The Most Common Mistakes Investors Make

Experience, it is often said, is the best teacher. Perhaps that’s because it can be such a painful lesson to make mistakes. In some ways, it could be that the experience of others is the best teacher since we can learn from their mistakes and not have to make our own costly errors.

In light of that view, it could be useful to review “Learning From the Mistakes Made by Legendary Investors,” a recent article that appeared in the AAII Journal, a publication of the American association of Individual Investors.

Important Lessons for Investors

As a starting point, we will list the errors and then add some detail to several of them:

- Investors tend to expect the future to look like the recent past.

- Investors behave as if the price we paid for a security somehow should be factored into how we view the investment going forward.

- Investors make the mistake of thinking about the stock instead of the business.

- People loathe to admit that they were wrong about anything, and this is particularly true with investing.

- People often look to others for approval.

- People are overconfident.

- Success in one area of life does not guarantee success in the market.

- People think that if they build the perfect model or if they have better information, then they will be able to beat the market.

- Talking to friends and family about investing is a mistake.

- Intelligence is not enough.

The Importance of Independent Thinking

Several of the mistakes deal with the importance of ignoring the crowd. That can difficult. Many of us watch CNBC.

Source: CNBC.com

This can be a source of ideas. But we should also consider why the guests on CNBC are explaining why they like a stock. In some cases, they are attempting to sell us something by showing that they are smart and confident stock pickers.

In some ways, guests on CNBC are at risk of violating mistakes 5 and 6 above. They may be looking for approval and they be overconfident. We simply don’t know their motivation or their thinking. This means we need to think for ourselves.

Besides, the guest on CNBC will not call or email when they change their mind. And, many of them will change their minds. Even if the guest is right and tells us to buy the best stock in the market, we will still need to do our own research to know when to sell.

The importance of independent thinking cannot be overemphasized. But, some great investors have summarized their thinking in anecdotes that could be helpful for us to remember.

Sir John Templeton said, “The four most dangerous words in investing are, it’s different this time.” In the AAII article, the author notes, “I think the most dangerous words in investing are “I’ll sell when I get back to even.”

Anchoring to your purchase price is dangerous because most stocks are losers. Most stocks won’t be sold at a profit or even at a breakeven price. There is nothing wrong with taking a small loss, but big losses are hard to recover from financially and emotionally.

We can all hope that a stock comes back up in price. When waiting for this to happen, keep in mind this observation from hedge fund manager David Einhorn, “What do you call a stock that’s down 90%? A stock that was down 80% and then got cut in half.””

So, that is a simple lesson. Cut losses quickly and avoid larger losses. This means it will be necessary sometimes to admit that we are wrong.

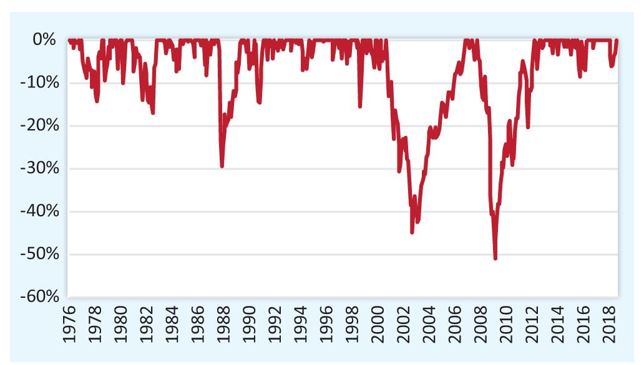

The importance of selling can not be overemphasized. That is especially true because there will be losses in the stock market. The next chart shows that there were frequent drawdowns in equity even in bull markets.

Source: AAII.com

This chart shows the percentage loss from the high in the S&P 500 and there are frequent losses. The index will almost always be between 1% and 10% below its high. In the current century, there have been two declines of more than 40%.

Should You Sell In the Declines?

This chart raises the question of how an investor can cut losses quickly since the market is almost always delivering losses of some size. This is perhaps a question of portfolio management.

An investor should maintain a diversified portfolio meaning they avoid putting all of their eggs in one basket. That would imply at least several stocks. They can buy a stock and use a stop loss on that stock. A trailing stop could be better than a static stop loss.

A trailing stop is defined by Investopedia as “a stop order that can be set at a defined percentage away from a security’s current market price. An investor places a trailing stop for a long position below the security’s current market price; for a short position, they set it above the current price.

A trailing stop is designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the investor’s favor, but closes the trade if the price changes direction by a specified percentage. A trailing stop can also specify a dollar amount instead of a percentage.”

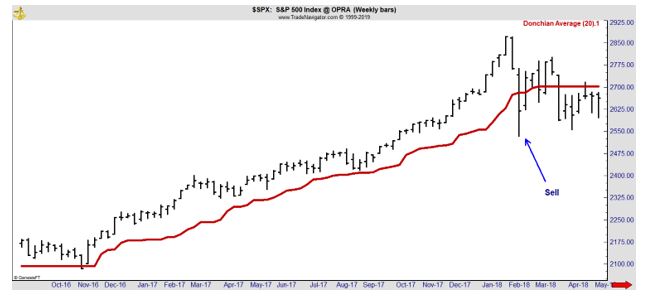

The next chart offers an example of how the trailing stop could be used.

The red line is a moving average that is based on the highs and lows. Any moving average could be used. Or recent lows could be used. Or a simple stop could be set 20% below the highest price since the trade was entered.

The stop moves with the action but will eventually be triggered. When it is triggered, the position could be closed. At that point, an investor could move into a new trade and hold that one as long as it remains above the stop.

In a bear market, a true bear market like the one in 2008, almost all stocks will be in down trends. In that market, gold or fixed income funds could be held. There is always a bull market in something and by avoiding mistakes, these up trends that eventually reverse could provide wealth to investors.