Investing in the Blockchain, Without All the Hassle of Investing on the Blockchain

Cryptocurrencies have the potential to change the financial world. They haven’t done so yet, but proponents of the asset class believe that changes will develop in the future. That’s why many buy various cryptos and hold them for potential gains.

Like any new technology, there is the possibility that cryptos will change the system. But, there is a great deal of risk. Investors in the currency accept those risks. But, many investors would like some exposure to cryptos without the high degree of risk in the currencies. This might be possible.

Investing in the Enabling Technology

Cryptos are an application of specific technologies. Among those technologies is the blockchain.

A blockchain is “a growing list of records, called blocks, which are linked using cryptography. Blockchains which are readable by the public are widely used by cryptocurrencies. Private blockchains have been proposed for business use.

Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. By design, a blockchain is resistant to modification of the data. It is “an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way”.

For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for inter-node communication and validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without alteration of all subsequent blocks, which requires consensus of the network majority.

Though blockchain records are not unalterable, blockchains may be considered secure by design and exemplify a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been claimed with a blockchain.

Blockchain was invented to serve as the public transaction ledger of the cryptocurrency bitcoin.”

Investors could consider investing in the companies that benefit from the technology in some way. That would include the technology companies that make the hardware to run the blockchain applications or the companies that are trying to design applications that rely on blockchain technology.

Exchange Traded Funds Could Provide Diversified Access to the Technologies

Determining which companies are involved in blockchain technology could require significant research. Then, it could require an evaluation of each company to determine whether or not that stock offers value or growth potential.

For individual investors, that level of research can be time consuming. In other investment areas, they have turned to exchange traded funds, or ETFs, to provide diversified exposure to different market factors, sectors or countries. The ETF providers have risen to the challenge of the blockchain, as well.

There are several ETFs that offer blockchain access. We describe three of them below and each one is slightly different.

Reality Shares Nasdaq NexGen Economy ETF (Nasdaq: BLCN) seeks long-term growth by tracking the investment returns of the Reality Shares Nasdaq Blockchain Economy Index (the “index”).

Under normal circumstances, at least 80% of the fund’s assets, other than collateral held from securities lending, if any, will be invested in component securities of the index.

The index is designed to measure the returns of companies that are committing material resources to developing, researching, supporting, innovating or utilizing blockchain technology for their proprietary use or for use by others (“Blockchain Companies”).

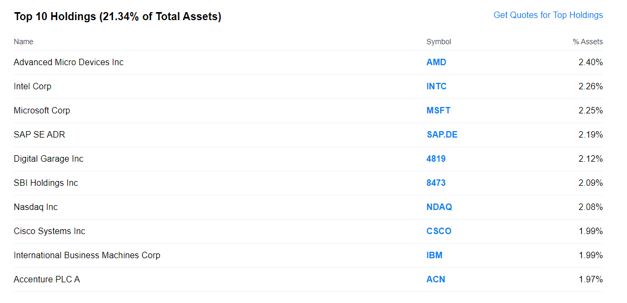

The fund is non-diversified which means a large amount of assets can be in an individual stock or industry. Its top holdings are shown below.

Source: Yahoo

BLCN provides exposure to the companies that make the hardware to run the blockchain and the software consultants that can help companies install the systems in their data centers.

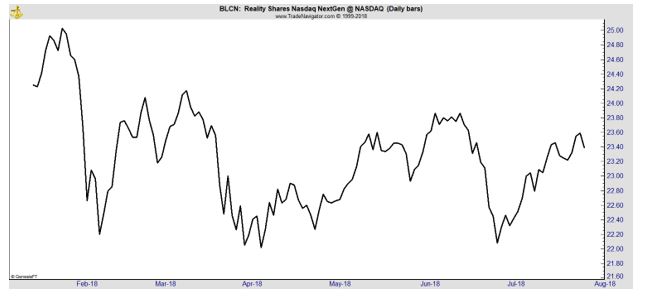

Like the other ETFs described here, BCLN has a relatively short trading history as the chart below shows.

The short trading histories make it difficult to evaluate the trend or momentum of the ETFs. That means investors are generally buying a concept with these ETFs, a one stop shop, so to speak, of an investment in the blockchain in some way.

Another ETF is the Amplify Transformational Data Sharing ETF (NYSE: BLOK). The investment seeks to provide investors with total return.

The fund is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets (including investment borrowings) in the equity securities of companies actively involved in the development and utilization of transformational data sharing technologies. It may invest in non-U.S. equity securities, including depositary receipts. The fund is also defined as non-diversified.

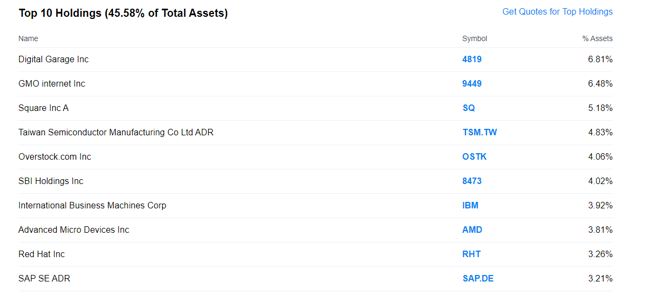

BLOK’s largest holdings are shown below.

Source: Yahoo

This is a more diversified approach in some ways and a more concentrated approach. BLOK includes some smaller companies and companies like Overstock.com that have simply announced plans to employ blockchain technology rather than developed proven revenue from the technology.

The holdings indicate BLOK could be considered more speculative.

A third ETF is the Innovation Shares NextGen Protocol ETF (NYSE: KOIN). The investment seeks to provide investment results that track the performance of the Innovation Labs Blockchain Innovators Index (the “index”).

The fund will normally invest at least 80% of its total assets in securities of the index. The index was designed by the fund’s index creator, to measure the performance of a diversified group of publicly-listed companies that use, or are involved in, blockchain (“Blockchain Innovators”).

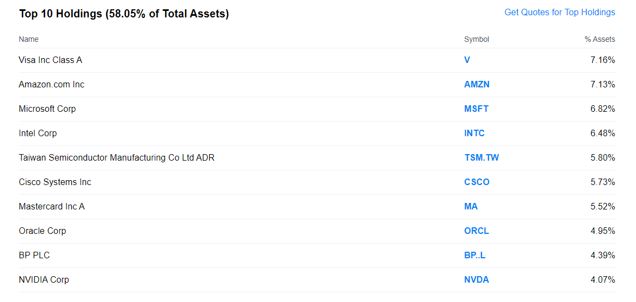

Large holdings are shown below.

Source: Yahoo

These are the large companies that could benefit from the blockchain but do not depend on blockchain for revenue or profits. It could be considered a more conservative approach to investing in the technology.

Investors could use any of these ETFs to obtain access to the blockchain technology. If the cryptocurrency market does revolutionize the financial system, some individual cryptos will do extraordinarily well.

But, investing in any crypto carries the possibility of losing 100% of your investment. That leaves many investors uncomfortable. To decrease the risks, while retaining some exposure to this emerging market, ETFs could be a suitable investment for more conservative investors.

These ETFs have the potential to benefit from the widespread acceptance of the blockchain technology that is at the core of the crypto markets. They will not deliver the same kind of gains a successful bet in crypto would have, but they are also unlikely to deliver a loss of 100%.

This could strike the right balance between risk and reward for some investors.