How to Invest in Cryptocurrency

There are two very common questions about cryptocurrencies. One is “what are cryptocurrencies?” Second is “how do I invest in cryptocurrencies?” We are going to ignore, for now, the question of whether or not you should invest in cryptocurrencies. That will be the subject of another article.

Cryptocurrency is a new technology and to define what it is, it may be best to let technologies we accept as reliable define the term. Wikipedia explains it is “a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank.”

In theory, “decentralized cryptocurrencies such as bitcoin now provide an outlet for personal wealth that is beyond restriction and confiscation.”

We turned to Wikipedia for a reason. It wasn’t that long ago that the web site seemed like a new idea and many skeptics didn’t believe it could work. The idea of a crowd sourced reference site seemed likely to fail because it was new.

The fact that anyone could contribute to Wikipedia was an advantage to its proponents and a disadvantage to its skeptics. In time, the idea of decentralized knowledge collection proved workable. And, that bodes well for the future of cryptocurrencies.

How to Invest in Cryptos

Although this is a new market, it does retain some features of older markets. Central to the crypto market is an exchange, the same type of organization that facilitates investing in stocks and bonds. However, in some ways, the crypto market is more efficient than the older stock and bond markets.

For cryptos, the exchanges allow for trading and they act like the online broker an investor would use to trade stocks. This really has no impact on the user experience. The trader enters a buy or sell order and the order is executed. The mechanics of the order flow differ, but they aren’t really important to individual traders.

To open a crypto account, a trader will go to an exchange. Large exchanges include GDAX and Coinbase. There are many other exchanges, but these are among the largest. They also offer insurance against some of the risks of theft of cryptocurrencies, a real risk that cannot be ignored.

Insurance is a sign of the maturity of the market. Many exchanges have been hacked. And, the insurance provided may not protect against all losses. But, the fact that some exchanges offer some degree of protection should be considered when opening an account.

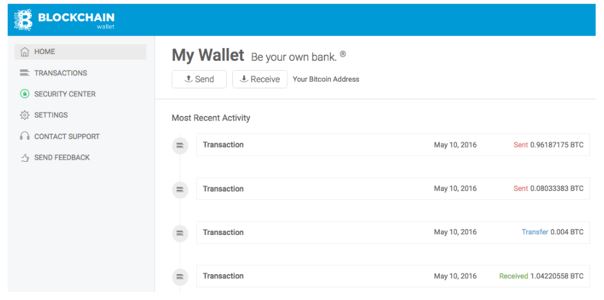

The account will generally require a cryptocurrency wallet, which is a software program that stores private and public keys and interacts with various blockchain to enable users to send and receive digital currency and monitor their balance. Blockchain is a popular wallet.

Source: Blockchain.com

After opening an account, you will need to verify your identity. This is required because of Anti Money Laundering rules and is a simple process that may involve uploading an image of your driver license. Online brokers like Fidelity or E*TRADE have similar requirements.

Then, you will fund your account with dollars from your bank account. This, too, should be a familiar process to stock market investors. Brokerage accounts are generally linked to bank accounts. This facilitates deposits and withdrawals to the account and prevents long delays for accessing funds.

Minimum account sizes are generally small and the exchanges are largely accessible to traders of any size.

Buying and Selling

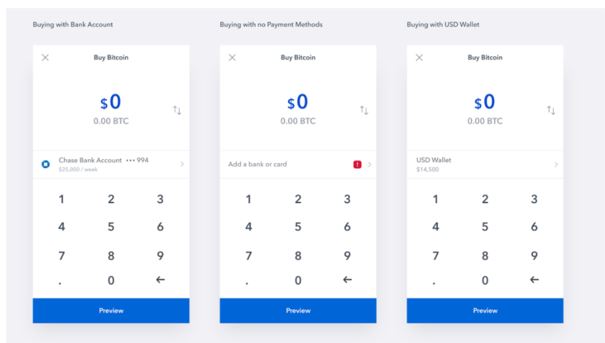

Entering trades is a relatively familiar process for traders familiar with trading at online brokers. Coinbase, for example, offers simple order entry screens depending on how the trader is funding the transaction.

