5 Monster Dividend Plays to Kickstart Your Second Salary

Dividend stocks are a great way to earn passive income.

So much so, they can actually help you secure a second monthly salary, by boosting your returns.

In fact, we’ve uncovered five stocks that have sustainable dividends of more than 10%.

By investing in a basket these stocks for the long term, you get to participate in the growth of those businesses, while being handsomely paid just to hold each of them.

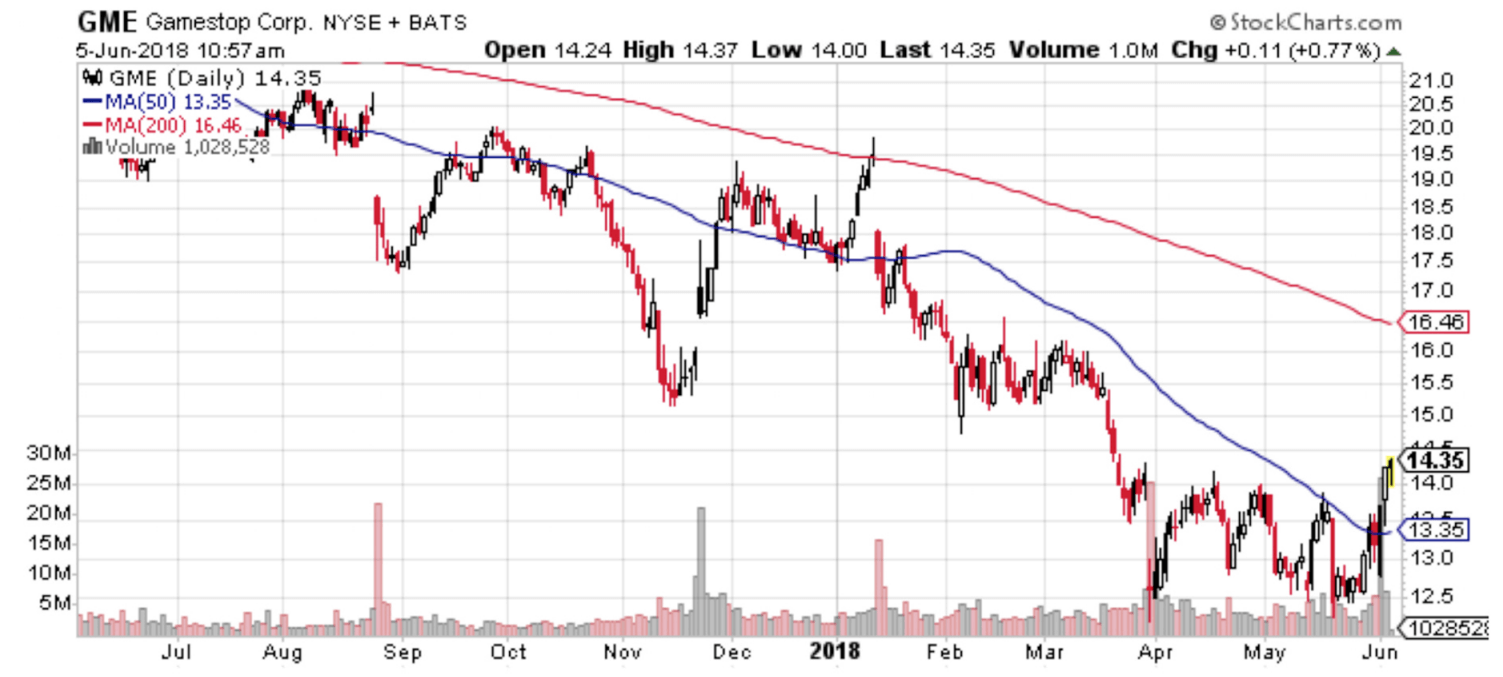

Dividend Trade No. 1 — GameStop Corporation (NYSE:GME)

GameStop Corp. operates as a multichannel video game, consumer electronics, and wireless services retailer. It operates in five segments: United States, Canada, Australia, Europe, and Technology Brands. The company sells new and pre-owned video game hardware; video game software; pre-owned and value video games; video game accessories, including controllers, gaming headsets, virtual reality products, memory cards, and other add-ons; and digital products, such as downloadable content, network points cards, prepaid digital and prepaid subscription cards, and digitally downloadable software.

