How to invest / participate in next uber stock

How to invest / participate in next uber stock Uber is believed to be worth about $70 billion. From outside the company, there is no way to obtain precise information about the financials. That makes it impossible to determine the exact worth of the company.

That’s not true of all companies. We could, for example, determine how much Apple is worth in a number of ways. As investors, we could add up the value of all outstanding shares in the company. Or, we find the total enterprise value of Apple by considering the value of stocks and bonds that are issued.

It is important to note here that we are referring to the company’s price in the marketplace. This isn’t the company’s value from an investor perspective. It’s merely an accounting exercise to determine what all of the company’s current investors have put into the company.

For Uber, that’s not possible for anyone outside the company without Uber’s permission. Uber is a private company and as a private company, it is not required to share its financial information or discuss anything about its operations.

Despite the lack of information about its operations, the company is estimated to have a valuation higher than 80% percent of the companies in the S&P 500.

This growth has been made possible because Uber does have investors. The company makes deals with private equity investors to fund its growth. And, these private equity investors are enjoying the growth in Uber and other startups before the public has a chance to buy the stock.

What is Private Equity?

Private equity is an investment category consisting of large investors that make direct investments in private companies. Occasionally, private equity will invest in public companies, buying out all of the other investors and taking the company private.

The funds for these deals comes from institutional investors and accredited investors. The meaning of this term is defined by the Securities and Exchange Commission which says, “An accredited investor, in the context of a natural person,

includes anyone who:

• earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year,

OR

• has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).”

Based on these tests, it’s reasonable to assume that accredited investors are individuals with considerable risk.

Private equity can be used to fund new companies, as is the case with Uber and many other tech companies. It can also be used to take companies as was the case when Blackstone bought out Hilton Hotels for about $9 billion in 2007.

Blackstone proceeded to restructure the company’s debt and brought in skilled managers who improved operations. When Hilton went public again in 2013, it was worth over $12 billion and Blackstone made billions of dollars.

Other funds make targeted investments like the T1D Venture Philanthropy Fund which has invested $32 million to make high-impact early-stage investments to accelerate commercial development of life-changing therapies for people living with type 1 diabetes.

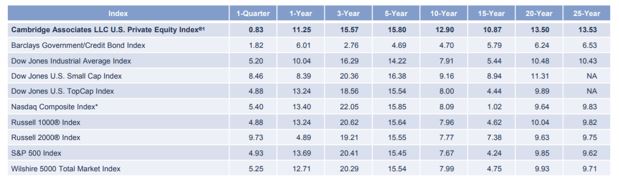

Historic Returns Top Stocks and Bonds

What makes private equity investments so appealing to investors is their rate of return. In the long run, as an asset class private equity has significantly outperformed stocks and bonds.

Source: Cambridge Associates

These returns are so high because there is a great deal of risk involved with private equity deals. In cases where the investment is in a startup company, there is no guarantee of success. Many startup companies fail and many others deliver mediocre returns.

But, there are, of course, some large winners among startups and a single large investment in a company like Google, Facebook or possibly Uber could dramatically improve the track record. Private equity can also deliver large gains in biotech or any other sector.

Patriarch Partners, LLC, is a private equity firm with investments in more than 75 companies across 14 industry sectors. Founded by Lynn Tilton in 2000, Patriarch was built upon a proprietary patented financial model designed to manage and monetize the distressed portfolios of financial institutions.

The company focuses on mundane businesses and current investments include Dura Automotive, Performance Designed Products, Universal Instruments, Spiegel Catalogs, MD Helicopters, Rand McNally, and Stila Cosmetics.

Its founder has increased her investment from $10 million to more than $500 billion over 20 years.

Patriarch’s returns demonstrate the potential for private equity investments in stark terms. In recent years, it has become possible for ordinary individual investors to add private equity to their portfolios. This is possible through ETFs or with a direct investment in the largest firms.

Buying Into Private Equity

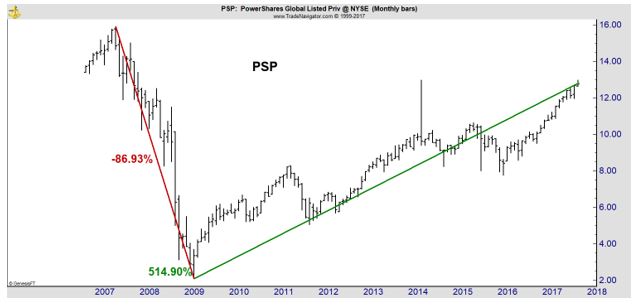

Among the simplest ways to add private equity to your portfolio is with the PowerShares Global Listed Private Equity Portfolio (NYSE: PSP), an ETF that provides exposure to the industry. An ETF, or an exchange traded fund, is an investment fund that invests in other companies.

PSP is a fund designed to track the Red Rocks Global Listed Private Equity Index (Index). The fund will normally invest at least 90% of its total assets in securities, which may include American depository receipts and global depository receipts, that comprise the Index.

The Index includes securities, ADRs and GDRs of 40 to 75 private equity companies, including business development companies (BDCs), master limited partnerships (MLPs) and other vehicles whose principal business is to invest in, lend capital to or provide services to privately held companies (collectively, listed private equity companies).

PSP’s largest holdings are in non-US based private equity investments. This provides investors with a diversified investment that is not directly tied to the US economy. The performance of the fund has been significantly better than the S&P 500 in the bull market. But, the fund lagged in the bear market.

PSP has nearly doubled the gains of the S&P 500 since the stock market bottomed in 2009. However, the ETF lost about 160% of the decline of the S&P 500 in the prior bear market.

This chart highlights the rewards and the risks of private equity.

Another way to invest in private equity is with one of the world’s largest private equity firms, The Blackstone Group, L.P. (NYSE: BX). This stock has gained more than 1,400% since the market bottom.

Blackstone began trading in 2007 and lost 89% in the bear market in its short history.

These two charts place the asset class in perspective. Large returns are possible in private equity, but the risks are also high. Despite the risks, the investment could be worth considering.

Perhaps the best approach for many investors is to consider adding private equity to their portfolio during bear markets. When the next downturn comes, history tells us to expect losses in the industry that are larger than the losses of the broad stock market averages.

The large losses make perfect sense. In a downturn, there will be many business failures. Private equity seeks out exposure to the riskiest investments. In an economic downturn, distressed companies and startups will face the same challenge. Obtaining cash for operations will be difficult.

However, in a bull market, some of these startups and turnarounds will be among the biggest winners as the economy expands.

The ability to hold private equity in a bull market but not a bear market provides individuals with an advantage over accredited investors who face long lockup periods on their investments. One approach could be to buy BX or PSP when they are trading above their 200-day moving average.

Selling when the price of BX or PSP closes below its 200-day moving average could help investors avoid losses of 90% or more experienced in the last bear market.