Time To Look At This Sector Again

After the most recent meeting of the Federal Reserve, traders started reviewing their assumptions about rate hikes. Within days, futures of Fed Funds, a critical short term interest rate market, were pricing in the likelihood that there would be no more rate hikes.

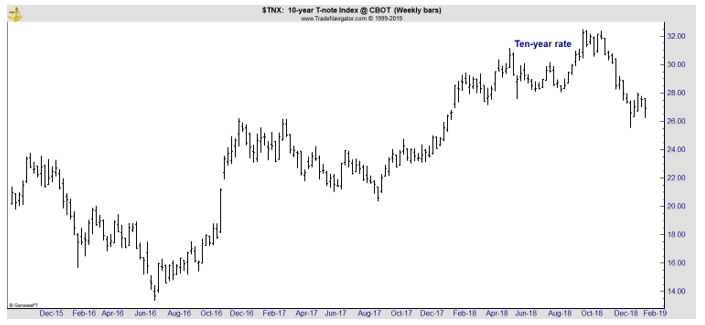

This marked a reversal in the outlook of just a few months ago. The reversal can be seen in other interest rate markets as well. The chart below shows the interest rate on ten year Treasury notes and the recent trend is down, reversing a longer up trend.

Lower rates would be likely if the pace of economic growth is slowing and mounting evidence indicates that is a possibility. If this trend continues, it could have important implications for the stock market and in particular for certain groups within the stock market.

Banks Could Be Turning

Interest rates always present a puzzle to investors in the financial sector. Some analysts argue that lower rates are bearish for banks while others argue the opposite. A recent article in Barron’s highlighted the view of one of the most well respected analysts in the sector.

“The market for banks stocks is fickle,” says Wells Fargo analyst Mike Mayo, a bull on the sector. “Investors always seem to be viewing the glass as half empty.”

Industry sources cited Mayo as “a prominent bank analyst when Wells Fargo & Co. hired him in 2017. The analyst was hired to “make calls on large-cap bank stocks in its securities business, according to a statement released on Monday.

“Mike’s stature in the industry is well-recognized,” Diane Schumaker-Krieg, global head of research, economics and strategy at Wells Fargo Securities, said in a statement. “We are thrilled to have such an influential voice in this critical sector join our growing platform.”

Now, his view on some banks is bullish.

According to barron’s, “Mayo’s view is that major banks represent a bargain, trading for an average of just 10 times projected 2019 earnings, and many yielding 3% or more. He sees bank profits rising 8% to 10% this year as the industry boosts revenues and keeps a tight lid on costs.

“The negative sentiment has created an opportunity with uniquely attractive valuations,” he says.

Banks have the most aggressive capital-return plan of any major industry group, at around 100% for the 12 months ending in June. That is providing a major lift to earnings per share.

Some banks like Citigroup (NYSE: C) and Wells Fargo (NYSE: WFC) are expected to return more than 100% of their earnings to holders in dividends and stock buybacks.

Yet bank stocks were among the worst performers in a strong stock market Thursday afternoon. The KBW index of 24 leading banks was down 1.7%, while the S&P 500 index rose 0.7% to 2,699. Banks also were down Wednesday in the face of a big gain in broad market indexes, with the S&P up 1.6%

Among top banks Thursday, Bank of America (BAC) was off 96 cents, or 3.3%, to $28.11: JPMorgan Chase (JPM) fell 1.5% to $102.89; and PNC Financial Services Group (PNC) declined 2% to $121. Morgan Stanley (MS) was off 1% to $42.05 and Goldman Sachs Group (GS) lost 2.4% to $197.65.

The downdraft in bank stocks comes after a strong start to 2019. Even with the losses Thursday, bank stocks are ahead of the overall market with a nearly 12% gain, versus less than 8% for the S&P 500. Banks, however, were whacked in 2018, losing about 20% on average, while the S&P 500 declined 6%.”

The chart of Invesco KBW Bank ETF (NYSE: KBWB) is shown below.

Interest Rates Could Change the Trend

Barron’s continued, “Banks are viewed as beneficiaries of higher rates because they generally can boost loan rates faster than deposit rates and a higher-rate environment normally occurs when the economy is robust. Economic strength is good for loan demand and credit quality.

The most “asset-sensitive” banks, meaning those that tend to get the biggest earnings boost from higher rates, were among the worst performers Thursday. Bank of America and Comerica are viewed as being particularly asset sensitive. Other asset-sensitive regional banks showed similar losses.

Bank-deposit “betas,” or the percentage increase in market interest rates that is passed on to depositors, is around 50%. That means that the higher rates do tend to fatten bank profit margins, although Mayo says that is often overstated as a factor behind earnings growth.

He argues that Bank of America is benefiting from a 25-year effort to build a national banking footprint and that its major investments in technology should continue to allow it to outpace the industry. Bank of America trades for around 10 times 2019 earnings and yields 2.1%.”

Industry leader JPMorgan (NYSE: JPM) also trades for 10 times 2019 earnings and yields 3.1%. The S&P 500 index is valued at about 16 times forward operating earnings.

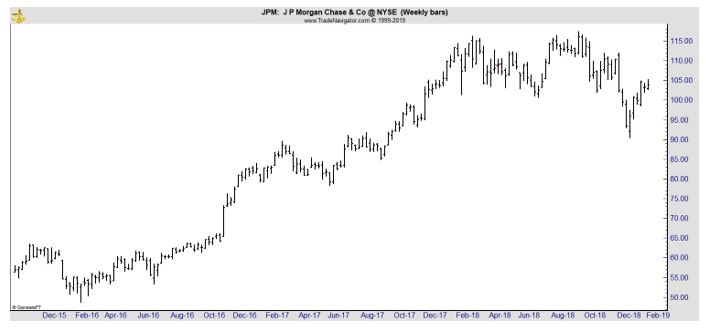

The long term chart of JPM is shown below.

The chart looks similar to the bank ETF. This is true for most banks. The recent lows, below the previous lows, could be a bear trap and a bullish reversal would push the stocks in the industry to new highs.

Other analysts agree with Mayo according to Barron’s. “Bernstein analyst John McDonald recently wrote that the earnings baton for banks is passing to loan growth from rates. He sees 3% growth in net interest income in 2019 and 2020. driven by a 65%/35% mix of loan volumes and rates, against a 35%/65% mix in 2018.

He noted that banks like SunTrust Banks (STI) that have shown accelerating loan growth have been outperformers. Loan growth in recent months has accelerated to a rate of 4% from 2% in the middle of 2018, McDonald wrote.”

Of course, this demonstrates why it is difficult for individual investors to make sense of analyst expectations. ETFs can be helpful to avoid the need to identify individual stocks that are likely to be winners.

In addition to KBWB, investors can consider Financial Select Sector SPDR ETF (NYSE: XLF) or SPDR S&P Bank ETF (NYSE: KBE) as diversified investments offering exposure to the banking industry.

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.