Five S&P 500 Stocks With the Most Downside Risk

The stock market is in the midst of a pull back. Formal definitions of bear market markets require waiting for major market averages to decline by at least 20% before the official status of the market can be changed.

For at least some investors, this formal definition might seem insufficient. After all, they will have lost 20% or more of their portfolio before they recognize the obvious situation which is that stocks are falling.

However, there is no way to know precisely whether stocks will rise or fall in the future. That means there is no other way to know whether or not a decline is a pull back, a correction or a bear market until the decline has reached the predefined milestones.

But, Caution May Be Advisable

Whether we are in a bear market or not, it could be prudent for investors to exercise caution. One way to do that is to be sure they are not holding the riskiest stocks.

There are a number of ways risks could be defined in the stock market. We chose a quantitative approach. We defined the riskiest stocks as those with cash flow growth that is below average, who are overvalued based on the EV/EBITDA ratio and whose stock prices have lagged the broad market over the past six months.

Before identifying stocks that are vulnerable in a bear market, let’s look at why we selected those three factors.

Cash flow is the lifeline of a company. Without sufficient cash flow a company will be unable to maintain operations. Even if cash flow supports operations, it might not be enough to allow for the company to invest in operations. Or, it might not be enough to permit management to reward share holders with dividend increases or share buy backs.

Because cash flow is so important, it can be considered the most important fundamental measure of a company.

EV/EBITDA is the enterprise value (EV) to earnings before interest, taxes, depreciation and amortization (EBITDA) ratio. It includes a great deal of information and could be among the best ways to measure value.

At least that was the conclusion the authors of an upcoming paper reached. Two researchers and money managers, Wesley Gray and Jack Vogel, will be publishing “Analyzing Valuation Measures: A Performance Horse-Race Over the Past 40 Years” in the Journal of Portfolio Management.

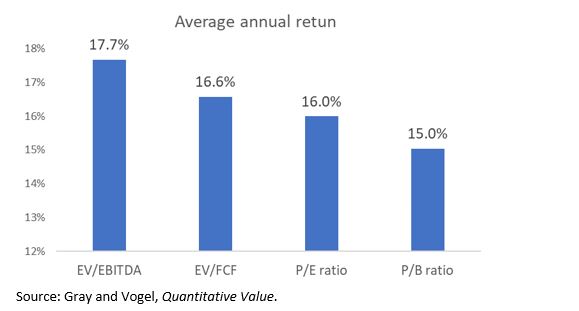

They have already shared their results in a book, Quantitative Value. In the book, they found that the EV/EBITDA has historically been the best performing metric and outperforms many investor favorites including the price to earnings (P/E) ratio and the price to sales (P/S) ratio.

Their study looked at the period from July 1, 1971 until December 31, 2010. Some results are summarized below.

Digging Deeper Into Valuation

One reason the EV/EBITDA ratio may not be as popular as other tools is because it does involve more research to calculate.

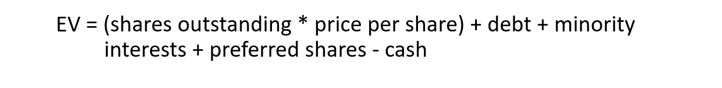

The enterprise value of a company is a comprehensive measure of its market value. To calculate EV, you start with a company’s stock market capitalization (the number of shares times the market price). You then add the total amount of debt the company issued at current market value and subtract the amount of cash and cash equivalents they have on the balance sheet.

This would represent the total cost of acquiring a company since a new owner would be acquiring the debt as well as the equity. Cash is subtracted in the calculation because it could be used to, at least partially, finance the purchase.

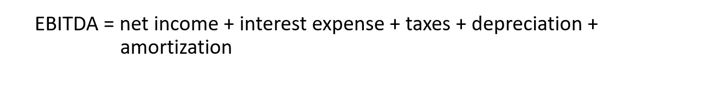

EBITDA is found by adding the expenses associated with interest, taxes, depreciation and amortization to the amount of net income.

EBITDA shows the performance of a company independent of the performance of its decisions related to taxes and capital structure. Earnings, for example, are reduced in some companies through tax strategies or by issuing debt to fund growth. EBITDA neutralizes the effect of those actions.

This ratio is available at a number of sites, including popular research sites like Yahoo and Google.

This ratio is used in practice like any other valuation metric. Low values are generally considered to be better than higher values.

This means that if you are comparing possible investment opportunities, it can be best to consider the one with the lowest EV/EBITDA ratio as long as the opportunities are in the same industry.

Finally, we used the stock price as a filter for a company’s prospects. If the stock price fails to keep up with the market, investors has a group have a dim view of the company’s prospects. That is especially important right now as the market appears to be vulnerable to a steep sell off.

Putting It All Together

We searched for the weakest stocks in the S&P 500 Index and this screen identified five:

- Brighthouse Financial Inc (Nasdaq: BHF)

- E*TRADE Financial Corp (Nasdaq: ETFC)

- Jefferies Financial Group Inc (NYSE: JEF)

- Macerich Co (NYSE: MAC)

- Monster Beverage Corp (Nasdaq: MNST)

One way investors can use this information is to avoid these stocks or to sell their positions in these stocks if they own them.

Another way to use this information is as a trading strategy. Investors could buy put options on these stocks to potentially benefit from declines in these companies.

A put option provides buyers the right, but not the obligation, to sell 100 shares of the stock at a predetermined price for a predetermined amount of time. The maximum loss when buying puts is the amount of money required to open the trade in a cash account.

If the stocks decline, the put options should increase in value, delivering a profit in a declining market. This could be useful to investors looking to offset losses in core holdings or seeking to profit from the market weakness.

Now is an ideal time to develop and implement bearish trading strategies. Waiting for the official beginning of the bear market will require suffering significant losses. Acting before then could create profit opportunities for investors.