This Could Be the Most Important Decision for Investors

While many investors spend a great deal of time considering what to buy, that may not be the most important decision for investors. The other decision investors might focus on is the decision related to when to sell. But, again, that might not be the most factor contributing to their long-term success.

According to the American Association of Individual Investors, in what the editors consider to be one of the most important articles they ever published,

“It is widely agreed that the asset allocation decision is the most important one an investor will make. How you split your investment funds among stocks, bonds and cash (that is, short-term debt) is more important than your choice of stock mutual funds.

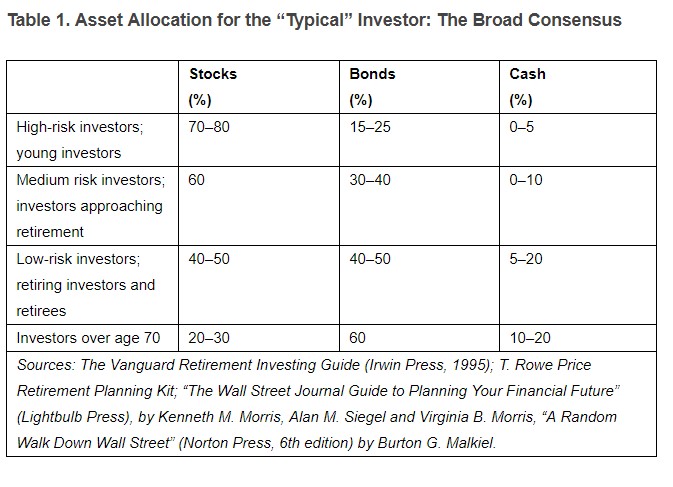

Experts, not surprisingly, do not always agree on the precise allocations that different types of investors should adhere to.

Yet, in comparing recommendations from published advisory sources, it is clear that there exists a broad consensus about the appropriate mix among stocks, bonds and cash for most individuals during each stage of their life cycle.

Of course, all recommendations carry a disclaimer that individual circumstances may dictate a mix that is quite different.

Many individual investors, though, resemble at least roughly the “typical” investor profile.”

There are some specific guidelines that could help many investors improve their performance, according to the article. The general rules include:

- Choose a fixed weight strategy, with rebalancing at least annually.

Specific asset mixes will differ at different points in an investor’s life cycle. In order to maintain a given asset mix, the portfolio must be periodically rebalanced.

The simple idea is that a stable asset mix gives an investor a stable risk exposure that is appropriate for their financial needs, which are typically dictated by the stage in life.

A fixed weight strategy is a long run contrarian strategy. When stocks rise from being fairly valued to overvalued, the investor sells the overvalued stocks and buys bonds (or cash), or when putting new money into the portfolio purchases bonds or cash rather than stocks.

When stocks fall from being fairly valued to undervalued, the investor sells bonds and buys the undervalued stocks, or uses new money to buy stocks. In short, a fixed-weight strategy allows someone to profit from market misvaluations while maintaining a stable risk exposure.

- A portfolio’s risk can be moderated by mixing stocks and debt.

Stocks are claims against real assets. Bonds and cash are debt, usually promising fixed returns. Stock and debt are fundamentally different animals and, consequently, their returns tend not to follow similar patterns to each other. Consequently, combining stocks and debt moderates the portfolio’s risk.

On a broader scale, individuals who hold stocks and debt in their investment portfolio and own their own home have their broad portfolio diversified among stocks, debt and real estate—three asset types whose returns do not vary closely together.

- The longer the investment horizon, the larger the portion of the portfolio that should be allocated to stocks.

Young investors who are years from retirement can invest more of their portfolio in stocks than the elderly. Although year-to-year stock returns are volatile, the young can be reasonably confident that the good years will more than offset the bad years over their investment horizon.

As you age and your investment horizon shortens, you are less confident that there will be enough good years to offset the bad, and the recommended allocation to stocks decreases.

- Everyone should have some exposure to stocks, even a conservative 80 year old couple.

