Peer to peer lending investment best returns – Get Passive Income

Interest rates are rising but they are still low. The truth is they are too low for many investors who seek a reasonable level of income from investments. A reasonable level of income varies by investor but it’s maybe a few percentage points above the rate of inflation.

That’s what interest rates were in the good old days. Before 2000, Treasury notes maturing in just 1 year typically carried interest rates of at least 5%. Certificates of deposit at banks often offered more than that.

With an interest rate of 5%, a $10,000 investment earns $500 a year. That may not be life changing money, but it is enough money for a retiree to enjoy a small vacation or fund nice gifts for grandchildren. Higher interest rates can, in simple terms, improve the quality of life for many.

Low rates are forcing investors to look elsewhere. But, many investors may not be aware of new markets that have been created.

Peer to Peer Lending Lets Individuals Be Bankers

Banks have long known that it is profitable to lend money. Their business model was relatively simple years ago. They collected deposits and paid account holders perhaps 3%. Then, they lent money for car loans, business loans or mortgages at perhaps 7% to 9%. The difference between the interest rates was profit.

Thirty years ago, consumers often went to their local bank to secure a loan. Now, they shop online and compare dozens of proposals in a matter of minutes. If the consumer has great credit, they often get a low rate and have funds quickly.

But, banks don’t lend money to every applicant. There may be consumers with bad credit who are a high risk or there may be consumers who simply don’t have a credit history the banks can judge risks with. The lack of credit for everyone led to a new market, the peer to peer or P2P lending market.

Peer to peer lending investment best returns is based on a simple idea. An individual goes to a web site and requests a loan, explaining why they need the loan and providing personal information. The site produces a risk profile. Other individuals look at the profile and decide whether they are willing to fund the loan.

In essence, an individual becomes the bank. Risks can be hedged by making multiple loans, or allowing investors to fund a small part of many loans. This is the way banks securitize mortgages and other debt and is feasible for individuals because the web site’s sponsors provide that service. After all, it’s just a computer program.

An example is an individual with $5,000 in credit card debt at a 20% annual interest rate, who is asking the P2P community to lend them $5,000 at 12%. Everyone wins in that deal since the borrower pays less interest and the lenders get better returns on their investments.

The market is currently funding an estimated $21 billion a year in P2P loans according to the 2017 Americas Alternative Finance Industry Report. And, the market is growing. But, of course, there are risks.

One report noted that an estimated 8% of loans were “charged off” as bad debt. This is how bankers describe loans that were never repaid. That estimate confirms this is a riskier market than banks are willing to fund.

By comparison, the average consumer loan from a bank are charged off at a rate of 2% to 3% in a typical quarter although that figure can rise. Even unsecured debt held on credit cards, considered to be the riskiest loans banks offer, generally show charge off rates of 3% to 5%.

Returns Are Compensation for Risks

Because some loans will be charged off, the higher interest rates are considered to be a compensation for risk. Charge offs could be thought of as losing trades. If an investor, for example, makes 100 trades, there may be 30 to 40 losses. This lowers the returns of the portfolio. Winners make up for losses.

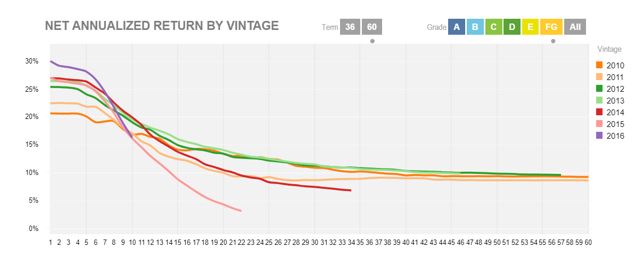

Lending Club, one of the largest P2P networks, shows the historical returns of loans made since 2010. The chart below shows this data for the lowest rated loans, or those that carry the most risk. More than 26% of these loans are eventually charged off.

Source: Lending Club

Despite the high charge off rates, investors have generally earned rates of more than 10% on average. The chart shows rates start out high but as losses mount, the actual returns on investments decline. This is why diversification is important.

If you do decide to make an investment in a P2P network, instead of funding one large loan consider taking advantage of the site’s ability to securitize loans. This allows you to, in effect, fund pieces of loans and reduce the risk of charge offs.

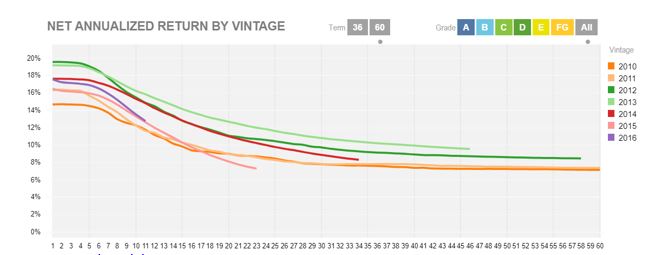

The next chart shows that returns will be lower with this approach but risks also decline. Higher grade loans default less often and the returns of all loans through the site reflect a charge rate of less than 10%.

Source: Lending Club

Diversification From the Stock Market As Well

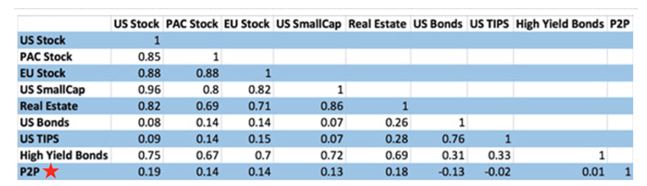

P2P lending is uncorrelated with the stock market. This is shown in the next chart which is a correlation matrix of various asset classes. Lower numbers show that the two assets move with less correlation.

Source: Mauldin Economics

For example, stocks of countries in the Pacific region (PAC stocks in the table) have an 85% correlation with US stocks. This means they move together 85% of the time. P2P lending shows a low correlation with all asset classes in the table.

This means when a market crashes, the returns from the P2P network are likely to remain stable.

Where to Learn More

Lending Club was founded in 2007 and is estimated to have a 45% market share of the P2P loans made. The site reports that 99% of portfolios with more than 100 Notes have seen positive returns and investors can start with just $1,000.

Prosper has been in business since 2006 and funded more thaP2P lendingn $10 billion in loans. The company allows investors to start with as little as $25 and estimates that returns will average about 6.8% a year.

Upstart was founded by ex-Googlers and notes that it is the first lending platform to leverage artificial intelligence and machine learning to price credit and automate the borrowing process. The company has originated more than $1.5 billion in loans since it began operating in may 2014.

In addition to its direct-to-consumer lending platform, Upstart provides technology to banks, credit unions and other partners via a “Software-as-a-Service” offering called Powered by Upstart.

According to the company, investors are earning an average 7.4% return across all grades with 97.6% of investors earning a positive return. But, to invest with Upstart, you must be an accredited investor.

This means a net worth of $1 million, excluding your home or an income of $200,000 or more in the last two years. Since you must be an accredited investor, they are open for investing in all states as they only are subject to federal securities regulations.

P2P lending could be a source of passive income for many investors and investors of all sizes could be able to participate in this new market.