hedge fund trading strategies | Generate Extra income

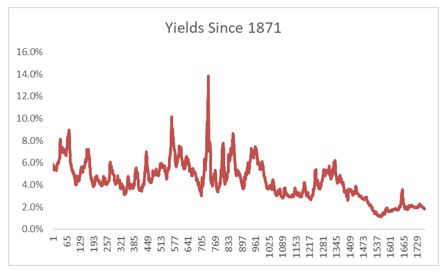

Stocks deliver income through dividends. These regular payments can build large fortunes over time. But, recent income from dividends has fallen to historic lows. The chart below shows the dividend yield of the S&P 500 index.

While dividends have been higher in the past, many investors have sought higher income. This is simply because investors will invariably seek more income no matter what the level of available income is. This means investors have put a great deal of effort into finding strategies to increase income.

Understand the Dividend Process

Among the strategies that hedge funds employ is the dividend capture strategy. Generate extra income with this hedge fund trading strategy. With this strategy, investors own stocks for the minimum time necessary to qualify for the dividend. It’s a fairly straightforward strategy.

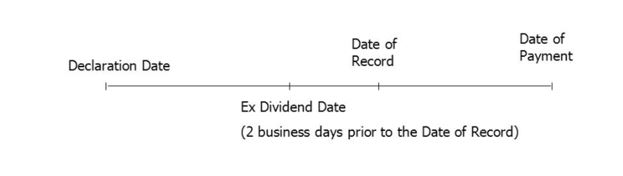

Dividend payments follow a well defined process. From the time a company’s Board of Directors decide to pay share holders a dividend to the time the investor receives the funds, a chronology of events unfolds.

The declaration date is the day on which a company issues a statement declaring its intent to pay a dividend. At that time, the company will also announce other key dates including the record date and the payment date.

The ex dividend date is the first business day that each share will trade without its dividend. This means that investors who owned shares before and on the ex dividend date will receive a dividend once it is paid.

This date is important because investors who acquire shares after the ex dividend date will not receive the dividend.

The record date is the business day on which a shareholder that is listed in the company’s records is deemed to have ownership of the company’s shares for the purpose of deciding who can and who cannot receive a dividend when paid. The record date is typically one or two business days after the ex-date.

The payment date or payable date is the date on which a company mails or transfers dividend payments to its shareholders of record. The payment date does not have to be a business day. It can also occur on a weekend or holiday.

The Dividend Capture Strategy

To capture the dividend, an investor needs to buy the stock before the ex dividend date. They are free to sell the stock on the ex dividend date or at any time after that and they will still receive the dividend.

Theoretically, a stock’s price should reflect the expected dividend payment prior to the ex-dividend date. Because investors purchasing the stock on the ex-dividend date do not receive the dividend, the price of the stock should theoretically fall by the dividend amount.

In theory, the price of a stock falls by the amount of the dividend on the ex dividend date. However, this doesn’t always happen in the market, especially since much of the buying in the market is driven by index funds and the value of the stock is irrelevant to these investors.

That creates the trading opportunity.

Consider a hypothetical stock, ABC Company, trading at $10 a share paying a dividend of $0.50 a share. A trader could buy the stock at the close on the day before the ex dividend date. In theory, the stock should open after the dividend is paid at $9.50 but assume a strong employment report boosts the stock to $9.75.

The dividend capture strategy trader now sells for $9.75. They capture the dividend of $0.50 and realize a profit of $0.25 per share for a one day holding period.

This strategy benefits from the fact that stocks do not trade in strict accordance with theory.

Benefits of the Dividend Capture Strategy

The obvious benefit of this strategy is that the trader generates significant profits in trades with a short holding period. Shorter holding periods can reduce risk since there is less time exposure to the stock market.

This strategy can also be implemented in any sector or with any size of stock. A free stock market screening tool at FinViz.com recently showed that there are 3,796 dividend paying stocks that could be used with this strategy, more than half of all publicly traded stocks.

Drawbacks of the Dividend Capture Strategy

Although this strategy has limited exposure to the risk that news will prompt a broad stock market sell off, there are some drawbacks that investors should be aware of.

One of the drawbacks is that the short holding period of the strategy could result in unfavorable tax treatment of the income. To count as a “qualified” dividend that is eligible to receive favorable capital gains tax treatment, the stock must be held for at least 60 days during the 121 day period that begins prior to the ex-dividend date.

This strategy will not qualify for that benefit. Employing the strategy in a tax advantages account could overcome this problem. Or, taxes may not be a concern for all investors.

Finally, commissions could eat into the profits. This problem could be addressed by using a low cost discount broker. At deep discount brokers, commissions can be less than a dollar and trivial to the results of an active trading strategy.

Finally, this strategy can be capital intensive. Traders must buy the shares since that is the only way to obtain the dividend. Low cost call options will not work with this strategy.

The dividend capture strategy can be used successfully by short term traders seeking income as long as they have sufficient capital to execute the trades. Alternatively, they could limit their trading operation to low priced stocks.

FinViz.com recently showed that there were 134 dividend paying stocks priced at $5 or less. This means the strategy could be used by investors with relatively small amounts of capital since 100 shares of these stocks would require capital of $500 or less.

If using low priced stocks, investors need to consider the liquidity of the stocks. Stocks with low liquidity can be more expensive to trade and it is even possible a trader could be unable to sell the shares when desired at a reasonable price. This is an important risk to consider.

However, even with the risks, the dividend capture strategy could be appealing to investors seeking higher than average levels of passive income.