Many investors are quite intrigued by the company’s yield of 11.7%.

Granted, the company is struggling at the moment.

In fact, Interim CEO Shane Kim has even noted that:

“We are obviously facing some interesting challenges. Our goal is to find the best person to provide the best leadership and energy for the company.”

And while comparable sales are in decline after a 5.3% drop in its latest earnings, the company is stills seeing strength in sales of the Xbox One and PlayStation 4 consoles. There retailer is also seeing health in its accessory business, including headsets and controllers for PCs and consoles.

Better still, GameStop believes most of its 2018 earnings will be generated in the latter part of the year especially around the holiday shopping season. The company has also made it clear that the dividend of nearly 12% remains a stop priority.

Dividend Trade No. 2 — New Residential Investment Corporation (NYSE:NRZ)

New Residential Investment Corp. is a real estate investment trust, focuses on investing in and managing residential mortgage related assets in the United States. It operates through Servicing Related Assets, Residential Securities and Loans, and Other Investments segments. The company invests in excess mortgage servicing rights (MSRs) on residential mortgage loans; and in servicer advances, including the basic fee component of the related MSRs. It also invests in real estate securities, residential mortgage loans, investments in consumer loans, and corporate. In addition, the company has an interest in a portfolio of consumer loans, including unsecured and homeowner loans.

What’s nice about REITs 1s that they can be very profitable investments. Many times, they have to pay at least 90% of their taxable income in dividends to shareholders, making them a great option for income investors.

It’s part of the reason we like NRZ, which hasa dividend yield of 11.12%.

Dividend Trade No. 3 — Buckeye Partners LP (NYSE:BPL)

Buckeye Partners, L.P. owns and operates liquid petroleum products pipelines in the United States and internationally. The company operates through three segments: Domestic Pipelines & Terminals, Global Marine Terminals, and Merchant Services.

At the moment, it carries a dividend yield of 12.09%.

What’s nice about BPL is that despite headwinds, it continues to pay out a distribution every quarter and has never reduced its distribution during its more than 30-year history, says CEO Clark Smith.

“2018 is a transitional year for Buckeye, as market conditions for segregated storage remain challenged and meaningful contributions from capital projects will not be realized until 2019 and 2020,” he says.

Plus, the company is quite confident in its future.

In fact, it just created a partnership with Phillips 66 Partners and And eavor (25% interest each, with Buckeye holding the remaining 50%) to build a new crude oil export terminal in Ingleside,

Texas. Buckeye is also working on a pipeline that can change flow direction that will allow it to expand its Michigan/Ohio business. That project is expected to be complete by the end of 2018.

