Where to Invest Money Now Learn different Investment Opportunities

Investors are constantly faced with a question. Every time they consider their investments, they need to ask, “what is the best investment now?” Ideally, they ask this question in an objective manner, ignoring what they have already invested in and focused solely on the future.

But, investors often have biases that affect their answer to this question. Some biases prevent investors from looking far from home for investment opportunities. This has been extensively documented by economists specializing in behavioral finance and is known as the home country bias.

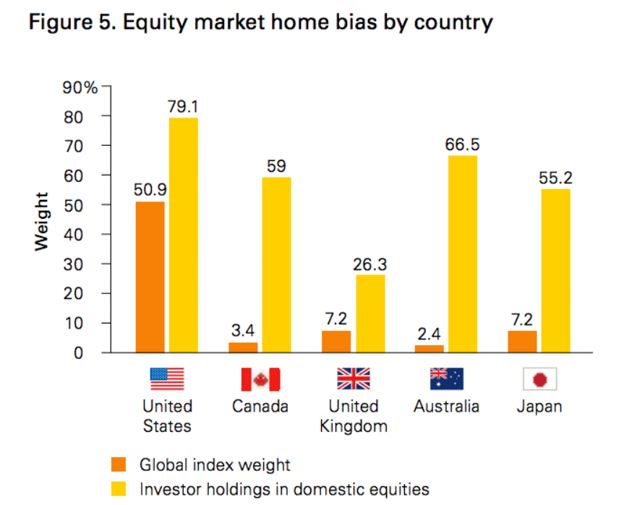

According to data from the International Monetary Fund’s Coordinated Portfolio Investment Survey, for example, investors in the United States dedicate more than 70% of their stock market investments to the US.

Experts believe this could be a mistake because the U.S. represents less than 50% of the total global stock market capitalization. That means there are other opportunities many investors are ignoring. The IMF data shows that this is not a problem limited to investors in the US.

Canadian and Australian investors exhibit similar levels of concentration of equity exposures (60%-70%) in their domestic markets despite these markets representing only 3.3% and 2.4% of the global opportunity set based on their respective weights in the MSCI ACWI index.

The MSCI ACWI index includes markets in 23 developed markets and 24 emerging markets. The IMF study used that index as a benchmark and identified the worst offenders of the home country bias based on the index.

Source: IMF Coordinated Portfolio Investment Survey

Home Country Bias Can Lead to Missed Value Opportunities

Investors in the US should consider looking beyond their country when considering where to invest money now. This is because the US is among the most overvalued stock markets in the world right now.

When considering how to measure value for global comparisons, it is important to recognize that different countries will experience different business conditions at different times. For example, one country could be in a recession while another is booming.

Stock market valuations can, and do, differ as business conditions change. One indicator that adapts to business conditions is the cyclically adjusted price to earnings ratio, more commonly known as the CAPE. This indicator was developed by Nobel Prize winning economist Dr. Robert Shiller.

CAPE is found by dividing the price of a stock market average by the average of ten years of earnings. It is cyclically adjusted by adjusting for inflation. Using the long term (10 year) average of earnings and adjusting for inflation smooths the ups and downs of the business cycle, in theory.

These characteristics make the CAPE ratio an excellent indicator to compare global stock markets. When deciding where to invest money now, investors can use the CAPE ratio to spot value. This can help them avoid the home country bias which can be especially important right now.

The current CAPE ratio for US stocks is 29. The only other times US equities have been this expensive on this measure include 1929, the peak of the internet bubble in 1999, and in 2008, just before the financial crisis.

There are only two markets in the world with higher CAPE ratios. Stocks in Ireland and Denmark are both priced at 36.8 times cyclically adjusted earnings.

There are some investors who believe CAPE is consistently overvalued and should be ignored because of this. But, other valuation metrics including the tradition price to earnings (P/E) ratio, the price to book (P/B) and price to sales (P/S) ratios and dividend yields confirm US stocks are overvalued.

US stocks rank near the top of global stock markets in all of these indicators and others. For individual investors based in the US, now is an ideal time to consider overcoming the home country bias and searching for value in international stock markets.

