Finding Value Overseas

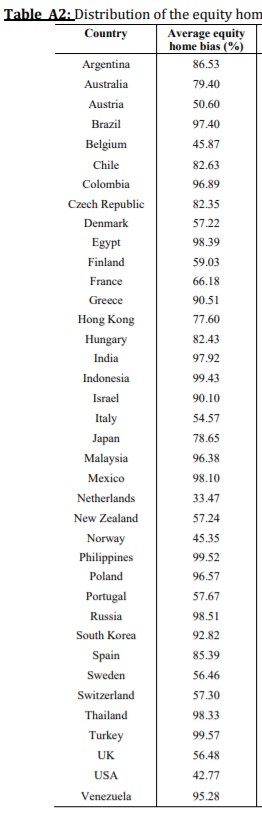

Investors tend to have a “home court” bias. For investors in the US, that means they often invest too much in the US, their home country. The home court bias isn’t limited to the US. One study found this bias exists around the world to varying degrees.

Source: University of Glasgow

Notice that in some countries, investors allocate more than 90% of their investments to their home country. This is particularly true in many emerging markets where risks can be relatively high and overseas investment could be beneficial.

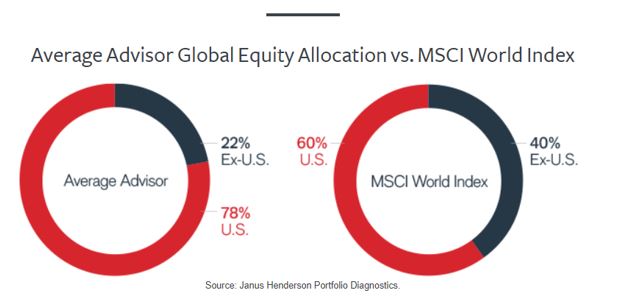

Quantifying the Bias

How big is the bias? To allocate funds with the size of their market cap, many investors should consider almost doubling their allocation to markets outside the US.

Source: Janus Henderson

Experts at Janus Henderson attribute the home court bias to persistent beliefs in myths:

- The myth that owning US multinationals makes a portfolio truly global

- The misconception that all global managers provide meaningful overseas exposure

- The overseas equity blind spot in income portfolios

The first myth that large cap stocks provide exposure is widespread. However, investing in multinationals through domestic markets doesn’t necessarily provide broad or balanced international exposure.

It’s important to consider that no two countries have the same sector exposure footprint. The U.S. is skewed toward technology and health care sectors, while the outside of the US portion of MSCI World Index has its highest concentration in financials and industrials.

Therefore, an equity investor in solely U.S. equities may be subject to large biases to a short list of U.S. sectors.

Then there is the belief that a global fund provides adequate exposure overseas. But, in some funds, the US market may account for 60% of holdings, despite the fact that global is in the fund name.

Finally, income investors tend to look at the US market and ignore the fact that the international high income equity universe is arguably much larger than what most investors find in their more familiar U.S. hunting grounds.

Overcoming the Home Bias Can Be Difficult

Many investors may believe they can’t adequately research opportunities in other countries. This belief could be accurate.

Companies may follow different accounting standards in different countries. This means even the ability to expertly analyze financial statements in the United States is not a guarantee that financial statements of companies in other countries will be the same.

Some investors turn to exchange traded funds (ETFs) to overcome this difficulty. There are ETFs available, tracking indexes in dozens of countries. This provides diversification and reduces the risk associated with investing in single companies.

This presents the problem of selecting the country to invest in. Here, again, investors can turn to ETFs and obtain a diversified portfolio. Funds are available to track the entire global market, sectors that have holdings across countries or regional groupings.

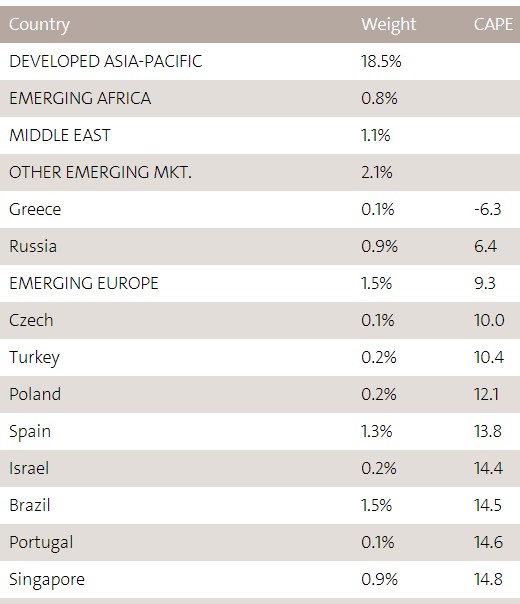

Here, the investor can target value precisely. Recently, countries in emerging Europe were the countries offering the greatest value using the CAPE ratio.

