Should I invest or own in commodities

When building a portfolio, many investors consider, in broad terms, how to allocate their funds. This makes sense because funds are limited while potential investment choices are almost unlimited. Some restrict this process to allocating a percentage of assets to stocks and bonds.

This approach can help reduce risk. In this case, risk is defined as the volatility of returns. In other words, asset allocation is a process intended to reduce volatility. It does not specifically address the risk of loss. In an investment account, some losses are inevitable.

Diversification attempts to reduce the volatility of losses. It does not seek to completely eliminate losses. It evens out the downside risks, in theory. This benefit explains the popularity of the 60/40 portfolio many investors adopt in retirement.

The 60/40 portfolio allocates 60% of funds to stocks and 40% to fixed income investments. There are a lot of decisions to make regarding the allocation within each sleeve of the portfolio but overall, this strategy is widely accepted as less risky than all stocks and potentially more profitable than all bonds.

The Problem Is Inflation

The 60/40 portfolio works well over a long time horizon. In the long run, much of the data we look at for the economy “evens out” with periods of high inflation followed by periods of low inflation, for example.

But, many investors don’t have a long time horizon to allow things to even out. If high inflation develops, we could expect interest rates to rise. This could have a devastating impact on bond investments.

For example, iShares 7-10 Year Treasury Bond ETF (NYSE: IEF) is a popular ETF for fixed income investors. This ETF offers a yield of 1.8%. If interest rates rise by 1%, the ETF should be expected to decline about 7.5% in value. This is more than 4 years’ worth of income.

In a high inflation environment, we would also expect stock prices to suffer. They could fall or deliver below average performance. Either outcome could be harmful to a retiree or anyone preparing to retire one day, or just about any investor.

Gold May, or May Not Shine

Gold is often viewed as the ultimate hedge against inflation. For that reason, some investors allocate part of their portfolio to gold as a hedge against inflation. But, there is no way to know if gold will move up when inflation strikes. It may, and it has in the past. But, gold has also lagged in the past.

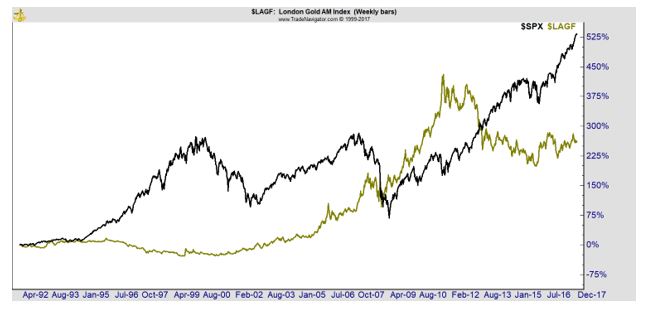

The chart below shows the percentage changes in the price of gold and the S&P 500. Gold is shown as the gold colored line. The price of gold, in this chart, is the price set in the London market every morning for delivery of physical gold.

You can see that stocks have usually delivered better returns than gold. From January 2009 through June 2013, gold delivered better long term gains than stocks. This may be surprising but it is the nature of markets that price moves will deliver unexpected results.

As the chart above shows, in the last bear market, gold delivered a degree of protection for long term investors who bought gold in the early 1990s. But, that is a lot of variable. Gold did not do as well in the previous bear market that accompanies the end of the Internet bubble.

There’s a Place for Gold and Another Hedge

Should i invest or own in commodities, Most investors own more than one stock. They do this to limit risks and believe that diversification is an important component of their investment strategy. This is also true for fixed income investments. Again, investors diversify their bond holdings.

To diversify bonds, investors consider risks associated with time and the chance of default by the bond’s issuer. This shows that there is often a great deal of thought put into diversification. But, when it comes to inflation hedges, investors often choose gold or gold and silver.

There is actually one investment that provides a diversified approach to protecting a portfolio against periods of high inflation. That investment is a diversified basket of commodities.

