How to invest or get paid in oil stocks now

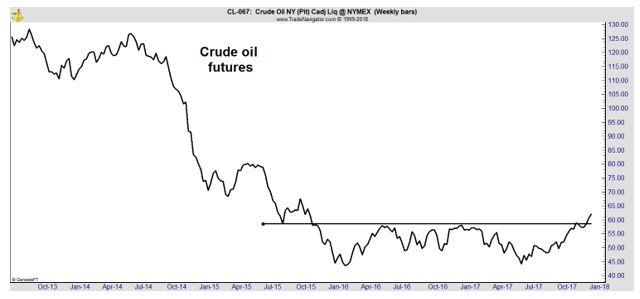

Learn about – How to invest or get paid in oil stocks now, Oil seems to be breaking out of its bear market and ending 2017 at its highest level in two years. In part, the gains could be the result of unrest in the Middle East. In particular, the protests in Iran reminded investors that turmoil is possible and almost any political problem could disrupt the supply of oil.

Saudi Arabia also remains focused on supply issues in the oil markets. That country has been driving production cuts that other OPEC nations have agreed to. Saudi Arabia is also expected to bring its national oil company to the market this year and is likely to maintain production cuts to support that.

The initial public offering (IPO) of Saudi Aramco is expected to raise billions for the country. The 5% sale of the company in an IPO is a centerpiece of Vision 2030, a plan intended to reduce the dependence of the Saudi economy on oil. The plan is championed by Saudi crown Prince Mohammad bin Salman.

To prepare for the IPO, last week, Saudi Aramco converted to a joint stock company, establishing the framework to allow future investors to hold shares in the company alongside its shareholder, the government.

Sources noted the conversion was an important step in the IPO process. The deal is expected to be the largest public offering in history and could raise up to $100 billion for the Saudi government. Given the high stakes, it’s not surprising to see the country enforcing discipline on OPEC members that is intended to move the price of oil higher.

Potential Gains from Oil Without Buying Oil

For many investors, the question is where to invest money for gains as they watch the price of oil seemingly recover from its steep selloff. They could buy oil in the futures market, but many individual investors lack a way to access the futures markets.

Futures markets are leveraged markets which offer the potential for large gains. These markets also carry the risks of large losses and it is possible to lose more than you invested in the futures market. This is not usually possible in the stock market unless traders use margin accounts or exotic strategies.

Without access to the futures market, many individual investors choose to buy oil companies. This offers exposure to the price of oil, but other factors can affect the best return on investment. For example, it is possible that management errors could destroy share holder value even if oil prices rise sharply.

To limit the risk investors can build a diversified portfolio of oil companies, owning several different companies to reduce the risk of management errors in one company leading to losses. This could require a large amount of capital.

An option for smaller investors that lack capital to diversify broadly or larger investors who choose not to dedicate large amounts of capital to the sector is to buy an exchange traded fund or ETF. An ETF generally tracks an index of companies providing low cost access to a diversified portfolio.

For exposure to the oil industry, investors could buy the VanEck Vectors Oil Services ETF (NYSE: OIH) or the Energy Select Sector SPDR ETF (NYSE: XLE). These ETFs hold companies involved in the sector and offer yields of 2% and 3%, respectively.

Oil Industry Exposure and Income

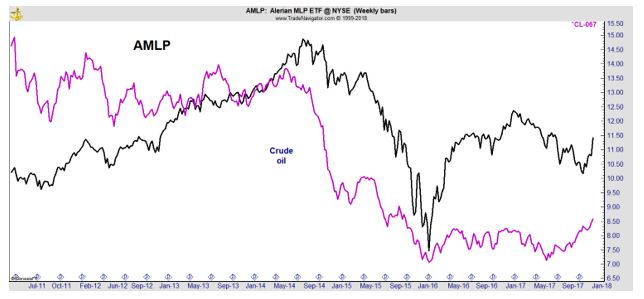

Another ETF, Alerian MLP ETF (NYSE: AMLP), also offers exposure to the oil industry. The next chart shows the relationship between the price of crude oil and the price of the ETF. Notice that both tend to move in the same direction and have a high degree of correlation.

AMLP delivers exposure to the Alerian MLP Infrastructure Index which is a capitalization-weighted composite of energy infrastructure Master Limited Partnerships (MLPs) that earn the majority of their cash flow from the transportation, storage, and processing of energy commodities.

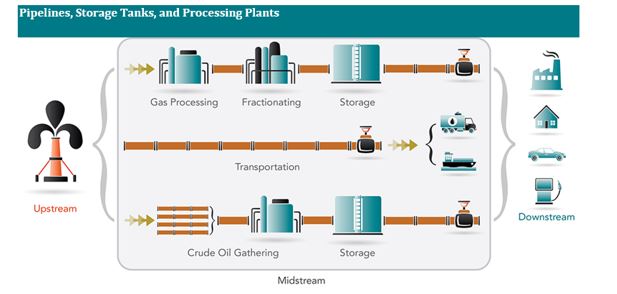

According to the fund manager, thematically, MLPs represent an investment in the build out of the US energy infrastructure, a process that is expected to unfold over the next few decades. MLPs own, operate, and build energy infrastructure assets such as pipelines, storage facilities, and processing plants.

The fund manager notes that, “Energy renaissance drives growth. Billions of investment dollars are required for infrastructure to keep pace with the boom in domestic production of natural gas and oil.” This spending will benefit the MLPs.

MLPs follow a toll road business model. They charge a fee to use their infrastructure rather than take the risk of searching for oil and gas or producing or refining the output from wells. MLPs usually have regional monopoly footprints and benefit from inflation-hedged contracts and inelastic energy demand.

This business model is summarized in the chart below.

Source: ALPS

This toll road structure creates an income opportunity for investors. The MLP structure is designed to maximize the benefits of share holders.

An MLP is a type of business venture that exists in the form of a publicly traded limited partnership. As such, it combines the tax benefits of a partnership where profits are taxed only when investors actually receive distributions with the liquidity of a public company.

A unique aspect of MLPS is that they are required to distribute all available cash to investors. MLPs can help reduce the cost of capital in capital-intensive businesses, such as the energy sector, and provide high levels of income to investors.

What is the Best Investment in Oil for Income Investors?

The characteristics of MLPs make them attractive to income investors. However, the income is dependent upon the skill of management which generates the need to diversify. AMLP offers instant diversification and could be the investment of choice for investors in this sector.

AMLP currently offers investors a yield of about 7.9%. This high level of income is not guaranteed and could vary with the business conditions of the underlying companies. However, the yield has been higher than 7.6% for the past five years as shown in the next chart.

An additional factor to consider before buying AMLP is that MLPs can require the filing of additional forms for income taxes.

An MLP is treated as a limited partnership for tax purposes. A limited partnership has a pass-through, or flow-through, tax structure, meaning that all profits and losses are passed through to the limited partners.

This offers a significant tax advantage; profits are not subject to the double taxation scenario in which corporations pay corporate income taxes, and then shareholders must also pay personal taxes on the income from their stocks. Further, deductions such as depreciation and depletion are also passed on to the limited partners. Limited partners can use these deductions to reduce their taxable income.

Share holders in MLPs will have to file the Schedule K-1 form. This is a more complicated form than most other tax forms. K-1 forms will often arrive late in the tax season which means filing later and could require the filing of an extension or amended return.

Overall, investors should consider the tax implications before they buy AMLP or any limited partnership.