Buying Assets for Pennies on the Dollar

The goal of investing is simple. Investors are trying to buy assets that will increase in value. That’s true of stocks, real estate, precious metals and other investments. This is a common goal of all investors, their strategic objective, in a sense. But, the tactics to reach that objective vary.

In the long run, all successful investors are paying pennies on the dollar for assets. The dollars will come in the future as long as they accurately gauge the value of the assets today. That means that successful investors are simply hunting for bargains.

This is a tactic every shopper is familiar with. If they are shopping for paper towels and the product is normally priced at $5, they are more likely to buy if the store marks the price down to $3.80. That’s because they are now paying $0.76 for a dollar’s worth of paper towels.

Value investors in the stock market are looking for the same type of sales.

Identifying Value

Investors have developed a number of strategies to find value in the stock market. Many of these strategies are complex while others are relatively simple to implement. As individual investors, we believe it is important to have strategies that are as simple as possible, but no simpler.

One of those strategies that is straightforward to implement is based on the book value of a company.

An asset’s book value is equal to its carrying value on the balance sheet, and companies calculate it netting the asset against its accumulated depreciation. Book value is also the net asset value of a company calculated as total assets minus intangible assets (patents, goodwill) and liabilities.

For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales taxes, service charges and so on.

For investors in stocks, book value can be applied with the price to book (P/B) ratio as a valuation multiple is useful for value comparison between similar companies within the same industry when they follow a uniform accounting method for asset valuation.

As with most fundamental metrics, a low P/B generally shows a high degree of value when compared to a stock with a high P/B ratio.

One appealing aspect of the P/B ratio is the opportunity to quickly identify assets that are selling for pennies on the dollar. When the P/B ratio is less than 1, the price of the stock is below the book value and there is a potential opportunity to buy the stock at a discount.

Understanding Risk

However, stocks are not like paper towels and a discounted price may not always be a bargain. A stock with a low P/B value could be a troubled company, one that is perhaps headed to bankruptcy. That is a risk of value investing and exists no mater which valuation metric is used to identify value.

There are some steps that can be taken to reduce this risk. It is important to remember that risks can never be completely eliminated but they can be mitigated. A catastrophic risk management plan could include a stop loss rule that sells a position if the price declines by a large amount.

To mitigate risks, investors could consider requiring the stock to be in an up trend. This would indicate that buyers are interested in the stock and in effect the market is confident that bankruptcy is a remote possibility.

Another strategy for reducing risk is to require the payment of a dividend. This will not protect against additional declines as much as it will reduce the impact of additional declines, since the dividend provides a small payment to the investor while waiting for the price to increase.

Risks could also be mitigated by limiting investments to large cap stocks. There is no guarantee a large cap company will not fall into bankruptcy but the risks are lowered since there is a greater likelihood of small companies suffering financial crises.

Implementing the Strategy

Like other fundamental metrics, the P/B ratio can be used to evaluate the value of a stock. For example, an investor could limit investments to stocks where the P/B ratio is less than 1, indicating the stock is selling for less than the book value of the company.

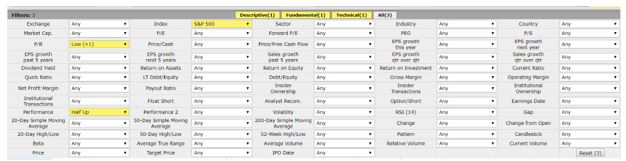

One way to find stocks meeting that requirement is with the free stock screening tool available at FinViz.com. At this site, you could screen for a variety of fundamental factors like free cash flow, high levels of institutional ownership and bullish institutional transactions. An example is shown below.

Source: FinViz.com

For this screen, we selected stocks that are included in the S&P 500 index and that have a low P/B ratio, specifically a ratio below 1. The screener allows investors to select a variety of values and we also required that the stock be higher in the past six months.

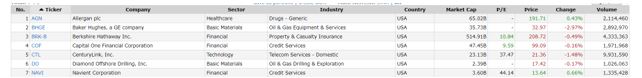

Just seven stocks passed the screen.

Source: FinViz.com

Any of these stocks could be a buy. Allergan, for example, shows a bullish chart pattern, which would be expected given the requirement that the stock be higher than it was six months ago.

Allergan plc (NYSE: AGN) is a specialty pharmaceutical company. The company operates through three segments: US Specialized Therapeutics, US General Medicine and International.

The US Specialized Therapeutics segment includes sales relating to branded products within the United States, including Medical Aesthetics, Medical Dermatology, Eye Care, Neurosciences and Urology therapeutic products.

The US General Medicine segment includes sales relating to branded products within the United States that do not fall into the US Specialized Therapeutics business units, including Central Nervous System, Gastrointestinal, Women’s Health, Anti-Infectives and Diversified Brands.

The International segment includes sales relating to products sold outside the United States.

The stock has a P/B ratio of 0.91 according to FinViz although other sources show different values. Investors will need to determine which data source they are comfortable with and stick with that source consistently.

It is possible to implement the strategy with call options to lower the capital required. It could be rebalanced every six months, or annually. Endless combinations of rules are possible but long term success is most likely when rules are minimized and applied consistently.