Mistakes Fixed Income Investors Can Make

It seems as if income investing should be more leisurely than investments in the stock market. That would, in theory, allow time for investors to act thoughtfully and avoid many of the mistakes traders are prone to make in the stock markets.

Among the biases is one associated with limited attention spans. Investopedia explains, “There are thousands of stocks to choose from but the individual investor has neither the time nor the desire to research each.

Humans are constrained by what economist and psychologist Herbert Simon called, “bounded rationality.” This theory states that a human will make decisions based on the limited knowledge they can accumulate. Instead of making the most efficient decision, they’ll make the most satisfactory decision.

Because of these limitations, investors tend to consider only stocks that come to their attention through websites, financial media, friends and family, or other sources outside of their own research.

For example, if a certain biotech stock gains FDA approval for a blockbuster drug, the move to the upside could be magnified because the reported news catches the eye of investors. Smaller news about the same stock may cause very little market reaction because it doesn’t reach the media.”

Because information on fixed income investments is generally less widely available, it’s reasonable to assume biases like this haven’t affected that market. But, new developments changed the fixed income markets and new research is being done to determine how similar investors are in these markets.

Income Investment Markets Can Be As Fast As Equity Markets

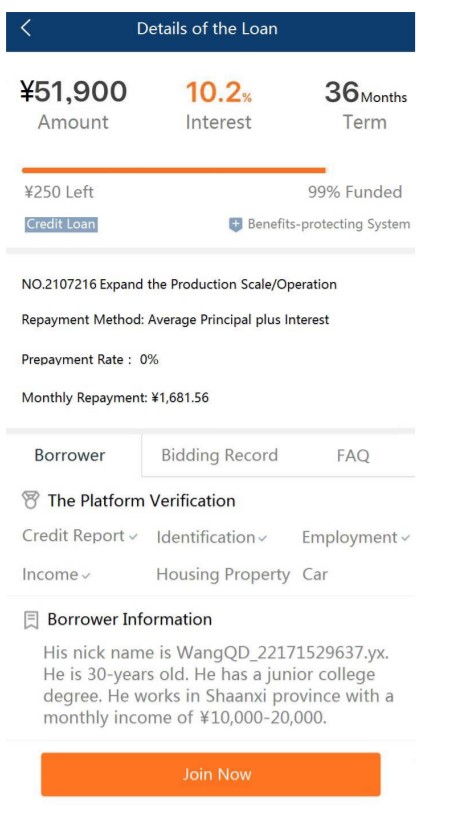

New research includes a paper titled “Investment under Fast-Thinking” which looked at a major peer to peer lending market, Renrendai, one of the leading P2P lending platforms in China. This market allows investors to fund loans with a click on their phones using information like the screenshot shown below.

Source: Investment under Fast-Thinking

This is a fast moving market. Due to the market environment, the loans on this platform were generally highly appealing and were usually sold out quickly. For example, 25% of the loans listed on Renrendai are fulfilled within 42 seconds and 90% are fulfilled in under eight minutes.

The researchers had a rich data set of 10,385 loans and 205,724 transactions, and the cumulative amount of loans in the sample is over $100 million. The data covers a time frame spanning two years and four months.

Given the fast moving market, investors focused on the interest rates of proposed loans rather than risk factors like credit scores.

Data revealed that risk and returns are directly related, just as they are in the equity markets. The authors found loans with a “High Risk” (HR) rating offered the highest interest rate but, on average, underperform other loans by over 1% per year

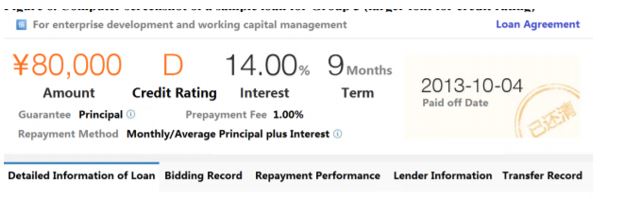

While investors focus on returns, they could be nudged to look at risk by simply reconfiguring the screen as shown in the figure below.

Source: Investment under Fast-Thinking

Now, the risk rating is clearly visible. Regulators could do this to improve investor information but market makers could resist a change like that. One of the important lessons from this research is that investors must do their own homework.

The Conclusions Offer Hope for Investors

Another factor the researchers noted is the fact that investors can learn from mistakes. After suffering a loss, traders slow down their decision making process.

As the authors explained,

“Using data from a major online peer-to-peer (P2P) lending market, we document that investors appear to follow a simple rule of thumb: they rush to loans with high interest rates without sufficiently examining other information (e.g., borrower’s credit rating), which is freely available on the interface.

For example, on average, loans with a “High Risk” rating under-perform other loans by over 1% per year. Through experiments, we show that by making credit rating information more salient, we can “nudge” investors into paying more attention to ratings and hence improve their investment returns.

Finally, first-hand experience matters for learning: After a recent default of his own loan, an investor tends to increase his decision time, avoid loans with “High Risk” ratings, and hence obtain higher returns. In contrast, after observing others experiencing a default, the effects are significantly smaller or negligible.”

There are two lessons to learn from this paper.

Investors in any market can act too quickly, even when fast reactions can increase the risk of loss. But, investors can learn from mistakes which is beneficial but the downside of learning from experience is the fact that experience can be an expensive teacher.

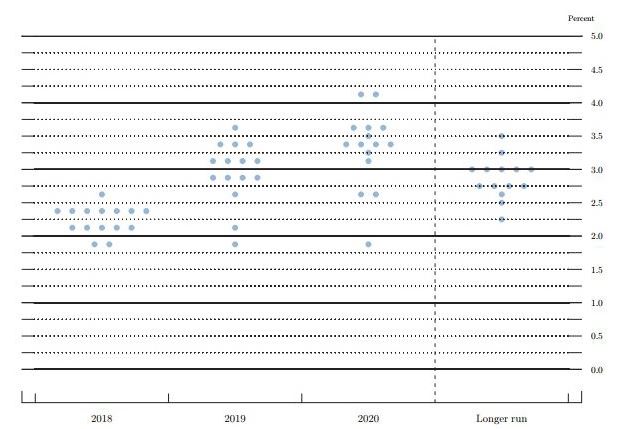

These are important lessons for income investors to learn. Rates are likely to remain low, despite the fact that rates are rising. The Federal Reserve expects short-term interest rates to stabilize near 3% in the long run.

Source: CNBC

This indicates rates will remain low for some time. Income investors will be tempted to reach for yield, as they have been for most of the last decade. However, the pressure to reach for yield may increase as frustration with low rates increase.

But, as the study of the peer to peer market in China demonstrated, increased yield carries higher risks and income investors must remember that the return of their principal is at least as important, if not more important, than the return on their principal.

Reaching for yield can be a good move, but it requires analysis and income investors should not make quick decisions. They should take time to understand the investment opportunity and the risks associated with the investment.

Income investors should also consider the alternatives to their desired investment. If an investment offers higher yields, there is almost certainly more risk.

Finally, income investors should think of the impact a loss will have on their portfolio. An extra 1% in yield could lead to a loss of 10% of principal and that would reduce future income by 10%, in essence forever.

Thinking fast is advantageous at times. But, in the investment markets, and particularly in the fixed income investment markets, thinking slow could be profitable in the long run.