Stocks Under $10 Ben Graham’s Formula Says Are Buys

Warren Buffett completed his graduate degree at the Colombia Business School which he specifically chose so he could study under Ben Graham.

Graham wrote the original textbook on investment selection with David Dodd. That book, Security Analysis, is still considered to be required reading by many market analysts. Graham also wrote The Intelligent Investor, a more accessible book designed for individual investors.

Graham believed that a company’s financial statement held the key to success. He advocated looking at the income statement and balance sheet to find stocks that offered value.

The Graham Number

In particular, Graham looked for stocks with a low price to earnings (P/E) ratio and a low price to book (P/B) value. He also explained a technique to combine these two metrics into a single number, the Graham Number.

The Graham Number is a geometric average of the P/E ratio and P/B ratio. The geometric average of two numbers is the square root of the product of the two numbers. Graham advised investors to look for value and defined value as a P/E ratio of less than 15 and a P/B ratio of less than 1.5.

The Graham Number combines those two values into a single data point. It is thus the square root of 22.5 times the P/E ratio times the P/B ratio. When divided by the current market price, ratios below 1.0 indicate value.

Now, we know from news stories Buffett recently told CNBC that “one of the fellows in the office that manage money … bought some Amazon (Nasdaq: AMZN) so it will show up in the 13F” later this month.

Buffett was referring to either Todd Combs or Ted Weschler, who each manage portfolios of more than $13 billion in equities for Berkshire.

Buffett has long been a fan of Amazon and its CEO, Jeff Bezos, praising the company’s dominance and the founder’s business prowess. But while Buffett has sung the company’s praises, he’s never bought Amazon shares.

So a headline that Berkshire was buying shares likely would spark interest in the markets.

“Yeah, I’ve been a fan, and I’ve been an idiot for not buying” Amazon shares, Buffett said. “But I want you to know it’s no personality changes taking place.”

The stock had a P/E ratio of almost 100 and a P/B ratio of almost 20 yet the Graham Number is just 0.11 so it could be an interesting value stock.

Of course, one example does not prove the value of the Graham Number, but it provides some degree of confidence in the technique.

The Graham Number could be used to screen for stocks that offer value, and it could be hidden value as in the case of Amazon.

Now, it is important to remember that there is no guarantee any stock will increase in value. Also, it is important to remember when we search for stocks using quantitative measures, our goal is to identify stocks that meet those criteria.

Just because a stock has a low Graham Number, it does not mean the price will rise and any individual trade based on that idea could be a winner or loser.

We recently screened for cheap stocks with Graham Numbers below 1.

We limited our search to low priced stocks.

Individual investors understand that low priced stocks could be appealing for two reasons. One reason is that the low price means they have little down side risk in dollar terms. The second reason is that low priced stocks are generally the ones that deliver the largest short term gains.

One study looked at how low priced, or cheap, stocks performed relative to more expensive stocks. The study found that cheap stocks delivered more than six times the average return of the more expensive stocks in a typical quarter.

That’s why we limited our search for potential bargains by focusing on stocks priced at less than $10 per share. While we would like to see stocks at even lower prices, there just weren’t many that passed our stringent screening criteria, so we had to use a cut off value of $10 to ensure some degree of diversification in this screen.

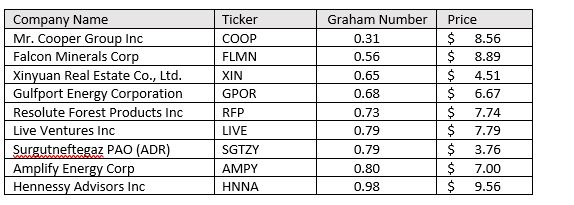

The stocks that passed this screen are shown below.

This list could be used as a starting point for research.

Some of these companies, like Mr. Cooper Group (Nasdaq: COOP), may not be well known.

Mr. Cooper Group provides servicing, origination and transaction-based services related principally to single-family residences throughout the United States. It offers mortgage servicing and a loan originations platform.

The company operates through its subsidiary, Nationstar Mortgage Holdings Inc. it operates through its brands, such as Mr. Cooper, Xome and Champion Mortgage.

The company’s Mr. Cooper brand is a home loan servicers that is focused on providing a variety of servicing and lending products, services and technologies. Xome provides technology and data enhanced solutions to homebuyers, home sellers, real estate agents and mortgage companies. Champion Mortgage is a reverse mortgage servicer.

The stock price does appear to be near support.

Analysts expect earnings per share of $2 in 2019 with increases to more than $2.70 in 2021. With six analysts covering the stock, the lowest estimates are for earnings of $1.45 this year and $1.95 in 2021. Even at the lowest estimates, the stock appears to offer value.

The stock offers liquidity with average trading volume of about 900,000 shares a day and potential value. This could be the kind of stock that warrants additional research and demonstrates the possible value of using the Graham Number to unlock investment ideas.