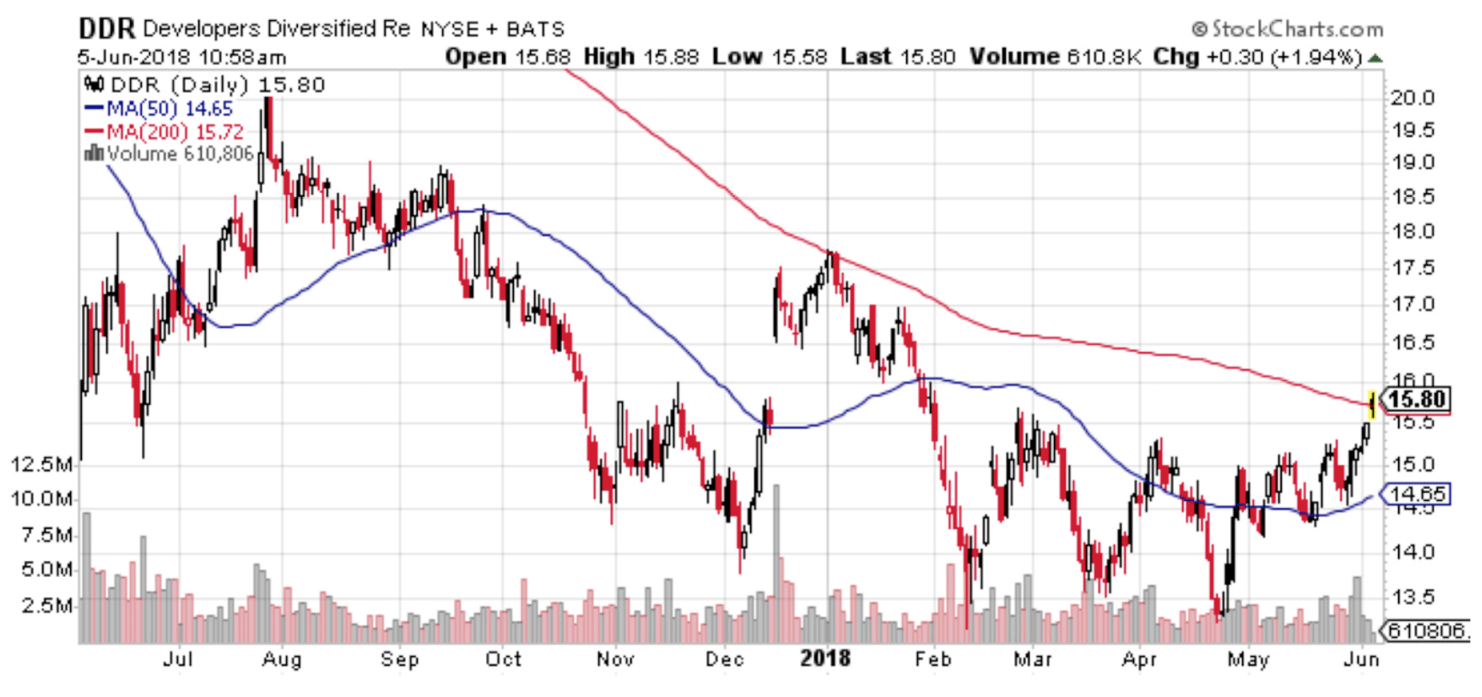

Dividend Trade No. 4 —- DDR Corporation (NYSE:DDR)

DDR is an owner and manager of 258 value-oriented shopping centers representing 89 million square feet in 32 states and Puerto Rico. The Company owns a high-quality portfolio of open-air shopping centers in major metropolitan areas that provide a highly compelling shopping experience and merchandise mix for retail partners and consumers. The Company actively manages its assets with a focus on creating long-term shareholder value. DDR 1s a self- administered and self-managed REIT operating as a fully integrated real estate company.

DDR carries a current dividend yield of 10.2%.

After announcing a 1:2 reverse stock split effective May 21, 2018, we’re seeing signs of confidence in the stock with insider buying. In fact, a director has been buying shares of the shopping center-focused real estate investment trust since February, including this past week’s more than 816,000 shares. At prices that ranged from $7.21 to $7.51 apiece, that cost them approximately $6 million.

In its most recent quarterly report, the company not edit had $97.8 million in funds from operation, or 26 cents a share, which was better than estimates of 23 cents. Funds from operations are a closely watched measure in the REIT industry. It takes net income and adds back items such as depreciation and amortization.

Revenue was $207 million, beating estimates for $199.3 million.