Source: Star Capital

The CAPE is the cyclically adjusted price to earnings ratio, which is also called the Shiller P/E, or P/E 10 ratio. It is a valuation measure that can be applied to any global stock market. It is defined as price divided by the average of ten years of earnings (moving average), adjusted for inflation.

Because it includes ten years of data, the CAPE is principally used to assess likely future returns from equities over timescales of 10 to 20 years, with higher than average CAPE values implying lower than average long-term annual average returns.

The chart of the lowest CAPE ratios offers a hunting guide for value on a global scale. To buy low CAPE countries, investors could consider iShares MSCI Poland ETF (NYSE: EPOL). These ETFs provide a diversified portfolio but do not provide diversification on a country basis.

A popular approach is to obtain exposure to emerging markets, which are generally believed to offer the greatest potential returns while carrying the greatest degree of risk.

Diversification and Safety in Emerging Markets

Emerging markets are characterized by greater market access and less potential for operational risks when compared to frontier markets, which leads to a larger base of potentially eligible investors. This is the middle of the three classes of countries which includes frontier markets, emerging markets and developed markets.

Dividends are a risk reduction tool that could help investors achieve returns. Wisdom Tree applies an index methodology to select a diversified portfolio.

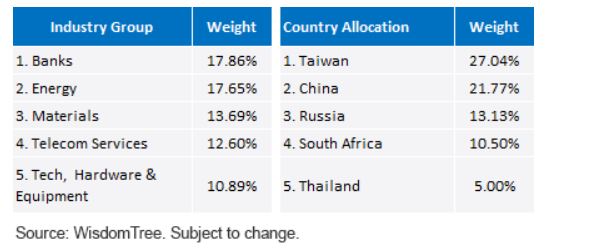

The WisdomTree Emerging Markets Dividend Index is a fundamentally weighted index that measures the performance of dividend-paying stocks selected from the following 17 emerging market nations: Brazil, Chile, China, Czech Republic, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey.

Companies are weighted in the Index based on annual cash dividends paid. The Index was established with a base value of 300 on May 31, 2007. The Index is calculated in US dollars and is updated to reflect market prices and exchange rates. It is rebalanced at least annually.

In the most recent rebalance, banks and energy stocks were the largest sectors while Taiwan and China were the largest countries in the index.

This index is available as the WisdomTree Emerging Markets Dividend ETF (NYSE: DVEM). The ETF has a limited trading history, having started trading in 2016 and been available only a period of generally rising markets.

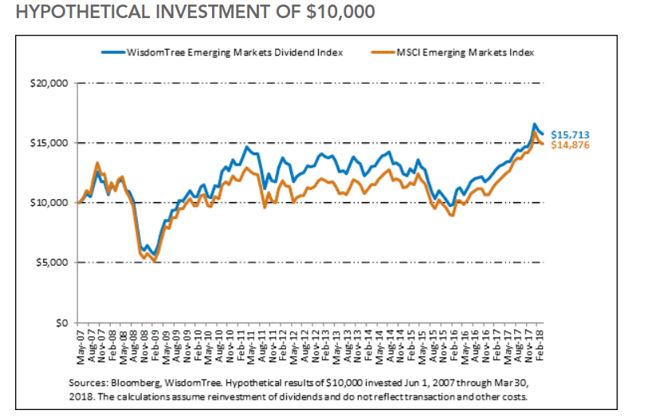

However, the ETF is based on an index whose holdings are defined by specific rules. This means it is possible to back test the portfolio to find its hypothetical performance. WisdomTree provides the results of this test which is shown below.

Source: WisdomTree

This indicates the fund could sell off sharply in a bear market as it did in the global market meltdown that began in 2008. Investors worried about a potential market decline may want to put this ETF on their watch list rather than buying now.

Or, they could dollar cost average into the ETF. This is a popular strategy for mutual fund holdings and could work equally well with ETFs.