Do-Good Investors Looking to Pot Stocks

Some investors are not worried about maximizing profits. Instead they seek to maximize gains consistent with their values. This investment framework goes by several names including Socially Responsible Investment, or SRI.

SRI is defined by Investopedia as “an investment that is considered socially responsible because of the nature of the business the company conducts.

Common themes for socially responsible investments include avoiding investment in companies that produce or sell addictive substances (like alcohol, gambling and tobacco) and seeking out companies engaged in social justice, environmental sustainability and alternative energy/clean technology efforts.

Socially responsible investments can be made in individual companies or through a socially conscious mutual fund or exchange-traded fund (ETF).

“Socially conscious” investing is growing into a widely-followed practice, as there are dozens of new funds and pooled investment vehicles available for retail investors.

Mutual funds and ETFs provide an added advantage in that investors can gain exposure to multiple companies across many sectors with a single investment. Investors should read carefully through-fund prospectuses to determine the exact philosophies being employed by fund managers.

There are two inherent goals of socially responsible investing: social impact and financial gain. The two do not necessarily go hand in hand; just because an investment touts itself as socially responsible doesn’t mean that it will provide investors with a good return.

An Investor Must Still Assess The Financial Outlook Of The Investment

One example of socially responsible investing is community investing, which goes directly toward organizations that have a track record of social responsibility through helping the community and have been unable to garner funds from other sources, such as banks and financial institutions.

The funds allow these organizations to provide services to their communities, such as affordable housing and loans. The goal is to improve the quality of the community by reducing its dependency on government assistance such as welfare, which in turn has a positive impact on the community’s economy.

As awareness has grown in recent years over global warming and climate change, socially responsible investing has trended toward companies that positively impact the environment by reducing emissions or investing in sustainable or clean energy sources. Consequently, these investments avoid industries such as coal mining due to the negative environmental impact of their business practices.”

One way to implement an SRI strategy is to sell off existing holdings that do not meet the requirements.

This is known as divestment, also known as divestiture and is the opposite of an investment. It is the process of selling an asset for either financial, social or political goals. Assets that can be divested include a subsidiary, business department, real estate, equipment and other property.

Divestment can be part of following either a corporate optimization strategy or political agenda, when investments are reduced and firms withdraw from a particular geographic region or industry due to political or social pressure.

Often, SRI involves avoiding tobacco stocks. But it doesn’t always mean avoiding smoking in a technical sense. In fact, some SRI funds are buying marijuana stocks.

According to Barron’s, California Public Employees’ Retirement System, the biggest pension fund in the U.S., won’t invest in tobacco companies. But apparently it doesn’t have an issue with marijuana producers.

The fund’s third-quarter filing of holdings to the Securities and Exchange Commission shows that it has a small position in Tilray stock (Nasdaq: TLRY).

As of Sept. 30, the pension fund, commonly known as Calpers, owned 1,617 shares of the Canadian maker of cannabis for medical and recreational adult use. Canada legalized recreational marijuana use in October, and Tilray’s initial public offerings in the U.S. and Canada were in July.

“In 2000, Calpers sold its positions in tobacco stocks and imposed a limited ban on investing in tobacco-related companies. Recently, the fund estimated that it missed out on $3 billion in returns through 2014 because of that decision.”

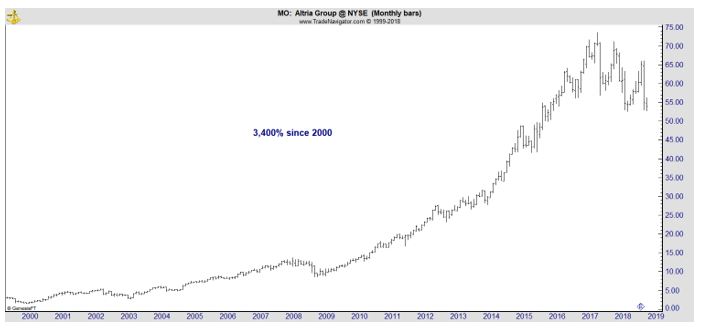

The chart of Altria Group (NYSE: MO) shows an example of the consequences of the decision.

That’s money Calpers could have used: As of last year, it had a $138.5 billion unfunded liability.

The decision to avoid tobacco was not without controversy.

“In December 2016, Calpers’ staff recommended removing all restrictions against investing in tobacco, citing the fund’s “current circumstances as a mature, cash-flow negative pension plan with increasing demands on investment returns to fund benefits.”

Despite the recommendation, Calpers’ staff recognized “negative societal implications of tobacco, with the primary negative externality being the health implications of using the product and the related costs across society.”

Calpers spokeswoman Megan White told Barron’s in an email that “concerns over ongoing litigation and regulatory risks facing the tobacco industry prompted the Investment Committee to divest.”

This Demonstrates That SRI Is A Challenge

When asked why Calpers is investing in marijuana stocks while it shuns the tobacco sector, White wrote, “The board does not make decisions about buying stocks. The investment office has delegated authority.”

In other words, there is no clear answer on what should and should not be a socially responsible sector or company.

The best answer is for investors to consider their own personal preferences. If you believe global warming is a significant threat to the future, it could be satisfying to avoid oil stocks and traditional energy companies.

Some investors will find they disagree with a particular political system and will want to avoid investments in a particular country. This strategy can deliver results in the form of change according to some experts.

One example is the divestment from South Africa which was first advocated in the 1960s, in protest of South Africa’s system of apartheid, but was not implemented on a significant scale until the mid-1980s.

The disinvestment campaign, after being realized in federal legislation enacted in 1986 by the United States, is credited by some as pressuring the South African Government to embark on negotiations ultimately leading to the dismantling of the Apartheid system.

This demonstrates investors can make a change in policies. But the first step, as it in so many cases, is to take action. It is similar to the farm to table movement or the “think globally, act locally” philosophy that can make a tremendous difference.