Finding Value Around the World

Investors often receive vague advice. They are told to buy value, hold for the long term and diversify broadly. Diversification should include investments in foreign markets because there will be times when different countries offer more value than the U. S. stock market.

The advice to consider overseas investments appears to be sound. It makes sense that there will be times when overseas markets do offer more value. But, the advice is vague, and that is truly typical of the advice offered to individual investors.

Fortunately, that vague advice can be defined in specific terms. Best of all, data is available for free to help investors implement that advice in a specific way.

Defining Value in Foreign Markets

Value is no different outside of the United States than it is in the United States. Value can be defined in terms of common valuation metrics including the price to earnings (P/E) ratio, price to book (P/B) ratio, ratios based on cash flow or sales or the dividend yield.

Investors can find success with any of those metrics. The key to long term success is to be consistent. When using value to find investments in the stock market, a holding period of at least one year should be considered. Even longer holding periods have been shown to be successful.

Academic studies looking at value in the stock market often consider holding periods of three or five years. However, one year may be most practical, since it reduces the likelihood of a long and extended period of time with below average returns.

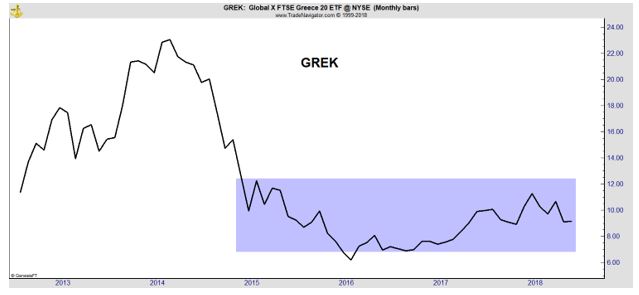

Greece provides an example of the long term under performance that is possible in the stock market. The chart below shows the Global X MSCI Greece ETF (NYSE: GREK) which has been in an extended trading range for more than three years.

Investors in GREK may be rewarded in the long run, but they are sacrificing returns in more promising investments while they wait. This is what economists call an opportunity cost and what traders often call dead money.

To avoid this problem, a rotation strategy could be used. To further minimize the impact of dead money, the dividend yield could be used to screen potential investments. A dividend is, in effect, a payment for waiting for an investment to deliver capital gains.

A Strategy For Finding Overseas Value

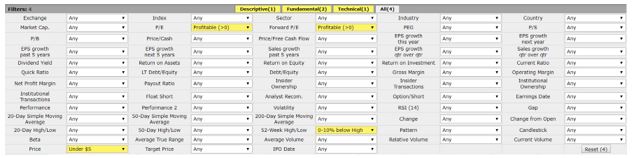

In the U. S., many investors use screeners for stocks having certain characteristics. They might screen for low P/E ratios or high dividend yields for example.

One way to find stocks meeting these requirements is with the free stock screening tool available at FinViz.com. At this site, you could screen for a variety of fundamental factors, high levels of institutional ownership and bullish institutional transactions among other criteria. An example is shown below.

Source: FinViz.com

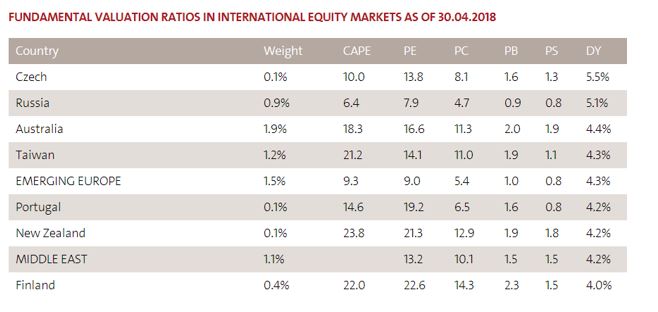

This type of screener provides a list of stocks that could be considered as buys. For international investors, a screener available for free at Star Capital could be useful. An example of the data available at that site is shown below.

Source: Star Capital

This example is sorted by dividend yields and is limited to countries with a dividend yield of more than 4%. The screener also includes regions, shown in all capital letters.

To implement a foreign investment value based investment strategy, an investor could start with this data. They could then find investments and re-balance their portfolio on a yearly basis using the same sorting strategy, dividend yield in this example.

Identifying Specific Investments

The list of countries with relatively high dividends is diversified geographically. An investor could find specific exchange traded funds, or ETFs, to obtain exposure to specific countries.

A theme also emerges in this information. Emerging markets, specifically in emerging markets in Europe and the Middle East, could be promising investments. There are a number of ETFs that provide exposure to emerging markets and any one of them could be considered a suitable investment for broad exposure.

To fine tune exposure to the high dividend countries, investors could seek out ETFs that offer exposure only to a specific country.

From the list of countries above, for example, an investor may not be able to obtain a single country ETF with exposure to the Czech Republic but funds with exposure to Russia, Australia, Taiwan and Portugal are available.

ETFs may have dividend yields that differ from that listed in the original data source. There are several possible reasons for this.

One is that the ETF may hold stocks that are different than the ones included in the overall country equity market index. Another is that the ETF may report dividend yields after various withholding taxes are considered. There could also be additional tax considerations for the individual investor.

If taxes are a concern, investors should consult with their personal tax professionals. Dividends received from stocks that are headquartered in foreign countries, or from ETFs with exposure to these type of companies, could require additional reporting and additional taxes.

If an investor is comfortable with the potential tax concerns, then these ETFs could offer high income. The ETFs could also be a source of additional research.

Single country ETFs will generally hold a diversified basket of stocks. The list of specific holdings will be available at web sites like Yahoo or Morningstar and at the fund sponsor’s web page. The complete list of holdings will be available in the ETFs regulatory filings.

Those holdings could be considered as potential buys. They may be available as depository receipts on U. S. based exchanges or they may be available for holding in brokerage accounts at many discount brokers who offer access to markets around the world.

When considering individual stocks, a similar strategy could be used, which involves buying the highest yielding stock in several different countries and re-balancing the portfolio at a predefined time period perhaps yearly.

International investing can be rewarding for individual investors and it can also be a means of achieving diversification. Data for selecting individual stocks or ETFs is readily available and a plan for rebalancing can be fairly straightforward. Value investors could find new opportunities in this area.