Finding Value in a Generally Overvalued World

The average CAPE ratio among global stock markets is 24.3 for developed markets and 16.5 for emerging markets. Emerging markets generally carry more risk than developed markets, so they should trade at some discount to developed markets based on CAPE.

One best way to invest is to allocate investments is to develop a strategy that moves to the most undervalued stock markets every year. This strategy would be relatively simple to implement using exchange traded funds or ETFs that offer a low cost Best way to invest in overseas stock markets.

ETFs generally track indexes in a stock market. There are hundreds of ETFs available and many track indexes and sector in foreign markets. ETFs trade just like stocks and carry low transaction and management fees making them ideal for individual investors.

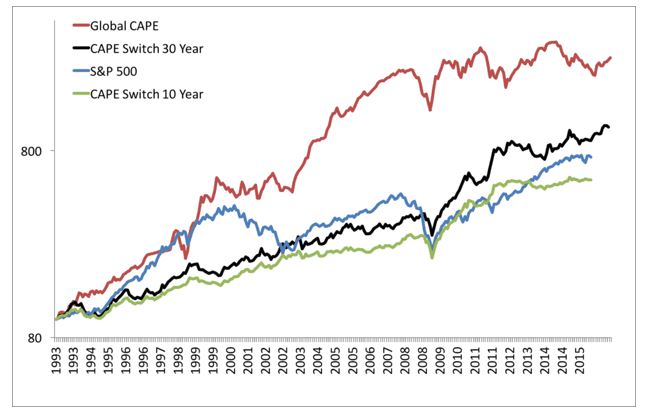

One strategy that can be used is to invest in the cheapest countries (that is those with the lowest CAPE ratios) and switch every year. In one study, this strategy was shown to significantly outperform a buy and hold investor with extreme home country bias who owns an index fund tracking the S&P 500.

Source: MebFaber.com

The chart above shows the Global CAPE strategy delivered an average annual return of 14.5% from 1993 through 2015. Over that time, the S&P 500 gained an average of 9% a year. The Global CAPE strategy also had less risk.

The Global CAPE is a diversified strategy. It invests in the cheapest 25% of countries, using the 25% of country indexes that have the lowest CAPE ratios. This could involve investing opportunities in about 10 countries and that can be replicated by individual investors.

There are two other strategies shown in the chart. Neither did better than the Global CAPE. The rules for those strategies is being provided for completeness so that readers know how the chart was constructed.

Both strategies involve switching to bonds when stocks become overvalued. In these tests, the strategy is invested in stocks when the CAPE is less than 20 and in bonds when the ratio is over 20. This switching system is tested with both 10-year bonds and 30-year bonds.

CAPE Switch 30 Year shows the results of switching between the S&P 500 and 30 year Treasury bonds. The CAPE Switch 10 Year strategy uses 10 year Treasury notes. Both strategies follow the same rules.

Risk can be measured in a number of ways. One of the simplest and most practical ways is to consider the largest loss in the test period. This allows an investor to understand how the worst period would have affected them personally.

The worst loss for the S&P 500 in the test period was 50.95%. This could have affected retirement plans for many individuals. The worst loss for the Global CAPE strategy was 39.62%. This could still delay retirement but is less than the S&P 500 which means a complete recovery should come quicker.

Where to Invest Money Now, Based on Value

For investors pursuing the largest gains possible, it can pay to invest outside of their home country. The chart below shows the ten countries with the lowest CAPE ratios.

Source: Star Capital

This strategy would need to be updated just once a year and could be implemented with ETFs. VanEck Vectors Russia ETF (NYSE: RSX), for example, is readily available and offers exposure to Russia. Other ETFs can be selected to obtain exposure to the other countries listed.

This portfolio could be rebalanced once a year, selling ETFs of countries that no longer appear on the list of the stock markets with the lowest CAPE ratios.

Smaller investors could start with just a few ETFs and add additional ones each year as their account size grows. This would be an efficient way to build stock market exposure and to overcome the home country bias.

For more investing tips, you can follow our weekly blog here.