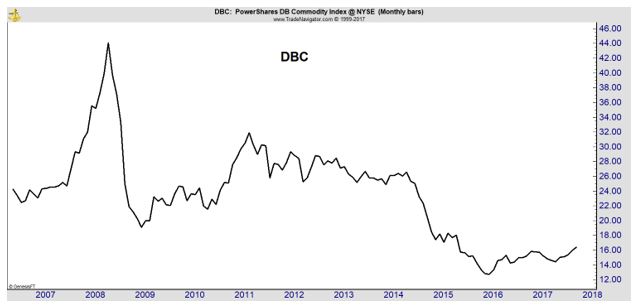

This is especially true when commodities are beaten down and attractive as a value investment. The chart below shows PowerShares DB Commodity Index Tracking Fund (NYSE: DBC). The price is near multiyear lows.

Before investing in a commodity ETF, it is important to know what the ETF is and how it works. This ETF is a rules-based index composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world.

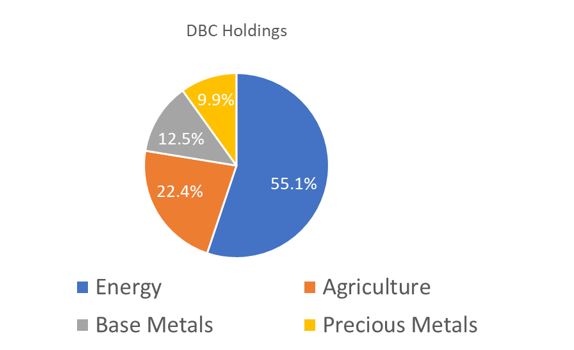

The ETF buys and sells exchange traded futures rather than derivatives on those instruments like many other commodity ETFs do. DBC and the index that it tracks are rebalanced and reconstituted annually in November. For now, the index has a high degree of exposure to energy.

Source: Invesco

With DBC, an investor is largely obtaining exposure to the energy markets since this sector is likely to dominate the performance of the fund. Within the energy sector, there is a high degree of correlation between the components which include oil, gasoline and heating oil which are derived from crude oil, and natural gas which is often a buy product of crude oil production.

The diversification, the fact that about 45% of the fund’s return will not be directly correlated with the energy sector, will be useful at times. However, this example shows why it is important to know exactly what an ETF is holding before owning it.

Consider Your Investment Choices

Another popular commodity ETF is the iShares S&P GSCI Commodity-Indexed Trust (NYSE: GSG). This fund tracks the Goldman Sachs Commodity Index and is also overweight in the energy sector. In fact, GSG provides even more weight to the energy sector than DBC with 62% of its holdings in that sector.

One of the less popular ETFs, the WisdomTree Continuous Commodity ETF (NYSE: GCC), could provide the best choice for diversified exposure to commodities. This fund holds less than 12% of its assets in the energy markets.

Source: WisdomTree

GCC reports assets under management of about $160 million. This is relatively small but the fund sponsor has a history of maintaining access to its funds when they reach this size.

The size of an ETF, measured by the amount of money under management, is important for investors to consider. Fund sponsors are, of course, providing access to the funds so that they can collect management fees and earn a profit.

Small ETFs have a history of folding. This is because continuing to offer the fund is simply not profitable for the sponsor. In order to be profitable, a fund would need to cover fixed expenses which include listing fees, accounting, auditing and custodian fees in addition to paying a manager.

When a small fund is dissolved, share holders can be hit with large, and unexpected, tax bills if the fund simply liquidates its positions. Therefore, it is important to consider whether or not an ETF is likely to survive when making an investment decision.

Given the choices, investors need to decide what is right for them. As an inflation hedge, some will want gold. This could be a gold ETF, through gold mining stocks or with physical gold. Others will want a diversified commodity portfolio.

If selecting a diversified commodity portfolio, consider the holding of the ETF before buying and understand what it provides exposure to. Instead of DBC, for example, it could be best to hold GCC and an ETF that tracks oil. This could provide diversification and exposure to energy.