Eliminating the Risks of Bitcoin Investments

Risk and return are always assumed to be inseparable. In other words, you always have to accept higher than average risks in the pursuit of higher than average gains. Likewise, lower risks are only available when the potential rewards are lower than average.

This is the standard investment theory and something that any financial adviser can explain in detail. But, it might not always be true.

Derivatives Serve Useful Purposes

Large banks and investment firms often use derivatives to meet their investment goals. Warren Buffett is, rather famously, not a fan of derivatives, having once called them “financial weapons of mass destruction” but does often use derivatives in his own portfolio.

It’s more likely that Buffett was highlighting the fact that derivatives can be dangerous for uninformed investors but if you take the time to understand them, they can be used to manage risks. In fact, risk management was one of the reasons derivatives became popular.

One of the most popular derivatives is the structured note. This is “a debt obligation that also contains an embedded derivative component that adjusts the security’s risk/return profile.”

One example of a structured note is a popular annuity contract that guarantees investors they will not lose money and they will be able to participate in the gains of the stock market. For example, they may be assured their account value will never decline below its value on a certain date every year.

So, every May 31, for example, the account is valued. If the value fell from the previous year, the annuity provider makes up the difference. If it increased in value, the annuity holder sees a gain in their wealth.

This sounds risk free. But, and there is almost always a but, there is a cost. In this example, the investor might only get to keep half of the stock market gains or their gains in any year may be capped at 10%. They still benefit from the gains and they still hold no risk. They just pay for that protection.

For institutions, structured notes often take on a different form. Bloomberg recently explained the strategy used by institutional investors:

“[I]f you have $10,000 to invest for five years, you spend some of it buying a risk-free security (classically, a Treasury Strip) that matures at $10,000 in five years, and then — because that Strip costs something like $8,750 today — you spend the rest buying the risky thing that you really want to buy.”

Instead of directly buying the risky asset, you could buy call options on the asset to enhance the return profile of the structured note.

Bloomberg explained that the transaction is actually a little more nuanced:

“Instead of just telling clients to buy Strips and options to get the asymmetric payoff profile that they want, you can take the clients’ money, use some of it to buy Strips, some of it to buy options and some of it to pay yourself a fee, and guarantee the clients the asymmetric payoff profile that you think they want.”

That is often the essence of a Wall Street transaction where the client obtains something of value and the investment bank providing the service is entitled to a fee for providing the service. For small investors, the fees aren’t worth the effort for Wall Street so individuals face challenges obtaining these products.

A Bitcoin “Structured Note”

At least one firm is currently working on this delivering this type of strategy to small investors using Bitcoin. The firm is “building a tax deferred savings product that gives you some participation in stock market upside with protection against any losses.”

But, they also address the question of whether or not a similar model could be applied to bitcoin and other cryptocurrencies and their answer is yes. The example provided is for a $10,000 investment but the idea works for any account size since Treasury notes could be bought for as little as $100.

Treasuries can always be bought, for free, through the Treasury’s web site, TreasuryDirect.org. Individuals obtain the interest rate available to large investors by submitting noncompetitive bids for bills, notes or bonds through that site. There is no fee so returns are generally going to beat those available through passive money market funds or exchange traded funds (ETFs).

Examples of How to Guarantee Your Investment

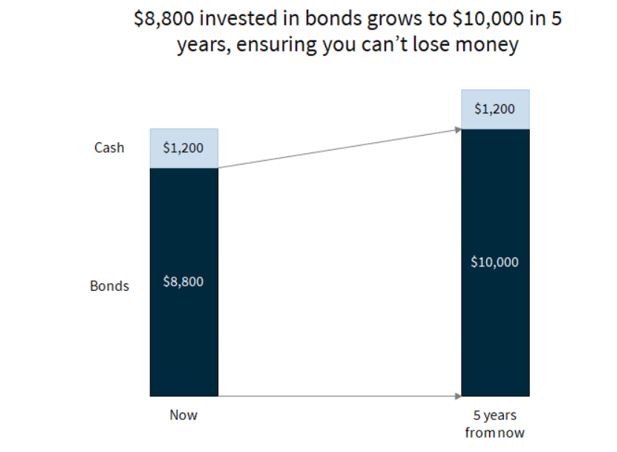

Now, to the example, assuming you have $10,000 to invest, you could buy a Treasury note maturing in five years. The recent interest rate of 2.6% for this investment means the cost will be about $8,800. You could then hold the remainder in cash and in five years, you have $11,200.

