Here’s Why 2019 Could Be a Bad Year for Stocks

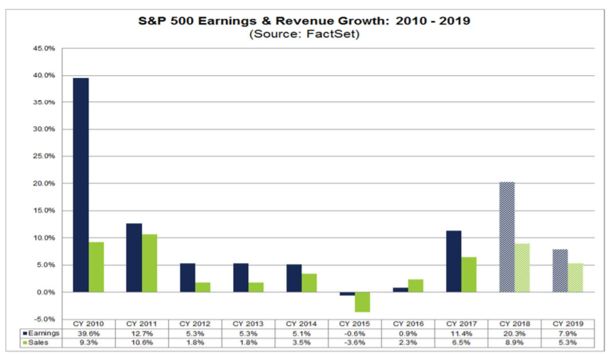

In the long run, stock prices are driven by earnings. That’s why investors should be concerned about 2019. According to the research firm FactSet, earnings growth is set to slow sharply. According to a recently published research report:

“…the estimated earnings growth rate for CY 2018 is 20.3%. If 20.3% is the final growth rate for the year, it will mark the highest annual earnings growth for the index since 2010 (39.6%).

…the estimated earnings growth rate for CY 2019 is 7.9%.”

In other words, investors must reevaluate the future prospects of the stock market with earnings slowing. It is important to remember that these expectations are not incorporating a sharp economic contraction which some analysts warn is possible.

Valuing Stocks

One reason stocks with slower growth are worth less is related to the idea of valuation models.

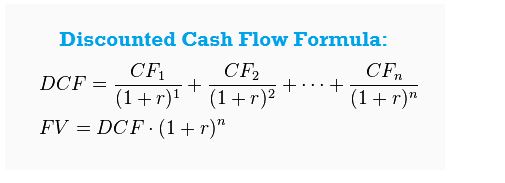

Unfortunately, the math to determine the fair value became more complex. Over time, a discounted cash flow (DCF) model has become the most popular way to value a stock.

This model recognizes that the value of future earnings is less than the value of current earnings because dollars will probably buy less in the future. This assumption is being reviewed as negative interest rates become more common but for now it is still a widely held belief.

This model recognizes that the value of future earnings is less than the value of current earnings because dollars will probably buy less in the future. This assumption is being reviewed as negative interest rates become more common but for now it is still a widely held belief.

In a DCF model, analysts develop estimates of a company’s future earnings and then make other assumptions to reduce the value of future earnings (by discounting) to today’s dollars.

There are usually a large number of assumptions involved in the process, for example sales and costs of sales need to be estimated along with interest rates, growth rates of the company’s earnings, the number of shares outstanding after accounting for buybacks and option grants and the risk premiums investors will assign different industries among other variables.

With a DCF, the estimated value of a stock can be determined to the penny, but any change in any of the assumptions will lead to a change in the estimated fair value of the stock. Different estimates explain why different analysts assign different price targets to stocks.

Data services usually average all of the available estimates and report a consensus price target. When an investor is considering two different stocks, if one stock is trading above the value defined by the DCF model and another is trading below the model’s price, the one trading below the model’s price should be the better value for investors.

A Simpler Approach

An alternative to the DCF model is the PEG ratio. Specifically, the formula for the PEG ratio is the P/E ratio divided by the EPS growth rate. The PEG ratio assumes a stock is fairly valued when the P/E ratio is equal to the estimates growth rate of earnings per share (EPS).

When using the PEG ratio, a ratio below 1 indicates a stock is potentially undervalued. Higher PEG ratios indicate stocks are overvalued.

This formula can be rearranged with simple algebra to find the target price (P in the P/E ratio). Fair value for a stock would be the product of the EPS growth rate and EPS.

We can use historic or expected numbers but next year’s estimated earnings and the long-term estimated growth rate are commonly used.

Let’s consider an example using a notional stock that we assume is trading at about $45 and the Wall Street analysts’ consensus target is $57. That value is derived from DCF models.

We can use the PEG ratio and multiply next year’s expected EPS of $3.87 by the expected EPS growth rate of 16.1%. This provides a price target of $62.31. This is fairly close to the consensus estimate and confirms the stock is undervalued.

The value of the PEG ratio is its simplicity and its objectivity. The math is simple – just multiply estimated earnings by the estimated EPS growth rate. This provides an objective value while Wall Street estimates tend to be subjective.

Often analysts will use assumptions designed to ensure a price target is above the current price of a stock. This might be done to help the Wall Street firm win investment banking business from a company even though that is not supposed to happen.

It might also be done because analysts don’t usually recommend selling a stock and setting a price target below the current price is an implied sell recommendation. The PEG ratio removes this type of subjectivity when determining a price target.

Given its simplicity, the PEG ratio could be all you need to find undervalued stocks. However, it does not work in all cases. When a company’s earnings are contracting, the estimated growth rate will be negative and the PEG ratio should not be used.

The PEG ratio is also not normally the best tool to evaluate income stocks. When a stock is valued for income rather than earnings, other valuation techniques are more appropriate.

When looking for buy candidates, the PEG ratio can provide a starting point. But, remember that when a stock is trading above fair value, value investors including Graham and Dodd recommend selling.

While Warren Buffett has popularized the idea that a good stock should never be sold, that rule generally applies only to him. Most of us benefit from selling and moving into stocks which offer better potential rewards.

Looking Ahead

Now, stocks are estimated to be delivering slower growth and the extent of that slowdown can be seen in the next chart.

Source: FactSet

The sharp decline in growth will mean lower price targets in accordance with the more complex DCF models and the simpler PEG ratio. This is a warning for investors in 2019.

The same will be true of individual stocks. Many companies reported strong earnings growth in 2018 as they recognized benefits of tax reform. The rates will largely be the same for 2019 for companies which means the growth they report will depend on increases in revenue and decreases in expenses.

Of course, share buy backs will also play a role in prices and many companies are still spending billions of dollars buying their own shares. Unfortunately, that might just be one factor driving higher EPS and might not be enough to carry stocks to new highs in 2019.