Source: Coinbase

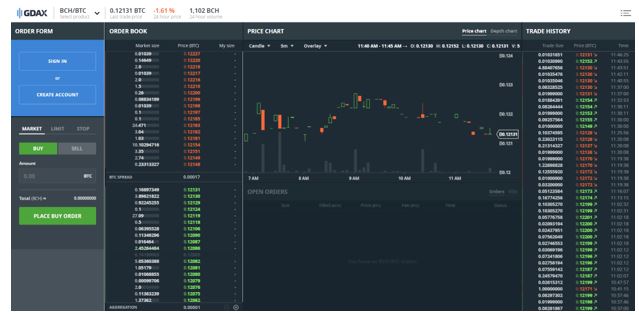

The exchange screen is likely to be familiar to stock market investors. A typical screen shows recent price action and allows for trade entry.

Source: GDAX.com

The mechanics of trading should be straightforward. To be sure they are, review trading screen at the exchange before you open an account. Reputable exchanges allow you to open an account for free and view exactly what the processes for trading and account funding are.

The question of fees should also be considered when opening an account. In general, fees will be expressed as a percentage of the transaction size and may be offset by rebates based on trading volume. Wallets may also carry fees for each transaction.

Fees, like commissions, are the cost of trading. Although they can rarely be completely avoided, every effort can be made to minimize fees. For crypto transactions, fees may be 0.25% per transaction for smaller trades and they can be higher.

Taxes, An Unavoidable Aspect of Trading

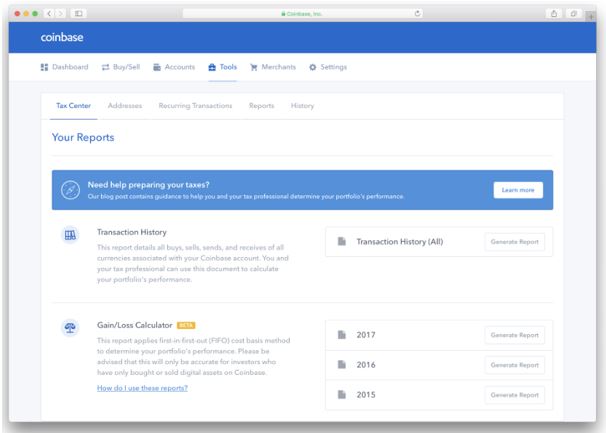

Just like with stocks, gold coins, real estate or any other investment, taxes must be paid on the profits of cryptocurrency trades. This makes it important to consider tax reporting tools when opening an account. The tax center at Coinbase is typical and similar to online brokers.

Source: Coinbase

The tax reporting requirements for cryptocurrencies will be important for investors as they profit, or suffer losses, in the market. The IRS has expressed an active interest in the markets.

In 2014, the IRS issued a notice declaring that cryptocurrencies are property, not currencies like dollars or francs. Often they are investment property akin to stock shares or real estate.

If an investor sells a cryptocurrency after holding it longer than a year, then the profits are typically long-term capital gains. Short-term gains on cryptocurrencies held a year or less are typically taxable at higher, ordinary-income rates.

Late last year, the Internal Revenue Service persuaded a federal judge to require Coinbase, a San Francisco-based digital-currency wallet and platform with about 20 million customers, to turn over customer information.

Driving the IRS’s decision was its belief that few bitcoin investors appear to be paying taxes due on sales. The court order is one of the agency’s first moves as it clamps down on cryptocurrency scofflaws.

Taxes may not be pleasant but the prospects of large gains in the crypto markets should offset the need to forward part of the gain to the government. In addition, proper reporting could identify losses or potential deductions that could offset other income.

Overall, the market is mature enough for many investors to have confidence enough to invest in.