How Real Estate Crowdfunding Can Create Passive Income

Real estate is a potential income investment, but many investors may overlook the possibility because of the high barriers to entry. Real estate can require large capital outlays to initiate the investment. Real estate can also be costly to get in to, and out of. Those factors could prevent investors from considering real estate.

But, there are new options available to smaller investors. Among those options are crowdfunding, an investment opportunity where individuals pool their assets to purchase real estate and participate in the potential gains and income from the property.

Crowdfunding also eliminates the need to research which properties to buy and the requirement to manage the investment property. But, crowdfunding can provide some of the same benefits a more active investor would enjoy such as tax benefits.

“The IRS allows investors to deduct depreciation of income-producing properties,” Steve Azoury, owner of Azoury Financial recently told U. S. News and World Report.

“For someone who owns a large amount of commercial property that produces a significant amount of taxable income, these deductions can be extremely valuable,” and real estate crowdfunding yields these same benefits to investors in a streamlined way.

The First Decision Facing Real Estate Investors

As with any other portfolio decision, an investor must start with high level decisions. The first decision is a familiar one, investors must select debt or equity. This is the same choice that investors in real estate investment trusts must make.

Equity investments in real estate offer the potential for price appreciation. They are also subject to losses if the value of the property decline. Debt investors face the same risk but they enjoy steady income and risks are reduced by the same foreclosure process that protects mortgage investors.

It is not always that simple. Some investment opportunities will combine both elements of the debt and equity investments.

The next decision for an investor is which crowdfunding platform to use. Although there are dozens of platforms available, investors should consider using the larger ones with an established track record. Smaller investors will also face limited options based on the minimum required investment.

Fundrise offers individuals access to real estate with a minimum investment of $500.

Source: Fundrise

Fundrise allows individuals to invest online in commercial real estate via eREITs and eFunds. Individuals can gain access to real estate deals without the high dollar commitment typically needed, without being an accredited investor and without paying the high front-end load fees.

However, it is important to remember that these are illiquid investments which means that your investment capital could be tied up for years in a Fundrise account.

Investors can participate in real estate deals through Fundrise with as little as $500 of capital and they can receive monthly income through this platform. It is possible on many deals to reinvest dividends if you choose to in order to compound wealth.

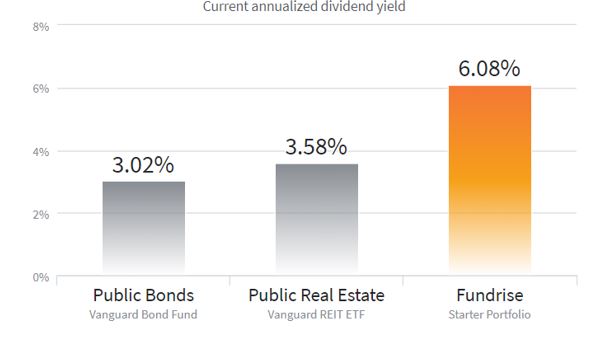

Returns can be higher for illiquid investments and this is true for a recent deal that Fundrise was offering. Investors in the starter portfolio were able to obtain passive income at an annualized rate of 6.08% per year.

Source: Fundrise

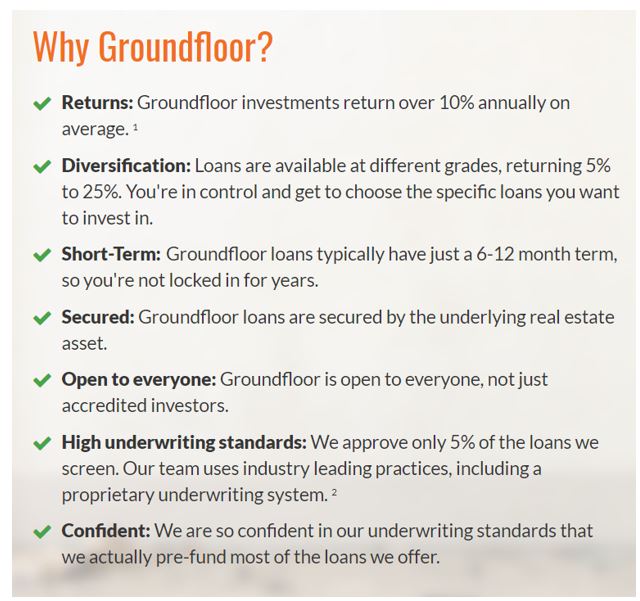

Another option is Groundfloor, an online platform specializing in lending for single-family or small multi-family home rehab and renovation loans. The firm provides access to short-term, high-yield returns with a minimum investment of less than $500.

Source: Groundfloor

Typical loans return 6% to 25% annually and loans generally carry a term of six to twelve months.

A real estate investor secures a loan through Groundfloor rather than a traditional bank or a hard money lender to finance a residential real estate project. That borrower submits a loan application and after review, the loan is assigned a loan Grade A through G and a corresponding rate where Grade A loans are the least risky, with the lowest rate of return and Grade G loans are most risky.

Grade A loans generally offer returns of 6.5% and Grade G loans generally offer returns of 25% with each letter grade offering a rate within that range.

As an investor, you can browse the summary view of loans funding on the Groundfloor web site or view more information on the loan detail page for each loan. You decide when, how much, and where to invest. Investing is simple and efficient.

With Groundfloor you are, in effect, allowed to create your own REIT. When you invest your money with a REIT, the REIT manages your risk and reward. With Groundfloor you choose how much, when, and in what properties.

The same is true of other crowdfunding sites which include RealtyShares, which reports funding over 1,000 projects and returning more than $120 million to investors, and PeerStreet, a marketplace where accredited investors can invest in high-quality private real estate loans.

Not all investors will qualify for sites that serve only accredited investors. Generally, to be considered an accredited investor, an investor will need a net worth of at least $1,000,000, excluding the value of one’s primary residence, or have income at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount this year.

The term “accredited investor” is defined by the Securities and Exchange Commission and is generally not waivable. However, there are many crowdfunding sites that allow nonaccredited investors to participate.

Crowd funding real estate is an opportunity that investors should be aware of and is something income investors should consider as a source of passive income. However, the risks should not be ignored and illiquidity should be considered when making the investment.

For now, it is still a small market. Crowdfunded real estate investments account for $2.5 billion of the $7 trillion commercial real estate market, according to CFX Markets. There is major growth potential in the industry as more investors lock in on the benefits of investing in real estate through crowdfunding platforms.

There’s also significant potential for individual investors interested in passive income and exposure to the real estate market.