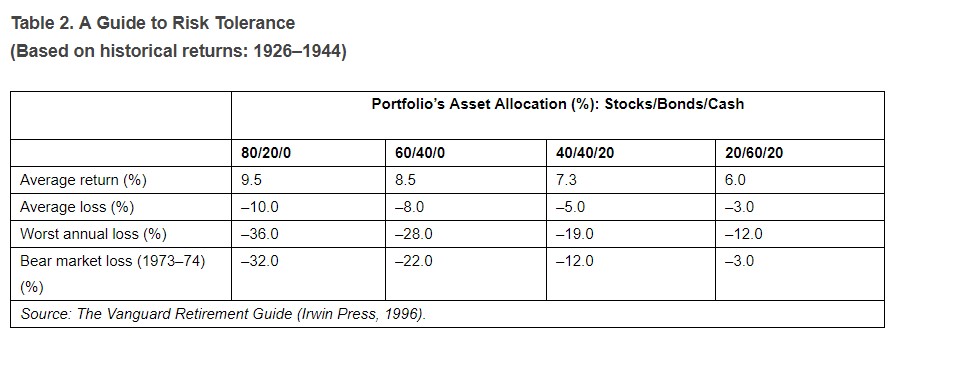

Historically, the returns on a portfolio of long-term Treasury bonds have been more volatile (that is, riskier) than a portfolio with 90% bonds and 10% common stocks.

Stocks held alone are riskier than bonds held alone, but due to the magic of diversification you can add some stock to an all-bond portfolio and actually reduce the portfolio’s risk.

Diversification means not putting all your eggs in one basket even if the basket looks safe. Since 1926, the volatility of an 80% bond/20% stock portfolio has been equal to that of a 100% bond portfolio. This helps explain why no one recommends a stock weight of less than 20%.

- Diversify within the stock portion of the portfolio. In particular, an investor should always have an exposure to large-value and large-growth stocks.

There are two dimensions to investing in the stock market: size and style. Size refers to the size of the firm. In general, the 500 stocks comprising the S&P 500 are considered “large” stocks, which account for almost 75% of the market value of all U.S. stocks.

Style refers to the investment style or philosophy to which a company is most likely to appeal. Growth investors seek growth stocks—firms with fast-growing earnings. Value investors seek value stocks—firms whose shares are selling below their “real” value.

- International stocks should be a part of everyone’s portfolio, with the possible exception of the elderly.

Recommendations for international exposure start at about 15% to 20% for younger investors, and gradually decrease as one gets older. One source recommends no exposure for those who are 75 or older.

- Young investors should put more emphasis on international stocks, small stocks and growth stocks while older investors should put more emphasis on large-cap stocks, especially value stocks.

While broad diversification is always encouraged, younger investors can take more risk, and can therefore place greater emphasis on the riskier portions of the stock market; older investors can still invest in these areas, but their emphasis should be on more stable, large-capitalization companies.

- Investors can avoid the emerging international stock markets.

Emerging stock markets promise a wild and bumpy rise. The average Mexican stock lost 60% of its value in three months ending in March 1995. Of course, dramatic gains are also possible.

- As one ages, shift the bond portion of the portfolio from primarily long term bonds to primarily intermediate term or short term bonds.

Bond prices become more stable as maturity shortens. Thus, the advice to shorten bond maturity as one ages is consistent with the other advice to move toward assets with more stable prices.

- As one ages, the cash portion of the portfolio increases.

Increasing cash assets is part of shortening the bond maturity for increased price stability.

- High grade corporate bonds and Treasury bonds of similar maturity are close substitutes.

No one distinguishes between buying high-grade corporate bonds or Treasury bonds of similar maturity, because the returns on these bonds move very closely together, although high-grade corporate bonds tend to have slightly higher yields.

Over the long run, these rules have delivered strong returns.

Within the stock portion of the portfolio, stock selection can add significant value and a disciplined approach to stock selection can deliver large returns.

Within the stock portion of the portfolio, stock selection can add significant value and a disciplined approach to stock selection can deliver large returns.