This Hedge Fund Legend Says Expect a Big Decline. Should You Listen?

High profile investors often make market forecasts in the age of CNBC. To some degree, CNBC creates this environment. The business channel needs to fill the trading day with programming. Producers and booking agents spend hours on the phone hoping to score a big name.

When they do obtain an interview with a legendary investor, the network promotes the interview and the financial media picks up on the story. Investors may be left to wonder whether or not they should care about the interview.

The answer is the same answer that addresses many financial questions. It depends.

Paul Tudor Jones Says a Decline Is Coming

Jones is a well respected hedge fund manager. In 1980, he founded his hedge fund, Tudor Investment Corporation. Soon after, he created the Tudor Group, a hedge fund holding company that specializes in fixed income, currencies, equities, and commodities.

Source: CNBC.com

Forbes Magazine estimated his net worth at $4.7 billion, making him the 120th richest person on the Forbes 400 and the 22nd highest earning hedge fund manager. He is known for his large-scale philanthropy and, eight years after founding his hedge fund, he founded the Robin Hood Foundation, which focuses on poverty reduction.

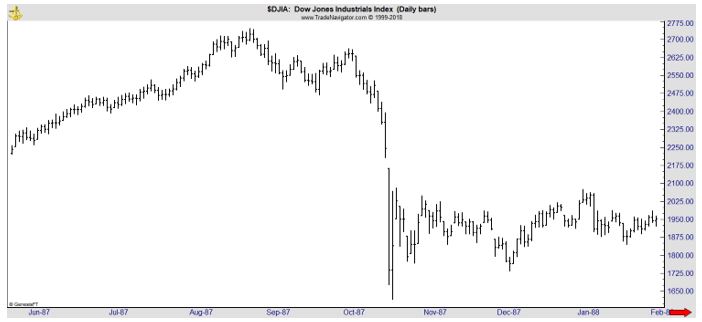

Among traders, Jones is well known for making a fortune in the October 1987 stock market crash.

Although Jones trades futures, his technique and philosophy could be useful for individuals to consider:

- Contrarian attempt to buy and sell turning points. Keeps trying the single trade idea until he changes his mind, fundamentally. Otherwise, he keeps cutting his position size down. Then he trades the smallest amount when his trading is at its worst.

- Considers himself as a premier market opportunist. When he develops an idea, he pursues it from a very-low-risk standpoint until he has been proven wrong repeatedly, or until he changes his viewpoint.

- Swing trader, the best money is made at the market turns. Has missed a lot of meat in the middle but catches a lot of tops and bottoms.

- Spends his day making himself happy and relaxed. Gets out of a losing position that is making him uncomfortable. Nothing’s better than a fresh start. Key is to play great defense, not great offense.

- Never average losers. Decreases his trading size when he is doing poorly, increase when he is trading well.

- He has mental stops. If it hits that number, he is out no matter what. He uses not only price stops, but time stops.

- Monitors the whole portfolio equity (risk) in real time.

- He believes prices move first and fundamentals come second.

- He doesn’t care about mistakes made three seconds ago, but what he is going to do from the next moment on.

- Don’t be a hero. Don’t have an ego. Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead.

His Latest Views

In a recent interview, Jones told CNBC viewers that he expects “the stock market’s wild ride will continue in 2019.”

“I think we’re going to see a lot more of what we just saw, which is a lot more volatility,” Jones told CNBC’s Andrew Ross Sorkin in a “Squawk Box” interview. “It’s really easy to say ‘I’m really bullish’ or ‘I’m really bearish.’ I kind of see a two-sided market.”

“I think in the next year it will be, from where we are today, … at least 10 percent down and 10 percent up; maybe 15 percent either way from where we are right now,” Jones said.

Stocks could fall between 10 and 15 percent next year from current levels, driven by increasing global credit and falling commodity prices, according to Jones.

“We are probably sitting on a big global credit bubble,” he said. “I hope I’m not underestimating the impact the potential negative impact that popping that bubble” will have.

However, this potential decline could lead the Federal Reserve to hold off on raising interest rates in 2019, which could boost equity prices along with continuing corporate buyback programs, Jones adds.

The Fed is expected to hike rates at a meeting next week. “The one thing I would say is there’s a high probability that this hike, assuming they hike, will be the last one for a long time,” said Jones.

But Jones is not always right.

However, he told CNBC on July 12 that stocks could go “crazy” to the upside to end 2018. The S&P 500 is down more than 1 percent for the year and has plummeted more than 10 percent since hitting an all-time high on Sept. 21.

How To Use This Forecast

When watching interviews like this, it could be important to remember that investors like Jones will not necessarily call CNBC and ask for air time when their opinion changes. And this means viewers should not take significant action based on these interviews.

This is especially true when the personality being interviewed is a trader like Jones. This is, of course, Jones’ current opinion. But something could change the analysis at any moment. When the facts change, successful traders like Jones will usually change their opinion.

They may even note that they trade the markets, not their opinions. Their opinions can and do change but their objective which is to make money will remain consistent.

This all indicates that investors should probably watch CNBC for the news and for the entertainment. They could consider the information the experts present as a starting point for research but they should not consider the comments in a short interview to be investment advice.

That may sound familiar. After all, that disclaimer is commonly seen on the network, on other business news channels and in many financial articles in other media besides television.

But it is difficult for some to do. They know that Jones made a fortune trading and may overweight his opinion, forgetting that Jones isn’t locked into that opinion. He will adapt to the market action and all investors, no matter how large or small their account, should be prepared to adapt as the market action dictates.