don’t involve buying the assets.

Buying the Income Stream

An asset class known as royalty trusts provides an interesting alternative. Royalty trusts generally invest in the energy sector.

The idea of a royalty trust is similar to the idea of allowing an oil company to drill in your backyard. That is actually not a farfetched idea since new fracking technology has allowed drillers to place wells on individual’s property.

In this case, the oil company would pay for the equipment and all required maintenance and operating costs. You, as the property owner would receive a share of the income but carry none of the risks. You would be enjoying royalties from the energy production.

Now, production will vary over time. And, that means the income from these investments will vary over time.

Royalty trusts are a pass through investment. Income from oil and gas fields, coal mines or other commodities passes through the trust to the trust’s investors. In this way, royalty trusts are similar to master limited partnership or MLPs.

Like an MLP, the trusts are traded like stocks. Both can provide significant income and both carry favorable tax treatment, at least for some investors. You should check with your personal tax adviser before investing in this, or any asset class since all tax situations are unique.

The major difference between the two investments is that MLPs own infrastructure like pipelines, generate revenue by charging a fee for others to use the asset. Royalty trusts own the rights to cash flow from production facilities themselves, like wells and mines.

MLP revenues will generally be locked into long term contracts. This prevents large swings in income for investors. With royalty trusts, income will vary from quarter to quarter, based on the performance of the commodity.

Royalty trusts are a way that producers can finance production. “It is common for numerous oil and gas producers to sell their producing assets to a royalty trust,” one expert noted.

“By doing this, the company has created a revenue stream that investors can then buy into. From there, all the royalties produced in the trust are distributed to the shareholders as income. Simply put, purchasing into a royalty trust is like purchasing specific cash flows.”

A Specific Trust Investment

San Juan Basin Royalty Trust (NYSE: SJT) owns royalties from working, royalty and other oil and natural gas interests owned by Southland Royalty Company, the predecessor to Burlington Resources Oil & Gas Company LP, in properties located in the San Juan Basin of northwestern New Mexico.

Almost all of its assets, 99% of the trust’s estimated proved reserves, consisted of natural gas reserves. SJT was founded in 1980 and is expected to continue operating for another 10 to 15 years.

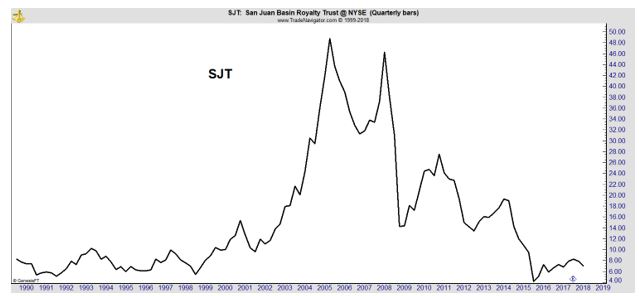

SJT has been trading in a relatively narrow range for several years but has been volatile in the past.

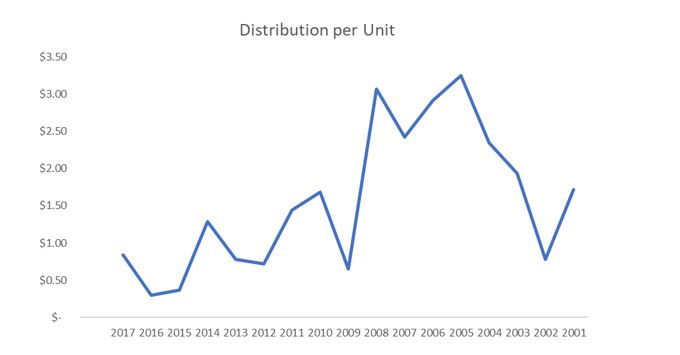

The distributions, however, have been in a generally rising trend.

The current yield is about 11.2%. This is well above the historic yield which has averaged 6.1% over the past seven years. The high yield could indicate the trust is undervalued or that the distributions are likely to decline.

SJT makes monthly distributions. The amounts vary and it’s reasonable to factor a negative outlook into the decision process. Assuming the distribution is half of last year’s level, the yield would drop to about 6%. That is still above average, but much lower than the current yield.

Advantages of royalty trusts include high yield because trusts are required to pay out essentially all of their cash flow as distributions. Because of this, nearly all royalty trusts with ongoing operations have above average yields.

Due to depreciation and depletion, distributions from most trusts are not considered income in the eyes of the IRS. Rather, the cash distributions are used to reduce an owner’s cost basis in the stock, which is then taxed at the lower capital gains rate and is deferred until an owner sells.

The trusts pay no corporate income tax which increases the amount of cash flow available for distributions. The trusts also benefit from a number of tax credits, although these can change as tax laws are changed.

Royalty trusts are a pure play on commodities. The distributions vary with the price of commodities. This means they can be volatile.

Royalty trusts will not be the best choice for all income investors. But, SJT is trading near $7 and the current yield is more than 11%. Its low price makes it accessible to small investors who have few opportunities for double digit yields.

While it can be tempting for small investors, the tax situation must be considered. There will be extra forms and if a tax preparer is used, this could lead to higher costs. If software is used, it could require an upgrade to the basic software. These costs could offset the income for some investors.