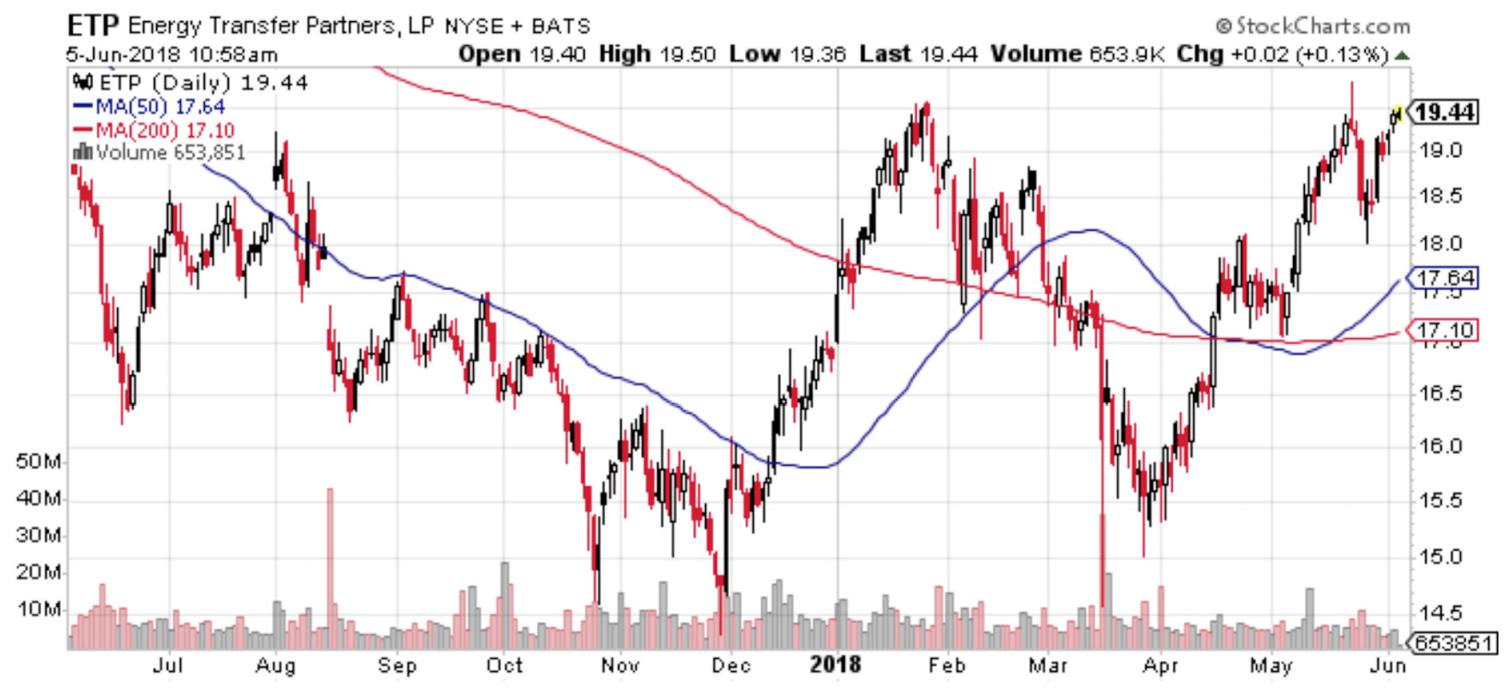

Dividend Trade No. 5 — Energy Transfer Partners LP (NYSE:ETP)

Energy Transfer Partners, L.P. engages in the natural gas midstream, and intrastate transportation and storage businesses in the United States. The company’s Intrastate Transportation and Storage segment transports natural gas from various natural gas producing areas through connections with other pipeline systems, as well as through its ET Fuel System and HPL System.

ETP carries a current dividend yield of 11.7%.

Better yet, it’s part of the explosive Permian Basin.

According to RigZone.com:

It “plans to build a crude pipeline from the Permian basin in Texas to the Houston Ship Channel and Nederland, Texas, which will have an initial capacity of up to 600,000 barrels per day (bpd). The pipeline will be “easily expandable” to 1 million bpd, in order to serve growing a export markets at coastal ports, the company said during first quarter earnings conference call. It is likely to come online by 2020. Surging crude output from the Permian basin, the biggest oilfield in the United States and the source of most of the country’s shale crude, is straining the region’s infrastructure. Pipelines are running full, sending crude prices there to the weakest level against benchmark futures in three and a half years.”