Source: Benjamin.com

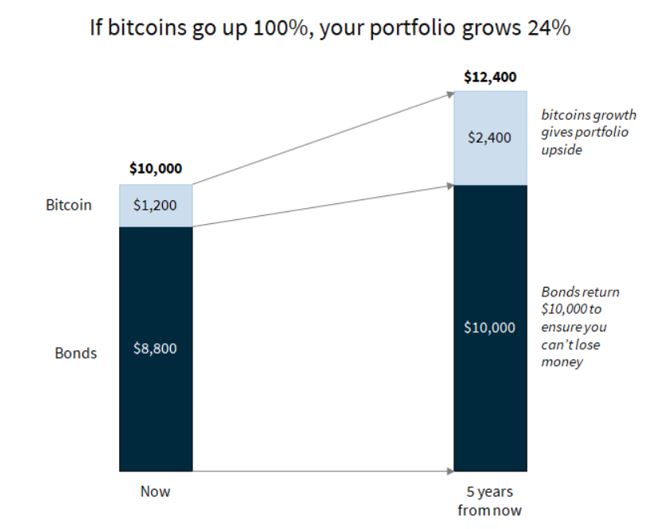

Now, you could also put that money into bitcoin. In that case, you would place $8,800 into the risk free Treasury note maturing in five years and the remainder into bitcoin or other crypto currencies. The next chart assumes the crypto investment doubles in value.

Source: Benjamin.com

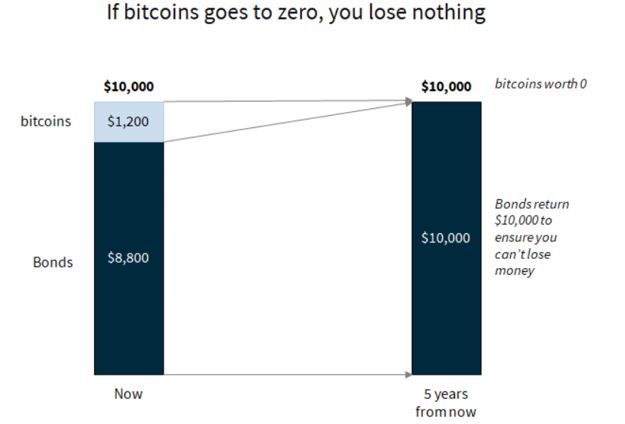

In this scenario, you earn a total return of 24% on your $10,000 investment. If you had instead invested $1,000, you would still enjoy a 24% return in this scenario and have an account worth $1,240. In the worst case, there is zero risk as the next chart shows.

Source: Benjamin.com

That’s the worst case and it means an investor loses nothing with this strategy.

Now, you may understand why Wall Street uses this strategy of structured notes. It can be applied to ensure a portfolio never suffers a loss.

The Risks Are Not Completely Eliminated

There are still risks with this strategy. There is the risk you may have to sell the Treasury early and that could mean a loss is incurred in closing that part of the structured note. There is, of course, the risk of loss in the asset that is used to boost returns.

This strategy could be applied with bitcoin or any other crypto currencies. It could also be applied with stocks, ETFs tracking market indexes or even volatility, gold or any other asset. It redefines risk and could allow an investor to boost returns in a portfolio even when losses are completely unacceptable.

Provided the Treasury is held to maturity, there is no chance of loss and potential gains are possible.