New Thinking on Reverse Mortgages

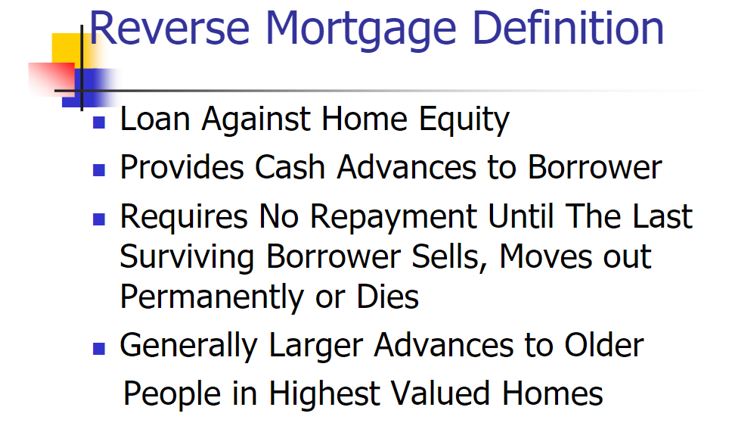

A reverse mortgage, according to Investopedia, “is a loan. A homeowner who is 62 or older and has considerable home equity can borrow against the value of their home and receive funds as a lump sum, fixed monthly payment or line of credit.

Unlike a forward mortgage – the type used to buy a home – a reverse mortgage doesn’t require the homeowner to make any loan payments.

Instead, the entire loan balance becomes due and payable when the borrower dies, moves away permanently or sells the home.

Source: National Center for Home Equity Conversion

Federal regulations require lenders to structure the transaction so the loan amount doesn’t exceed the home’s value and the borrower or borrower’s estate won’t be held responsible for paying the difference if the loan balance does become larger than the home’s value.

One way this could happen is through a drop in the home’s market value; another is if the borrower lives a long time.

Reverse mortgages can provide much-needed cash for seniors whose net worth is mostly tied up in the value of their home. On the other hand, these loans can be costly and complex – as well as subject to scams.

Potential Pitfalls

These products are looked on with skepticism by many. And with good reason in some cases.

The FBI and the U.S. Department of Housing and Urban Development Office of Inspector General (HUD-OIG) urge consumers, especially senior citizens, to be vigilant when seeking reverse mortgage products.

Reverse mortgages, also known as home equity conversion mortgages (HECM), have increased more than 1,300 percent between 1999 and 2008, creating significant opportunities for fraud perpetrators.

Reverse mortgage scams are engineered by unscrupulous professionals in a multitude of real estate, financial services, and related companies to steal the equity from the property of unsuspecting senior citizens or to use these seniors to unwittingly aid the fraudsters in stealing equity from a flipped property.

In many of the reported scams, victim seniors are offered free homes, investment opportunities, and foreclosure or refinance assistance. They are also used as straw buyers in property flipping scams. Seniors are frequently targeted through local churches and investment seminars, as well as television, radio, billboard, and mailer advertisements.

A legitimate HECM loan product is insured by the Federal Housing Authority. It enables eligible homeowners to access the equity in their homes by providing funds without incurring a monthly payment.

Eligible borrowers must be 62 years or older who occupy their property as their primary residence and who own their property or have a small mortgage balance. See the FBI/HUD Intelligence Bulletin for specific details on HECMs as well as other foreclosure rescue and investment schemes.

The FBI also provides for avoiding scams:

- Do not respond to unsolicited advertisements.

- Be suspicious of anyone claiming that you can own a home with no down payment.

- Do not sign anything that you do not fully understand.

- Do not accept payment from individuals for a home you did not purchase.

- Seek out your own reverse mortgage counselor.

New Thinking

Barron’s recently noted, “Reverse mortgages were once anathema to savvy financial planning. These loans—which let homeowners over age 62 pull equity out of their homes while still living in them—were viewed as a costly last resort for covering retirement shortfalls.

That thinking has changed as older owners find themselves sitting on record levels of home equity, while at the same time grappling with how to maximize retirement income. Though the upfront costs of reverse mortgages can be steep—we’ll get to that in a minute—when used judiciously, they can be a valuable tool in retirement.

“One of the most intriguing benefits, I think, is spending coordination with your portfolio,” says Neil Krishnaswamy, a financial planner and enrolled agent with Exencial Wealth Advisors in Frisco, Texas.

Borrowers can effectively use a reverse mortgage as a line of credit that they access when needed: They only pay interest on what they use, and the proceeds aren’t taxed.

In the event of a major market decline, for example, borrowers can access this equity in lieu of tapping their portfolios in a down market. “One of the biggest risks in retirement is that markets may not cooperate,” Krishnaswamy says. “If you have the option to access cash for spending in a tax-efficient manner, you can mitigate some of that risk.”

Some other uses: Homeowners who still have mortgages can use the proceeds of a reverse mortgage to pay off those loans and improve their cash flow, Krishnaswamy says. Depending on your age and health, a reverse mortgage may also be a less expensive insurance policy against long-term healthcare needs—and it might be the difference between claiming Social Security early or holding off for a higher payout.

The catch, of course, is that you or your heirs will need to pay back the loan when you sell the house or when you and your spouse both pass away. Interest, which recently hovered around 5%, accrues on any equity you access. Then there are the fees, which, although though rolled into the balance of the reverse mortgage, can be the biggest sticking point.”

Origination fees are the most significant up-front costs. Under HECM, a lender can charge up to 2% of the first $200,000 of the home’s value or $2,500, whichever is greater, plus 1% of any amount above $200,000. HECM caps total origination fees at $6,000.

Borrowers also need to pay FHA mortgage insurance premiums equal to 2% of the maximum claim amount, plus 0.5% of the outstanding balance annually. In the event a lender cannot pay out the reverse mortgage proceeds, insurance kicks in. If the value of the property falls below the outstanding loan balance, borrowers or their heirs don’t need to make up the difference.

In addition to these big fees, reverse mortgage borrowers also pay monthly servicing fees, which are capped at $35, plus many of the same upfront costs associated with getting a traditional mortgage. Those include appraisal fees, credit report fees, escrow fees, document preparation, and more.

All told, for loans of up to $200,000, for instance, a borrower could pay as much as $10,000 in upfront fees—which are typically rolled into the loan balance—plus ongoing mortgage insurance premiums and service fees of about $1,400 a year.

There are benefits and drawbacks just as there are with any investment.

Barron’s quoted one expert who said, “I’ve come full circle on reverse mortgages,” says Steve Vernon, a consulting research scholar at the Stanford Center on Longevity, and author of “Retirement Game-Changers.”

He added that he has even recommended it as an option for his friends in the San Francisco Bay Area, where average single-family home prices sit just under $1 million. “The costs of the loans are high,” he says, “but if you love your house and don’t have other resources, it’s something to consider.”

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.